Shares of Snap Inc. (NYSE: SNAP) were down 1% on Friday. The stock has dropped 81% this year. The general sentiment around the stock is pessimistic due to concerns over macroeconomic headwinds, ad spend slowdown and their impacts on the company’s revenue and profits. However, there is a slight spot of optimism around the company’s user growth and engagement trends which remain encouraging.

Headwinds

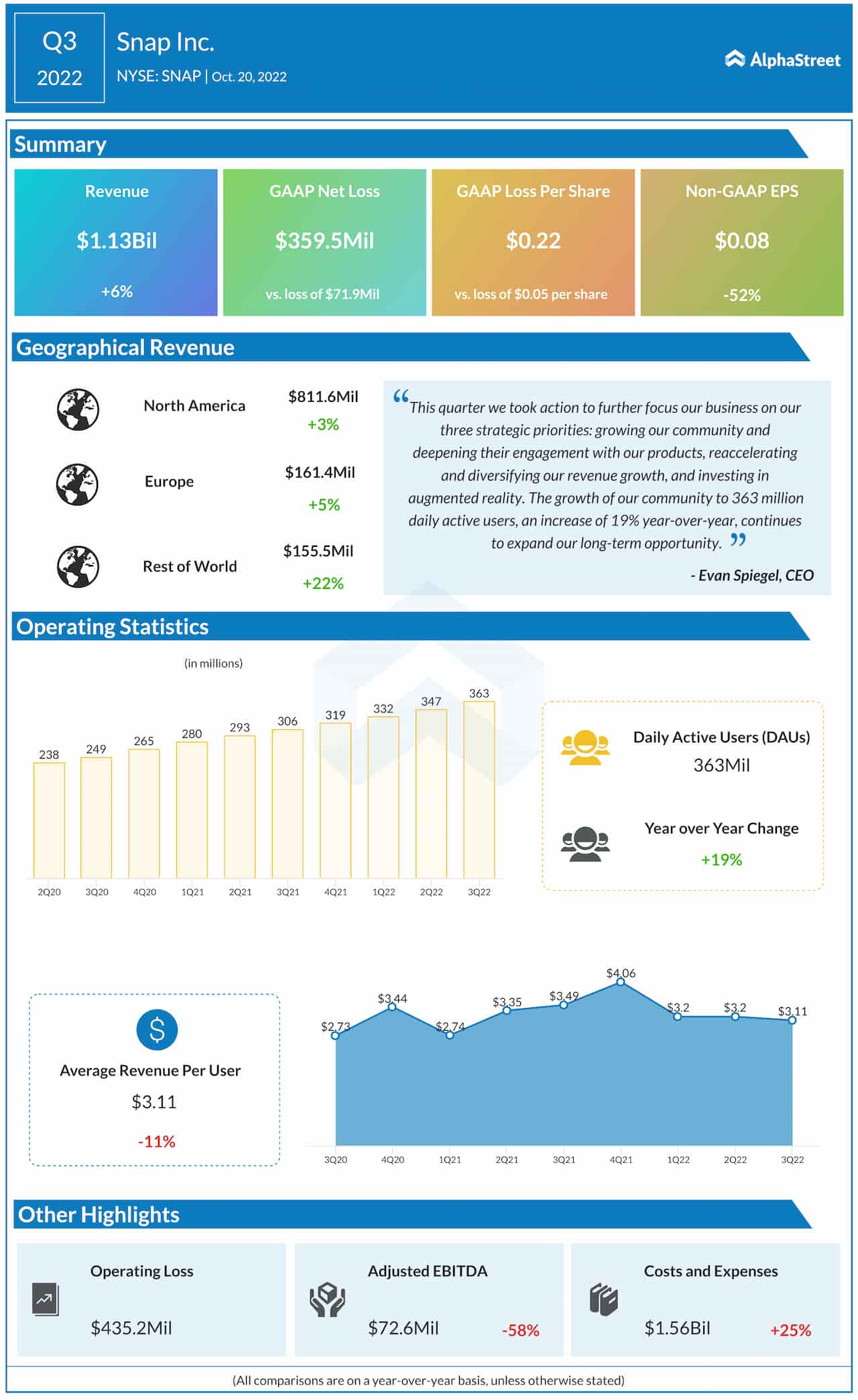

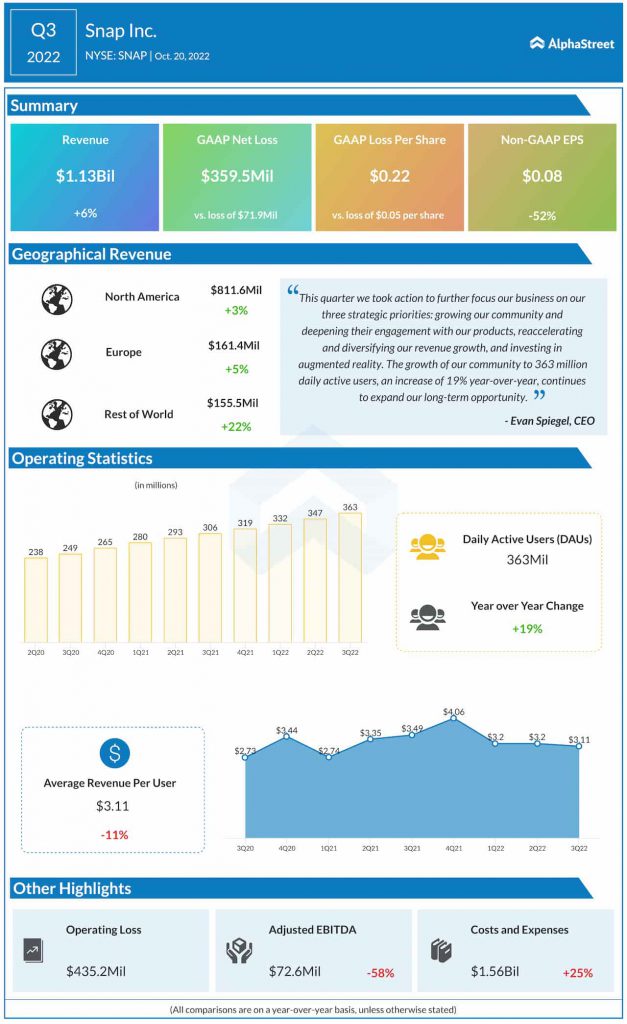

Snap’s revenue growth has been slowing down and its losses have been widening. For the third quarter of 2022, Snap’s revenue of $1.13 billion grew only 6% year-over-year compared to the double-digit increases that were recorded in the first two quarters of this year.

While the company saw revenues increase on a YoY basis across all its geographic regions during Q3, on a sequential basis, only North America recorded an increase. Revenue from Europe fell 5% while revenue from Rest of World remained flat sequentially.

Revenue growth is being impacted by platform policy changes, macroeconomic headwinds and increased competition. The company is also seeing a slowdown in digital advertising as inflationary pressures force businesses to reduce their ad spend. This slowdown in advertising is a major headwind for companies like Snap.

Snap expects revenue growth to decelerate through the fourth quarter of 2022 as well because Q4 has historically been dependent on advertising revenue. Hence, the company anticipates YoY revenue growth to remain flat in Q4.

Snap also saw a drop in average revenue per user (ARPU) in Q3. Global ARPU fell 11% YoY and the company recorded single-digit decreases in ARPU across all its geographic regions during the quarter.

Snap’s widening losses are also a concern. Net loss in Q3 widened to $359.5 million from $72 million in the year-ago period. Loss per share was $0.22 versus $0.05 last year. On an adjusted basis, the company posted earnings of $0.08 per share but this was down 52% from the prior-year quarter.

Tailwinds

Snap has been able to maintain user growth and engagement even in this challenging environment, which is encouraging. In Q3, the company’s average daily active users (DAUs) grew 19% YoY to 363 million. On a sequential basis, DAUs were up 4%. During the quarter, DAUs grew both sequentially and YoY across all geographic regions as well. For the fourth quarter, the company expects DAUs to be approx. 375 million, which would reflect a growth of 18% from the year-ago period.

Snap also has significant opportunity within its augmented reality (AR) platform. There are over 250 million people engaging with AR every day and this provides the company with opportunities to help businesses deliver immersive experiences and drive strong results. There is a wide range of digital experiences that can be made possible through AR that can help drive engagement and growth.

Click here to read the full transcript of Snap’s Q3 2022 earnings conference call