Southwest Airlines Co. (NYSE: LUV) reported better-than-expected earnings for the second quarter of 2019 but revenues fell short of estimates, sending the stock tumbling 4.7% in premarket hours on Thursday.

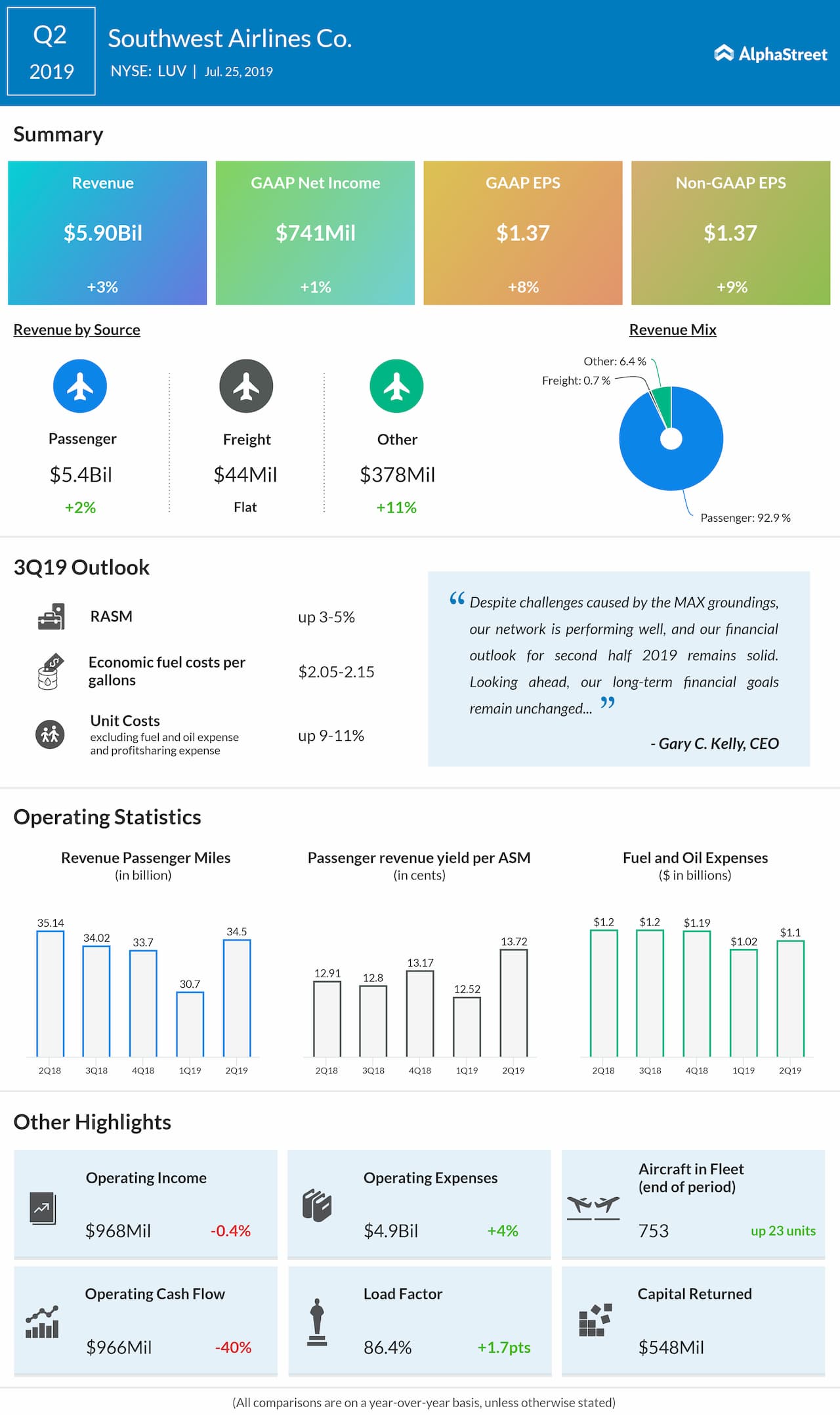

Total operating revenues grew 2.9% year-over-year to $5.90 billion but came in shy of forecasts of $5.94 billion. Passenger revenues increased 2.4% to $5.4 billion.

Net income was $741

million, or $1.37 per share, compared with $733 million, or $1.27 per share, in the year-ago period. Analysts

had forecast EPS of $1.34.

Unit revenues (RASM) increased 6.8%, driven mainly by a

passenger revenue yield increase of 4.2%, and a load factor increase of 1.7

points. Load factor reached an all-time quarterly record of 86.4%. Revenue

passenger miles fell 1.7% while available seat miles (ASM) dropped 3.6%.

Total operating expenses rose 3.6% to $4.9 billion. Unit

costs (CASM) increased 7.5%. Economic fuel costs were $2.13 per gallon compared

to $2.21 per gallon in the year-ago quarter. Fuel efficiency decreased 1.7% year-over-year,

due to the removal of the company’s most fuel-efficient aircraft from its

schedule as a result of the MAX groundings.

For the third quarter of 2019, Southwest expects RASM to

increase 3-5% versus last year. CASM, ex fuel, is expected to rise 9-11%. Available

seat miles are expected to decrease 2-3%. Fuel efficiency is expected to

decrease 1-2% year-over-year as a result of the MAX groundings. Economic fuel

costs are estimated to be $2.05 to $2.15 per gallon.

For the full year of 2019, CASM, excluding fuel and oil

expense and profit-sharing expense, is expected to increase 8-10% year-over-year.

ASMs are expected to decrease 1-2% year-over-year.

Due to the delay in MAX deliveries, and based on current guidance from Boeing assuming regulatory approval of MAX return to service during the fourth quarter of 2019, Southwest now estimates its 2019 capital expenditures to be in the range of $1.2 billion to $1.3 billion, compared with its previous guidance in the range of $1.9 billion to $2 billion.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.