Commerce

Alibaba expanded its services further into less developed markets during the quarter and the disruption in international tourism created an opportunity for its import commerce business. Tmall Global GMV grew 40% year-over-year.

The company plans to focus on acquiring new customers in less developed markets and to work on reaching its mid-term goal of serving more than 1 billion Chinese consumers. Alibaba will continue to expand its product supply, particularly in categories that are under-penetrated by e-commerce.

Alibaba’s investments in its New Retail operations helped in accelerating the digitalization of its brick-and-mortar retail operations thereby improving its omni-channel capabilities. The company’s grocery business benefited from more customers moving to online shopping for groceries and other essentials. More than 60% of Freshippo’s GMV came from online.

Alibaba’s Southeast Asian ecommerce platform Lazada saw a 100% growth in order volume year-over-year. Several consumers have moved to online shopping due to the health crisis and the company believes this trend will continue to drive growth in ecommerce in the region over the long term.

“In this highly competitive region with Lazada’s new leadership in place, we aim to build a sustainable digital business, leveraging Alibaba’s technology to serve local consumers and the business partners. During the June quarter AliExpress, our cross-border export marketplace, saw order conversion and the delivery time negatively impacted by challenges in cross-border logistics, but the situation has started to improve in July.” – Daniel Zhang, Chairman and CEO

Cloud computing

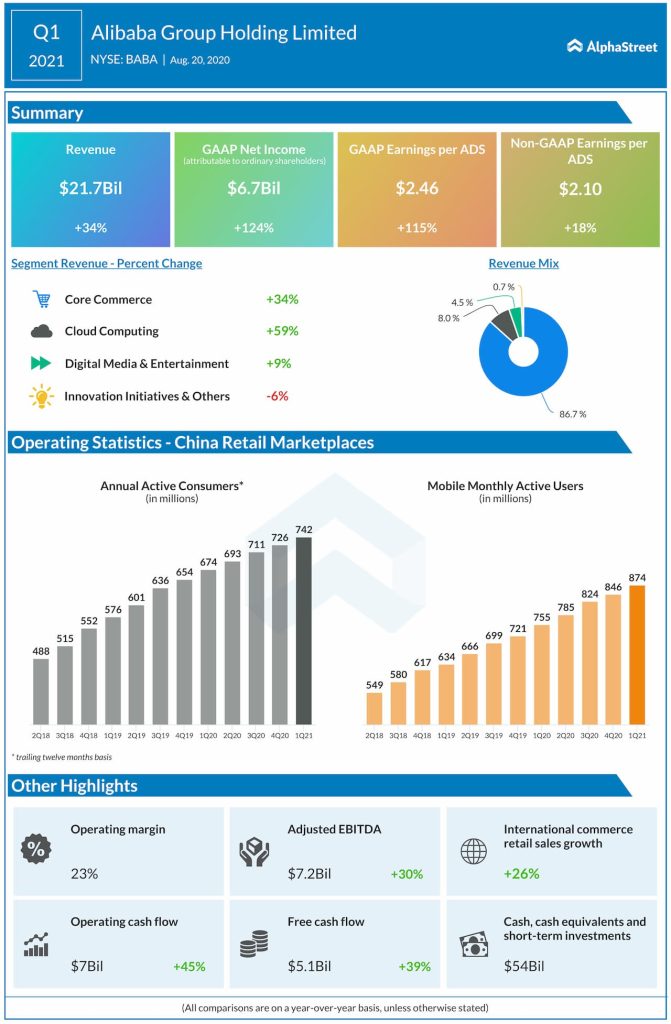

Amid the changes in the business environment, Alibaba saw higher demand for cloud infrastructure and services. Alibaba’s cloud computing revenue grew 59% year-over-year during the quarter. The company believes that as all industries undergo a digital transformation, all businesses will move to cloud and therefore expects the rapid growth in the cloud business to continue in the near and mid-term.

Based on third-party studies, the size of the China cloud market is estimated in the $15-20 billion range while the US market is about 8 times this number. So the China cloud market is at an early stage but it will be a faster-growing market compared to the US and Alibaba is optimistic about its prospects here.

Click here to read the full transcript of Alibaba Q1 2021 earnings call