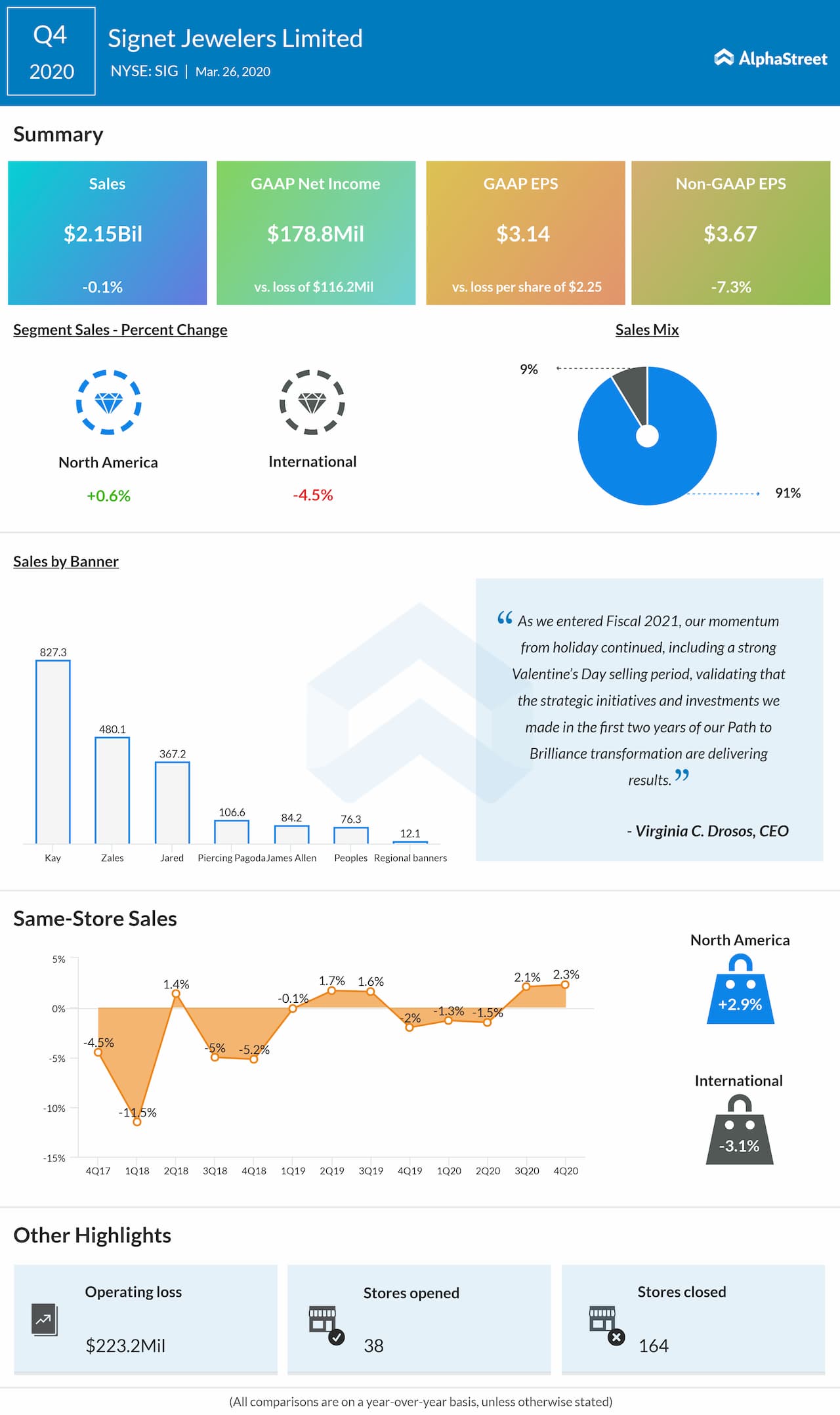

The company reported net income attributable to shareholders

of $178.8 million, or $3.14 per share, compared to a net loss of $116.2

million, or $2.25 per share, last year. Adjusted EPS totaled $3.67, beating

estimates of $3.47.

During the quarter, ecommerce sales climbed 15.1%

year-over-year to $299.9 million, accounting for 13.9% of total sales. Brick

and mortar same-store sales inched up 0.5%.

In North America, same-store sales increased 2.9%, with a double-digit

growth in ecommerce sales and a 1.1% rise in brick-and-mortar same-store sales.

The company saw strength in the Bridal and fashion category while Watches and Other

categories posted declines.

Signet saw weakness in its International division as sales

dropped across categories and the operating environment in the UK remained

tough. Same-store sales in the division fell 3.1%, pulled down by a decline of

5.8% in brick-and-mortar same-store sales. Ecommerce sales grew 15.8%.

In January, the company disclosed that its same-store sales

increased 1.6% during the holiday period. Same-store sales in North America

rose 2% while ecommerce sales jumped 13.5%.

Signet said it is not providing FY2021 guidance at this

time. The company has also decided to temporarily suspend the dividend on its

common shares and to pay the May quarterly dividend on its preference shares in

kind as opposed to cash.

On Monday, the company had announced that it would close all

of its stores in North America temporarily. On its conference call, Signet

stated that it has reduced its work hours and compensation across its teams.

The top executives have taken reductions to their pay as well.

Signet also said it is looking to reduce its store footprint

further as it focuses on moving towards a smaller store base with higher growth

potential and improved omnichannel capabilities.