After falling from a record high earlier this week, Oracle’s stock is expected to bounce back in the coming months. As of now, the stock needs to be approached with caution, given the high valuation, although the recent drop can be turned into a buying opportunity.

In Growth Mode

The company, which is considered a laggard in the cloud market, is probably all set to catch up with rivals leveraging the emerging new trends in the market. The ongoing enterprise migration to digital platforms – thanks to the virus-induced movement restrictions — has been creating a plethora of opportunities for technology companions.

Experts are of the view that Oracle has the potential to provide advanced enterprise cloud software and operate cloud infrastructure on which businesses can run their applications. However, the company might need to go the extra mile to achieve that, considering the relatively slow progress it has made in that area. Currently, the tech firm generates the lion’s share of its revenue from licenses for database software and middleware.

Strong Q3

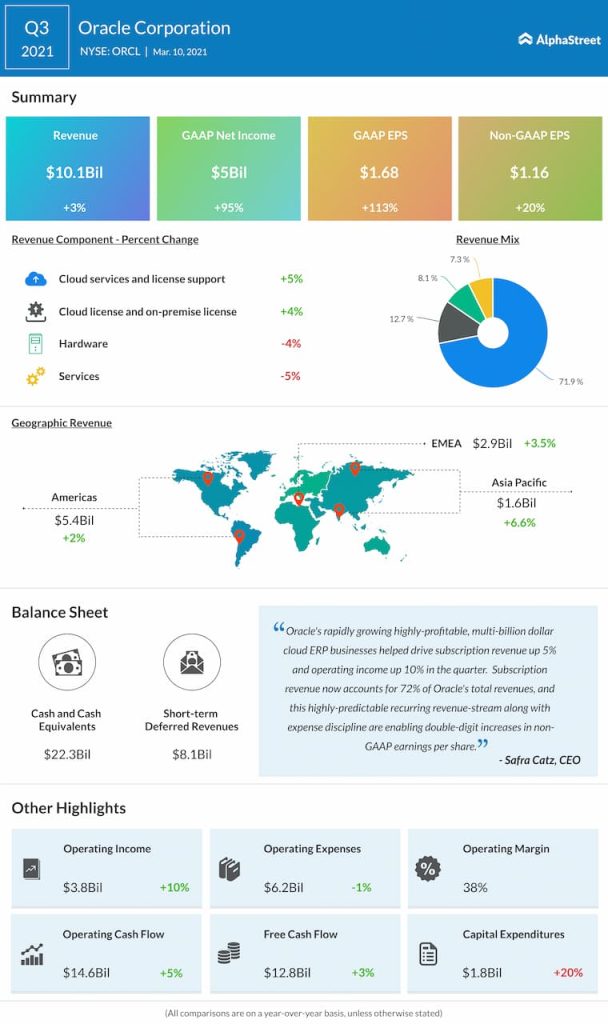

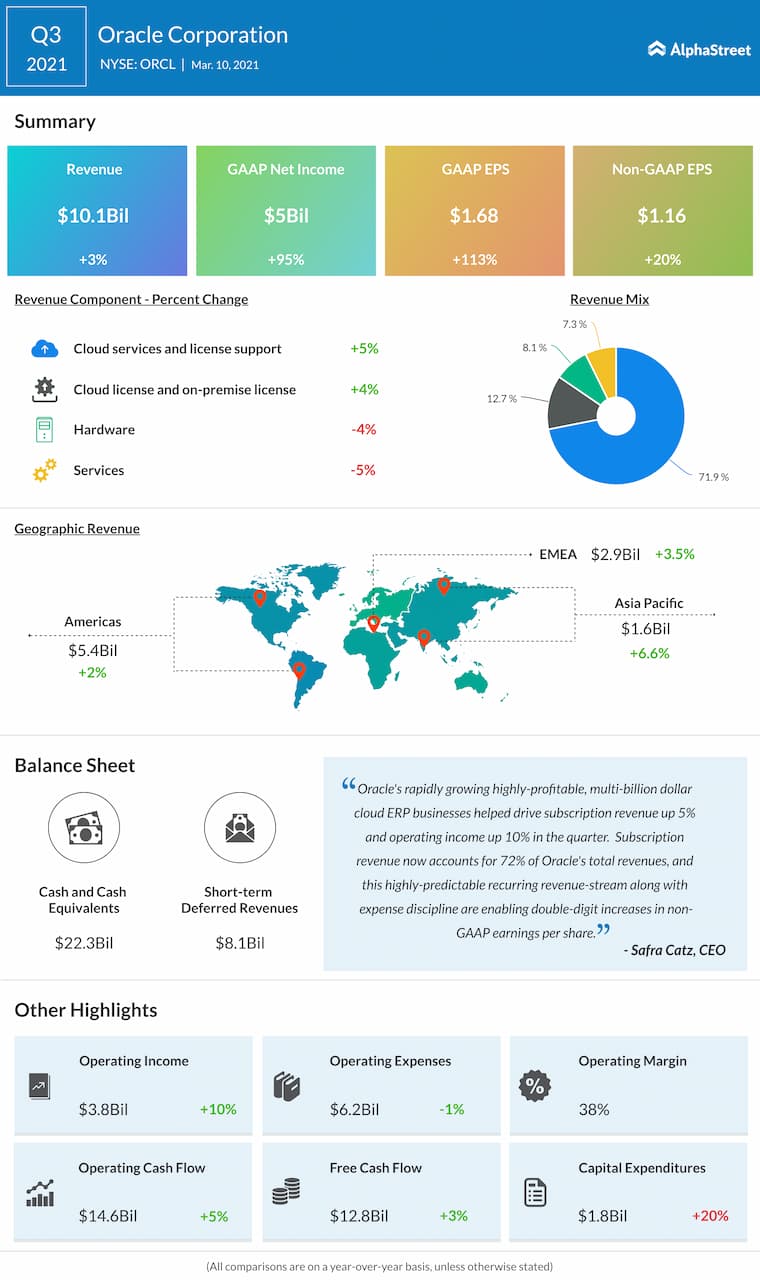

In the third quarter of 2021, unadjusted earnings increased 20% from last year to $1.16 per share and topped expectations. The bottom-line growth was driven by a 3% increase in revenues to about $10 billion. Market watchers were looking for slower growth. In the past several years, earnings either topped or matched analysts’ estimates regularly.

From Oracle’s Q3 2021 earnings conference call:

“As you can see, we had a great quarter and executed well against our growth plan. Revenue was in line with our USD guidance while EPS beat the midpoint of guidance by $0.05. Our total cloud services and license support revenue for the quarter was $7.3 billion, up 5% in US dollars, 2% in constant currency, driven by Fusion, Autonomous Database, and our Gen2 OCI Cloud. Recurring revenue as a percentage of total revenue now represents 72% of total company revenue and we anticipate this trend to continue as cloud services grow.”

But the positive outcome failed to impress the market as sentiment was weakened by the bleak guidance. Currently, the management expects revenues to grow 5-7% in the May-quarter, which is barely in line with analysts’ estimates. As a result, Oracle’s stock suffered one of the biggest intra-day losses on Wednesday evening.

Bullish Outlook

The bright spot of the third-quarter conference call was chairman Larry Ellison’s prediction that the company’s database software business would witness solid growth in fiscal 2022, which is in line with the general outlook.

Earlier this week, Oracle’s stock plunged from an all-time high of $72.64, losing about 10% in a single day. It has gained about 6% since the beginning of the year, all along outperforming the sector and the broad market.