Quarterly results

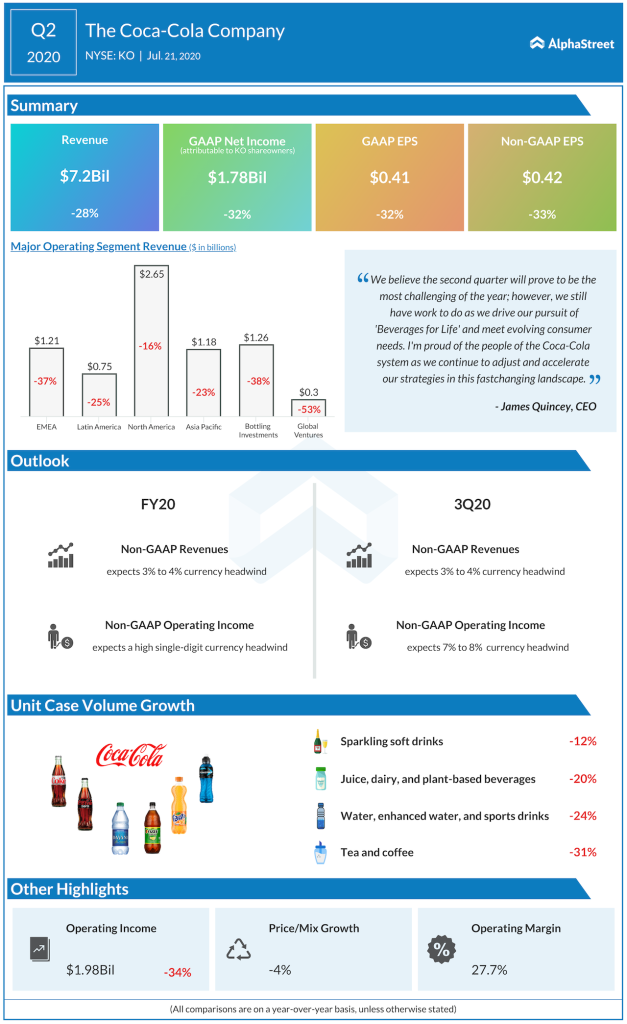

Coca-Cola saw its revenue fall 28% to $7.2 billion while adjusted EPS decreased 33% to $0.42. The company saw revenues decline across all its operating segments with the highest drop of 53% in Global Ventures.

The lockdowns and restrictions enforced due to the coronavirus pandemic led to most restaurants remaining shut and people staying at home which in turn impacted the performance of both companies in their away-from-home channels.

While PepsiCo’s beverages business is quite dependent on away-from-home and was impacted by weakness in this channel, its snacks business was strong enough to offset declines in this area and thereby cushion the overall top line. However, Coca-Cola derives around half of its revenues from the away-from-home channels and therefore took a harder hit to its top line during the quarter due to weakness in this space.

Business performance

PepsiCo’s product portfolio consists of both snacks and beverages while Coca-Cola focuses almost entirely on beverages. PepsiCo’s snacks business has delivered strong growth consistently compared to its beverages division making it more of a snack company than a beverages one.

In the second quarter, PepsiCo’s Frito-Lay and Quaker Foods segments delivered strong revenue growth of 7% and 23% respectively, as demand for snacks and ready-to-eat foods increased during the lockdown period. PepsiCo’s business across all its markets is cushioned by its mixed product portfolio.

Coca-Cola’s products include soft drinks, water, sports and energy drinks, juice, dairy and plant-based beverages, as well as tea and coffee. Its beverage-heavy portfolio depends significantly on away-from-home channels which makes it susceptible to adverse situations like the ongoing health crisis.

Sparkling soft drinks declined 12% due to pressure in away-from-home channels in regions like India and Western Europe. Juice, dairy and plant-based beverages fell 20% while water and sports drinks dropped 24%. Tea and coffee decreased 31%, mainly due to the closures of Costa retail stores in Western Europe.

PepsiCo continues to boost its portfolio by acquiring companies that specialize in different products. The acquisitions of SodaStream, Pioneer Foods and Rockstar add to the company’s offerings in sparkling water, snacks and energy drinks. Coca-Cola’s acquisitions have again focused on beverages with the company purchasing Costa Coffee and Nigerian juice and dairy beverages-maker Chi Ltd.

During its second quarter conference call, Coca-Cola said it is looking to give priority to its brands that are strong and have growth potential while exiting the ‘zombie brands’. These zombie brands are single-country brands which comprise over half of the company’s 400 master brands but have little to no scale. Their combined revenue forms around 2% of the company’s total revenue. Despite slow growth, they require resources and investments which make them unappealing.

Outlook

Looking ahead, PepsiCo expects its snacks and food business to remain resilient, but with some moderation in growth, and its beverages business to improve its performance in the latter half of the year. The company continues to improve its offerings in ready-to-eat foods with the launch of Cheetos Mac ‘n Cheese and it is working on the expansion of the Mountain Dew brand in the energy drinks category.

Coca-Cola has been seeing its unit case volume trends improve with the declines going from double digits to mid single digits, helped by improvements in away-from-home channels due to the easing of lockdowns. This trend is expected to continue in the second half of 2020.

To sum it up …

PepsiCo’s snack business definitely gives it an advantage over Coca-Cola as the former’s diverse line-up of products gives it a strong footprint across its markets. Coca-Cola’s dependence on away-from-home channels and its singular focus on one product category puts it in a soft position compared to its rival. All said, it appears that PepsiCo is in better shape in this pandemic-hit world.

Click here to access the transcripts of PepsiCo and Coca-Cola Q2 2020 earnings conference calls