Retailers have been finding it difficult to maintain healthy inventory levels lately as the shipping slowdown continues, thwarting hopes that the market reopening would bring about a full-fledged recovery. Sneaker giant Nike, Inc. (NYSE: NKE), which is hit hard by the supply chain crisis, has warned that longer transport times and production delays would continue to weigh on top line performance.

The company’s stock plunged after it reported mixed results for the first quarter last week, and is yet to recover from the two-year low. The market was particularly disappointed by sales falling short of expectations and the management cutting its revenue outlook amid weakening gross margins, due to higher logistics and transport costs.

Cautious Outlook

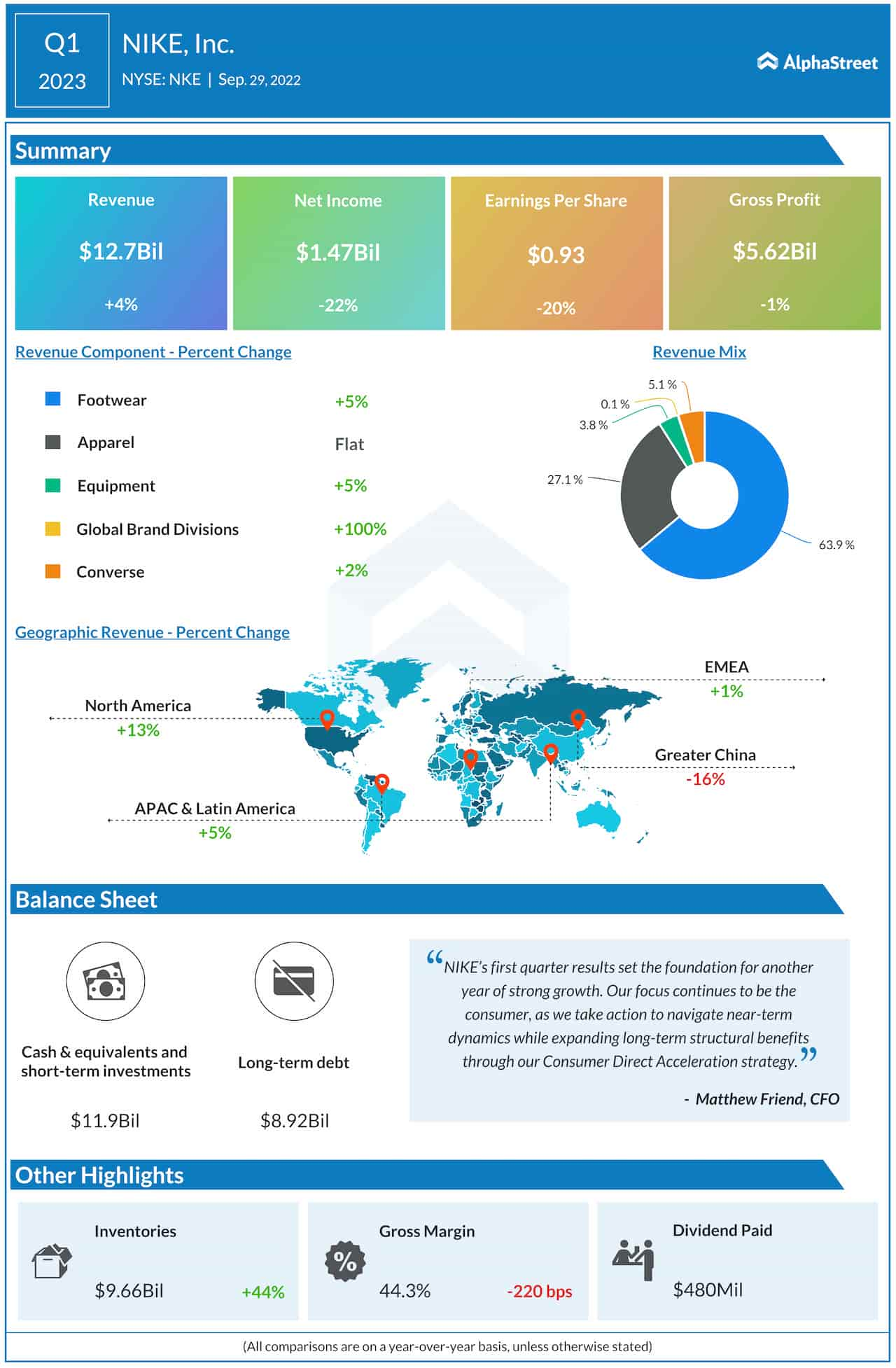

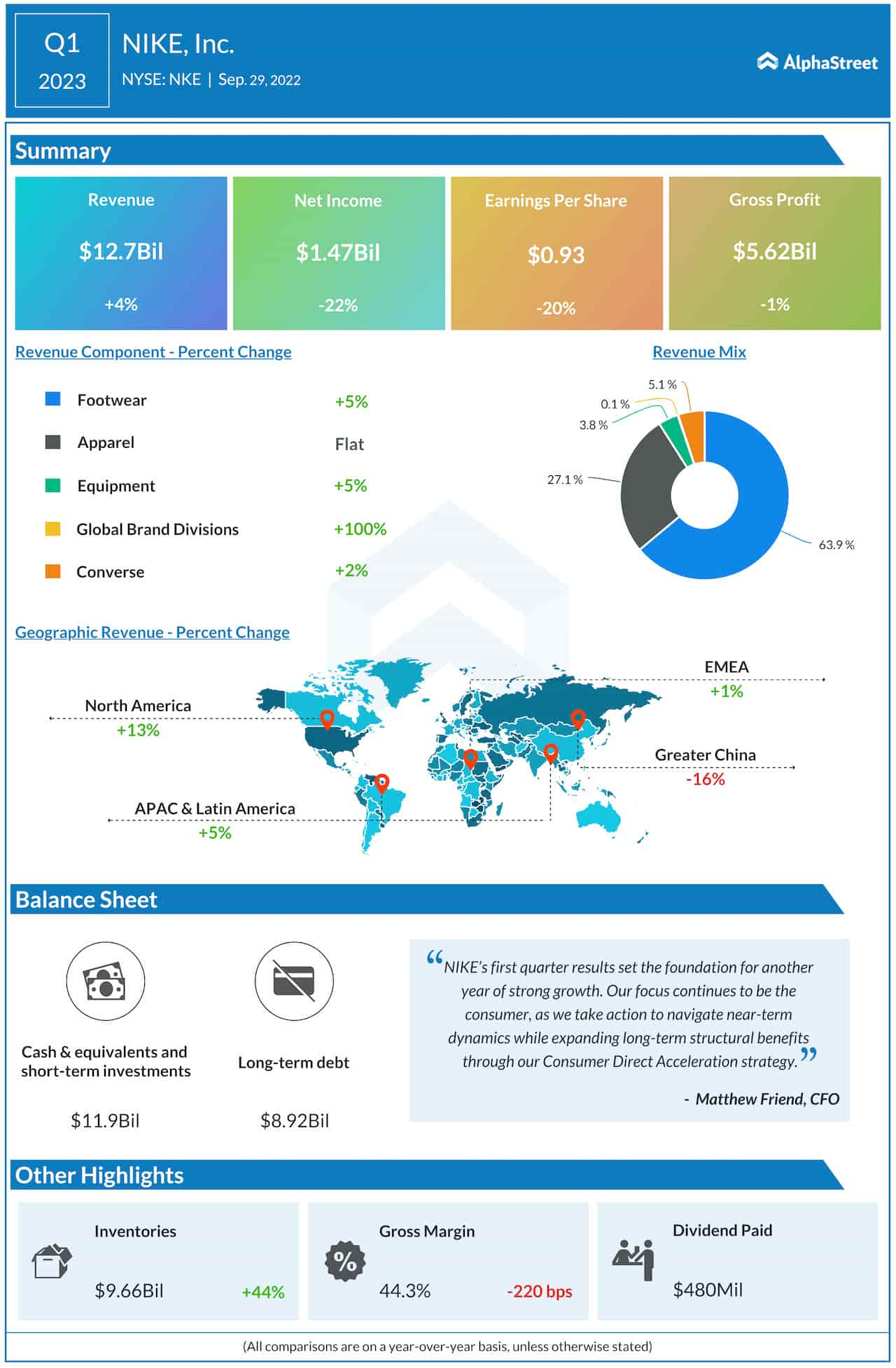

Nike now expects full-year sales to grow at a slower pace than estimated earlier, which mainly reflects softening sales in North America. The headwinds are expected to persist in the near future, but NKE remains a good bet for the long term. It is widely estimated that the stock would come out of the current slump in the remainder of the year, and go beyond the $100 mark.

NIKE, Inc. Q1 2023 Earnings Call Transcript

It is important to note that Nike’s problems are not internal, rather they are related to temporary factors that are not specific to the company. In the past, it has weathered such situations effectively, so it is very likely that it would bounce back as market conditions improve, thanks to the stable demand for its products across markets.

Right now, Nike enjoys a pricing advantage due to the absence of discounts and promotional offers. For the company, product innovation and continued investment in the business across all geographical regions have been top priorities despite the challenging operating conditions.

