Philip Morris is also seeing momentum in its reduced risk products category with particular strength in its IQOS devices.

Reduced Risk Products

Reduced Risk Products (RRPs) comprised almost one quarter of Philip Morris’ business during the third quarter and the category generated $4.9 billion in sales for the first nine months of the year. Heated tobacco units made up over 10% of total shipment volume during the nine-month period which is double the share seen in 2018.

Looking ahead, the company expects the strength in RRPs to drive this proportion higher and it is on track to achieve its target of 90-100 billion units in 2021. The East Asia & Australia region is set to deliver over half of its revenues from RRPs this year.

IQOS

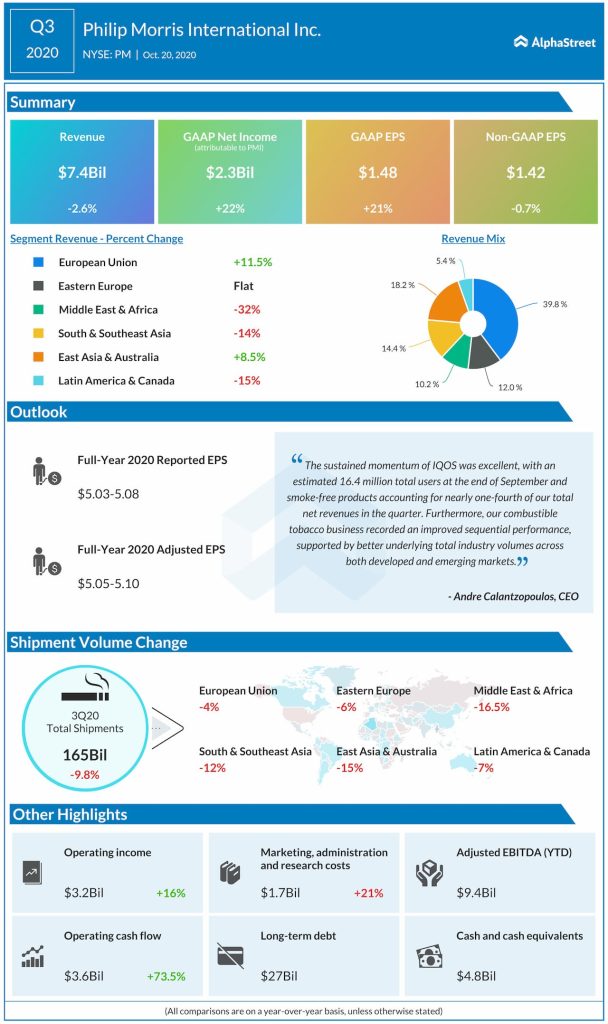

Total number of IQOS users was estimated at 16.4 million as of September-end, reflecting an increase of around 1.1 million users since the end of Q2 and over 4 million on a year-over-year basis. IQOS devices accounted for approx. 8% of RRP net revenues year-to-date.

The product showed strength across all key regions, including Japan, Russia and the EU. IQOS has witnessed double-digit share growth across a wide range of markets and continues to grow this share.

In the EU, the number of IQOS users reached 4.7 million in the third quarter while in Japan, this number reached 6 million. IQOS is currently available in 61 markets. Philip Morris rolled out its new e-vapor product IQOS VEEV in New Zealand during the third quarter and plans to expand this to more markets in the fourth quarter and next year.

Outlook

Looking into the fourth quarter, Philip Morris expects consumption trends to remain broadly stable compared to the third quarter. However there is still uncertainty related to the COVID-19 pandemic and its impacts on the business.

Despite challenges, the company raised its full-year 2020 adjusted EPS guidance to a range of $5.05-5.10, reflecting an organic growth of 5-6%. Philip Morris is estimating a total industry decline of 7-8% and a like-for-like decline in total company shipment volumes of 8-9%.

Click here to access the full transcripts of the latest earnings conference calls