Strong Data

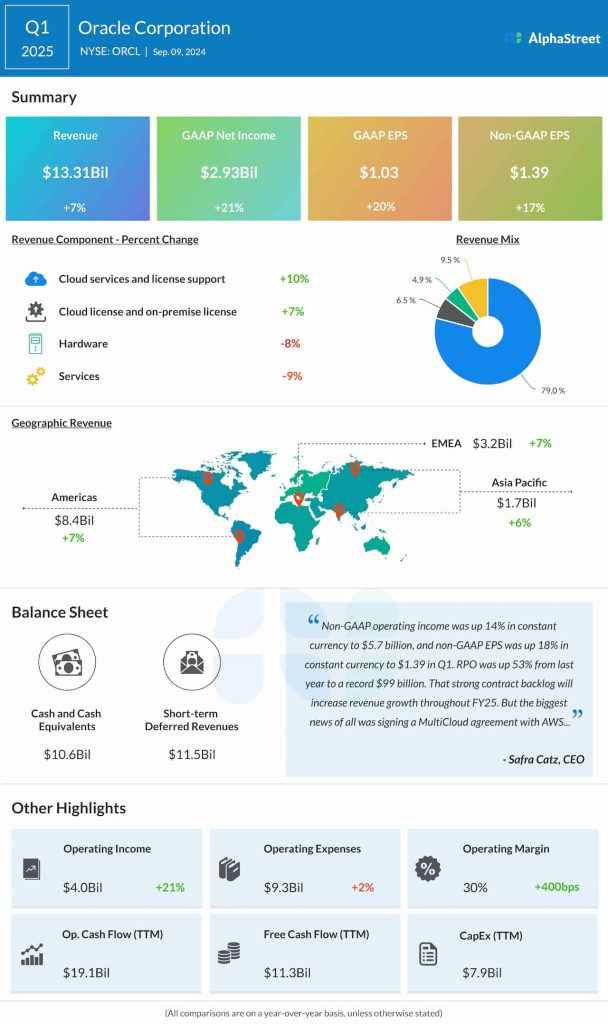

In the first three months of fiscal 2025, revenues increased to $13.3 billion from $12.45 billion in the same period last year and topped expectations. Cloud Services & License Support and Cloud License & On-premise License revenues grew by 10% and 7% respectively. Revenue increased across all geographical segments. Remaining Performance Obligations, a measure of revenue expected from existing contracts that have not yet been fulfilled, jumped 53% year-over-year to $99 billion.

Earnings, excluding special items, were $1.39 per share in the August quarter, compared to $1.19 per share in the prior-year period. Analysts had forecasted a slower growth. On a reported basis, net profit rose to $2.93 billion or $1.03 per share from $2.42 billion or $0.86 per share in the same period of 2024. Adjusted operating margin came in at 43% during the three months, up from 41% reported last year.

OCI Gains

Oracle Cloud Infrastructure is one of the fastest-growing areas of the business. Also, the database business is expanding at a faster pace than in the recent past, led by multi-cloud agreements with Microsoft and Google. More recently, the company entered into a partnership with Amazon Web Services to make Oracle available in the latter’s cloud. The significantly high backlog indicates that the company is going to stay on the growth path.

“We have dedicated cloud customer regions. We have national security regions. We have sovereign regions. We have Oracle alloy regions with our partners, and we have multi-cloud regions with Azure and Google Cloud and now shortly with AWS as well. This sizing flexibility and deployment optionality of our cloud regions continue to be significant advantages for us in the marketplace. As we’ve said before, we’re committed to returning value to our shareholders through technical innovation, strategic acquisitions, stock repurchases, prudent use of debt, and the dividend,” Oracle’s CEO Safra Ada Catz said at the Q1 earnings call.

Outlook

Considering the growing demand for its services, the company expects full-year capital spending to be double that of the FY24 capex. The management predicts a double-digit revenue growth for fiscal 2025. In the second quarter, total cloud revenue is expected to grow between 24% and 26%. On a per-share basis, adjusted profit is expected to be in the range of $1.45 to $1.49 in the November quarter.

ORCL has gained a whopping 46% in the past eight months and is trading well above its long-term average. The stock traded up 11% on Tuesday morning.