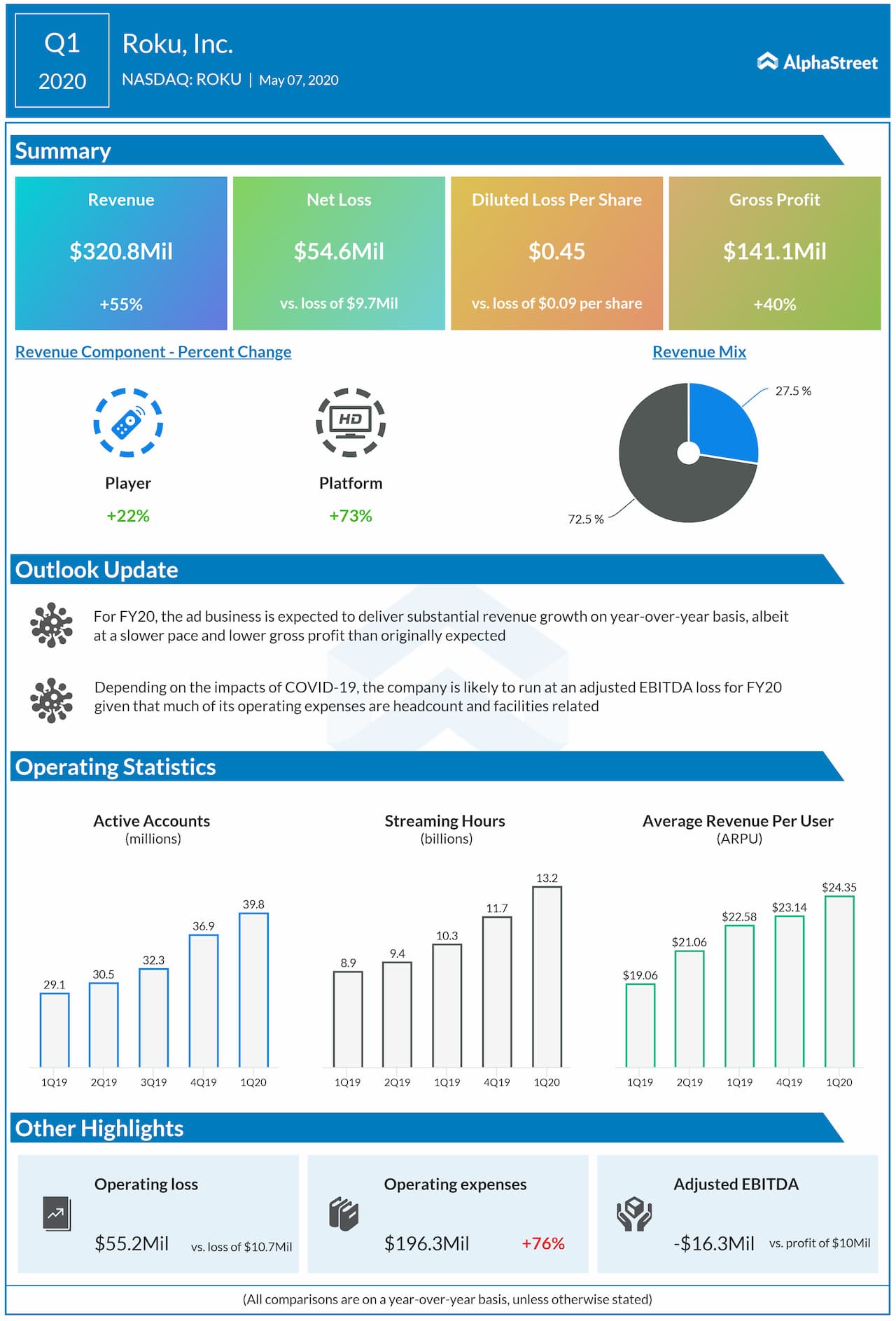

Roku, Inc. (NASDAQ: ROKU) reported a wider loss in the first quarter of 2020 due to higher costs and expenses. However, the top line rose by 55% on the acceleration in new account growth and an increase in viewing. Beginning in late Q1, Roku has started to see the effects of large numbers of people isolated at their homes due to the COVID-19 pandemic.

The pandemic associated stay-at-home orders and increased unemployment appear to have accelerated the shift from linear TV viewing to streaming during the past few weeks. Nielsen data showed that primetime linear viewing among adults 18-34 from March 16 to April 19 was down 18% year-over-year, and half of the TV viewing by this important demographic was streamed.

Despite the likelihood that total US advertising expenditures will decline in 2020, the company believes it is relatively well-positioned based on the effectiveness of its ad products and the trend towards streaming. The company expects its ad business to deliver substantial revenue growth on a year-over-year basis, albeit at a slower pace and lower gross profit that it has originally expected for the year.

The company has recently withdrawn its outlook for the full year. Depending on the impacts of COVID-19, the company is likely to run at an adjusted EBITDA loss for FY20 given that much of its operating expenses are headcount and facilities-related and therefore generally committed in the short-term.