Growth Strategy

The Consumer Direct Acceleration strategy has helped Nike increase its competitive advantages by transforming the operating model and driving deeper and more direct connections through digital. In the most recent quarter, digital sales for the Nike brand were up 29%. That should ease the impact of factory shutdowns in Vietnam, where the company manufactures about 50% of its footwear and 30% of apparel.

FL Earnings: Foot Locker Q2 adjusted profit drops as sales decline 9%

“Over the next 18 months, we’ll drive consumer energy through new products and storytelling, in essence, doing what NIKE does best. NIKE’s competitive advantages are also growing as the Consumer Direct Acceleration transforms our operating model, driving deeper and more direct connections through digital. NIKE membership serves as a catalyst for digital growth, driving greater engagement and higher lifetime value in our highest margin channel,” said Nike’s CFO Matthew Friend in a recent statement.

Key Numbers

Nike has reported better-than-expected earnings every quarter in the past two years. There has been a steady uptrend in revenue performance also. In the first quarter of 2023, a sharp decline in China was more than offset by higher sales in the other markets. Among the important operating segments, Footwear sales moved up 5%, while apparel remained unchanged, resulting in a 4% increase in total revenues to $12.7 billion. At $0.93 per share, earnings were down 20%.

NKE is trading sharply below its November peak and the 52-week average. The stock traded sideways on Monday afternoon, after closing the previous session lower.