The Stock

Read management/analysts’ comments on quarterly reports

As far as the management’s growth strategy is concerned, a key development was Oracle’s acquisition of health information technology company Cerner for about $28 billion in the first half. The deal marks the company’s foray into the healthcare market and is expected to give significant mileage to the Cloud business.

Cloud Power

The good news is that Oracle Cloud continues to grow organically, even though the broad tech market is experiencing weakness amid economic headwinds. The company is incorporating advanced AI capabilities into the cloud platform, in association with chipmaker Nvidia Corporation (NASDAQ: NVDA).

From Oracle’s Q1 2023 earnings conference call:

“Customers are already buying applications and cloud infrastructure from several different providers, including Microsoft, Amazon, Salesforce, Oracle, and others. Our job is to give our customers the ability to choose application and infrastructure technology from multiple clouds and then have those different clouds coexist and interoperate gracefully. Multi-cloud interoperability is an important step in the evolution of cloud computing.”

Snowflake appears to be on solid footing despite cloud slowdown

The market will be closely following Oracle’s second-quarter earnings report, which is slated for release on December 12 after the close of regular trading. Market watchers are looking for earnings of $1.18 per share, excluding special items, which represents a year-over-year decline of about 2.5%. The revenue estimate is $12.04 billion.

Financials

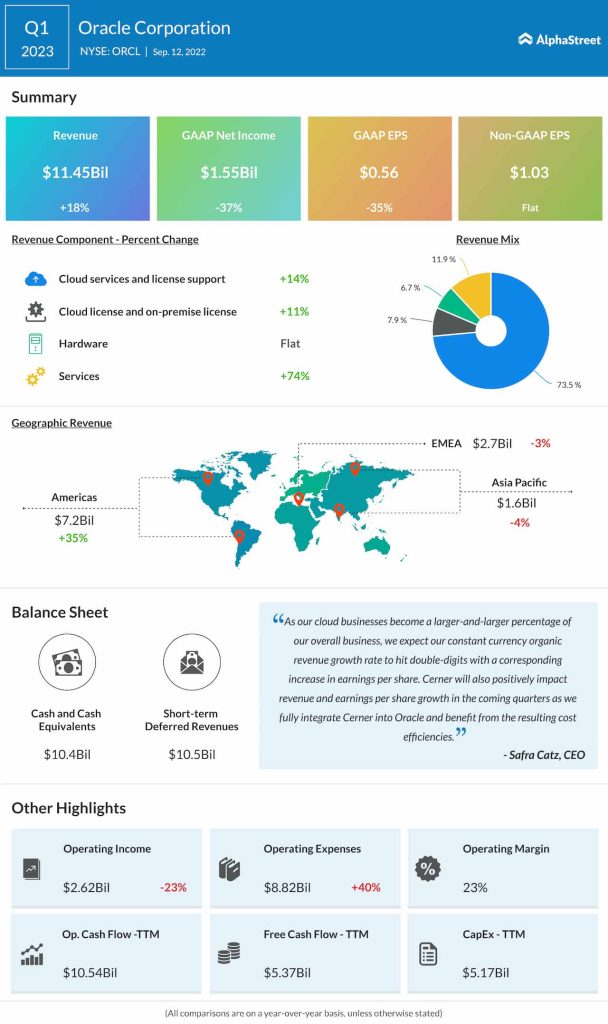

In the first quarter, double-digit growth in the core Cloud Services and License Support business drove up total revenues by 18% to $11.5 billion, significantly faster than the 5% growth recorded in the prior quarter. Earnings, adjusted for one-off items, remained unchanged at $1.03 per share. Revenues matched estimates, while the bottom line missed. It is worth noting that quarterly earnings either beat or matched estimates consistently for about five years, through the first half of FY22.

In a sign that the market was not happy with the mixed earnings outcome and the management’s weaker-than-expected second-quarter guidance, the stock slid in the following sessions and slipped to the lowest level in about one-and-half years. But it soon regained strength. ORCL traded lower on Tuesday afternoon, after closing the previous session down 3%.