NIO Day

The ET7 is priced at RMB448,000 before subsidies, or RMB378,000 with BaaS (Battery as a Service). The premier edition is RMB526,000, or RMB398,000 with BaaS. Deliveries are expected to start in Q1 2022.

NIO also introduced the 150 kWh battery, which can achieve a range of over 1,000 km for the ET7, and is compatible with all NIO models. The company also unveiled the Power Swap Station 2.0 which allows up to 312 swaps per day. NIO plans to have 500 stations in operation nationwide by the end of 2021.

Strong deliveries

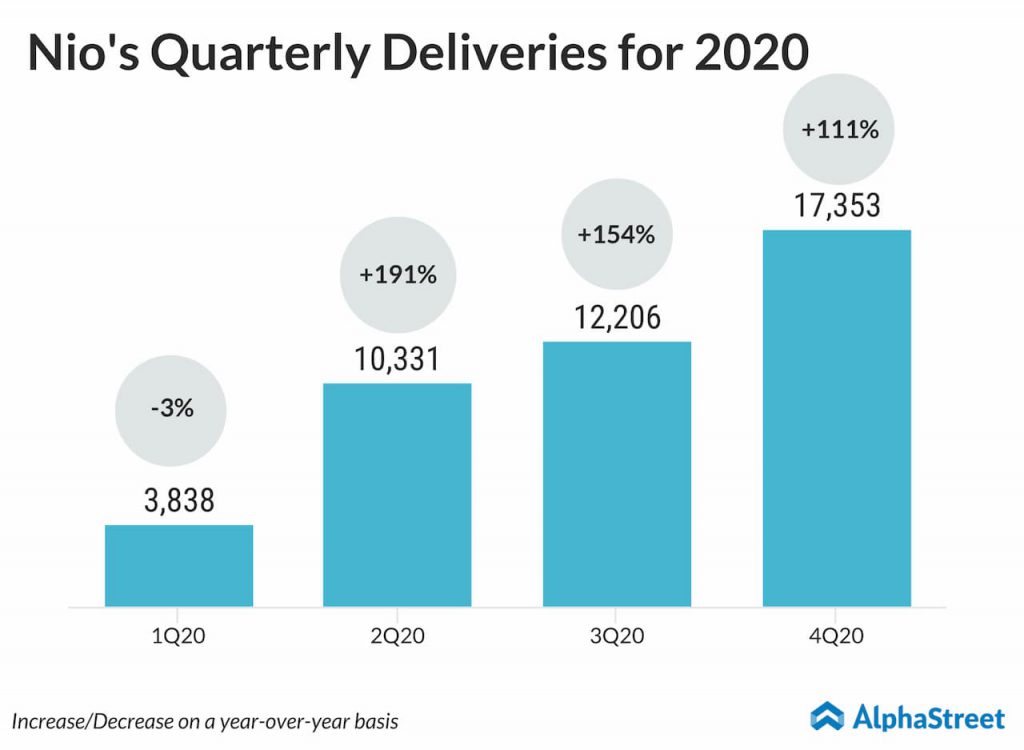

NIO reported strong triple-digit growth in deliveries for the most part of 2020. Deliveries rose 111% year-over-year in the fourth quarter of 2020. Cumulative deliveries reached 75,641 vehicles as of December 31, 2020. For the fourth quarter of 2020, revenues are expected to grow 119-126% YoY to a range of $921.8-947.9 million.

The overall sentiment around NIO’s stock is positive following the NIO Day event and a number of analysts have raised their price targets on the stock. Most of the analysts covering the stock have rated it as Buy.