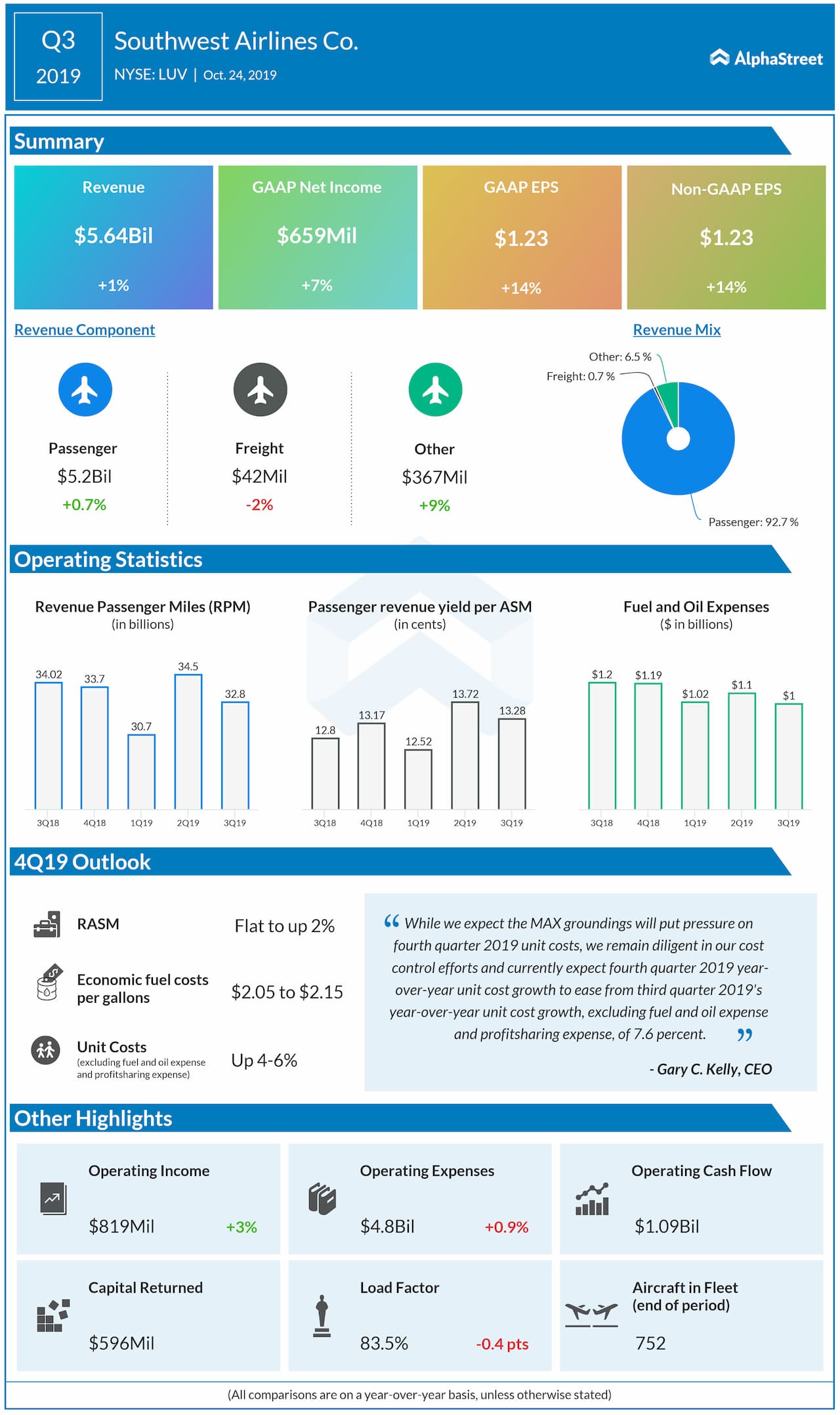

Net income was $659 million, or $1.23 per share, compared to $615 million, or $1.08 per share, in the prior-year quarter. Analysts had projected EPS of $1.08.

During the quarter, unit revenues (RASM) grew 4.2% year-over-year, driven mainly by a passenger revenue yield increase of 4.1%. Capacity decreased 2.9% year-over-year.

Total operating expenses increased 0.9% to $4.8 billion from the prior year. Unit costs (CASM), excluding fuel, oil and profit-sharing expense, increased 7.6%. Economic fuel costs were $2.07 per gallon. Fuel efficiency dropped 0.9% due to the removal of the company’s most fuel-efficient aircraft from its schedule due to the Max groundings.

For the fourth quarter of 2019, Southwest expects RASM to be flat to up 2%. Capacity is projected to decrease 0.5-1% year-over-year. CASM, excluding fuel and oil expense and profit-sharing expense, is expected to increase 4-6%. Fuel efficiency is expected to drop 1-2% due to the Max groundings. Economic fuel costs are estimated to be in the range of $2.05 to $2.15 per gallon.

Southwest expects capacity for full-year 2019 to decrease approx. 1.5% year-over-year. Due to the delay in MAX deliveries, and based on Boeing’s targeted regulatory approval of MAX return to service in Q4 2019, the company now estimates 2019 capital expenditures to be in the range of $1.1 billion to $1.2 billion, compared with the previous range of $1.2 billion to $1.3 billion.

Based on Boeing’s targeted regulatory approval of MAX return to service in Q4 2019, Southwest now expects to receive seven MAX aircraft deliveries during the fourth quarter, with the remaining 34 MAX aircraft originally scheduled for delivery in 2019 shifting into 2020. Due to the MAX groundings, the company deferred the retirement of seven of its owned 737-700 aircraft to future years.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions