Qutoutiao Inc. (NASDAQ: QTT) is slated to report its earnings results for the third quarter of 2019 on Tuesday, December 3, before the market opens. The top line will be benefited by success in growing the number of active users and the level of user engagement while the bottom line could be hurt by higher costs and expenses.

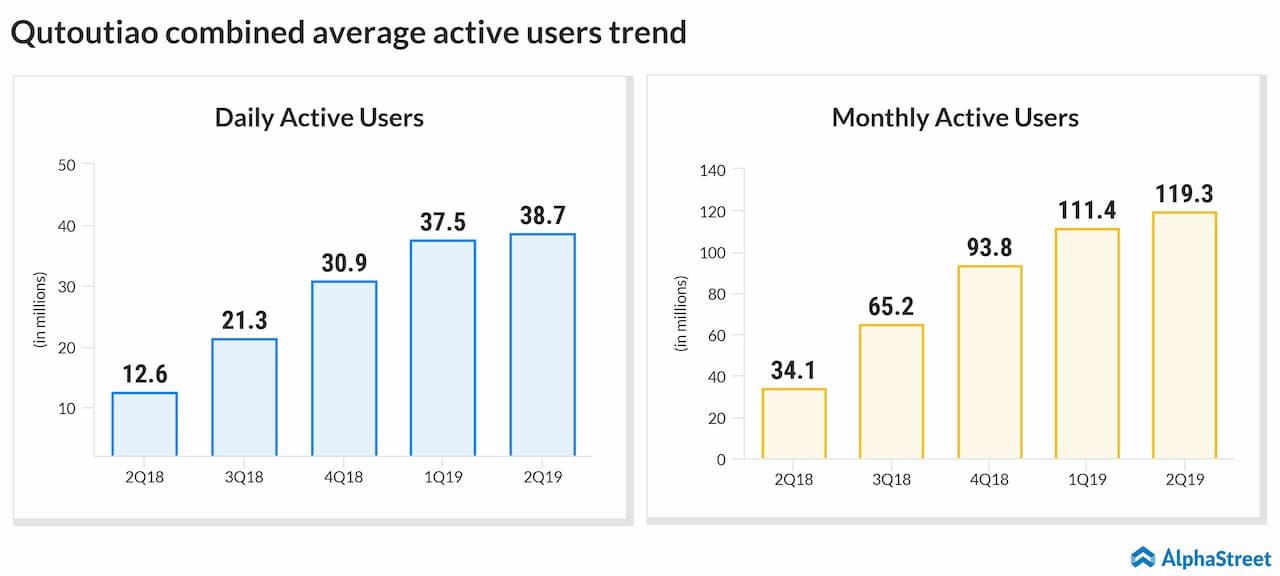

The company has experienced rapid growth since the launch of Qutoutiao in terms of installed users, monthly active users, daily active users, and revenues. The company’s user growth rate is expected to slow over time as the size of the user base increases. Due to this, the company’s success lies in its ability to increase user engagement with its platform.

In the past, user account systems and loyalty programs have contributed significantly to the growth in its installed users and high user engagement. However, the company remained clueless regarding the effective function of such systems and programs in the future. Along with this, the pressure could be mounting due to a possible increase in acquisition cost per user due to the implementation of new marketing initiatives.

The creation of new content formats and other products and services could be the driving factor for the increase of the size and engagement level of its user base. However, the competition for user traffic and user engagement as well as advertising and marketing spending could lower growth as the company faces strong competition in its business.

Analysts expect the company to report a loss of $0.35 per share on revenue of $196.4 million for the third quarter. In comparison, during the previous year quarter, Qutoutiao posted a loss of $0.40 per share on revenue of $144.54 million. The company has missed analysts’ expectations in all of the past four quarters.

For the second quarter, Qutoutiao posted a wider loss due to higher costs and expenses. Despite a weak digital advertising market, the Chinese mobile content platform achieved strong revenue growth driven by user base expansion across its products. For the third quarter, the company expects net revenues to be at a similar level as it has achieved in the Q2.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.