The COVID-19 pandemic has led a rapid shift to digital payments and has meaningfully reduced the use of cash. Payments solutions firm Square Inc. (NYSE: SQ) is among those who benefited from this trend and is seeing significant growth due to contactless payments.

The company reported strong results for the third quarter of 2020 a day ago and the stock is rallying as a result. Shares were up over 13% on Friday. The stock has gained over 217% since the beginning of this year.

Quarterly performance

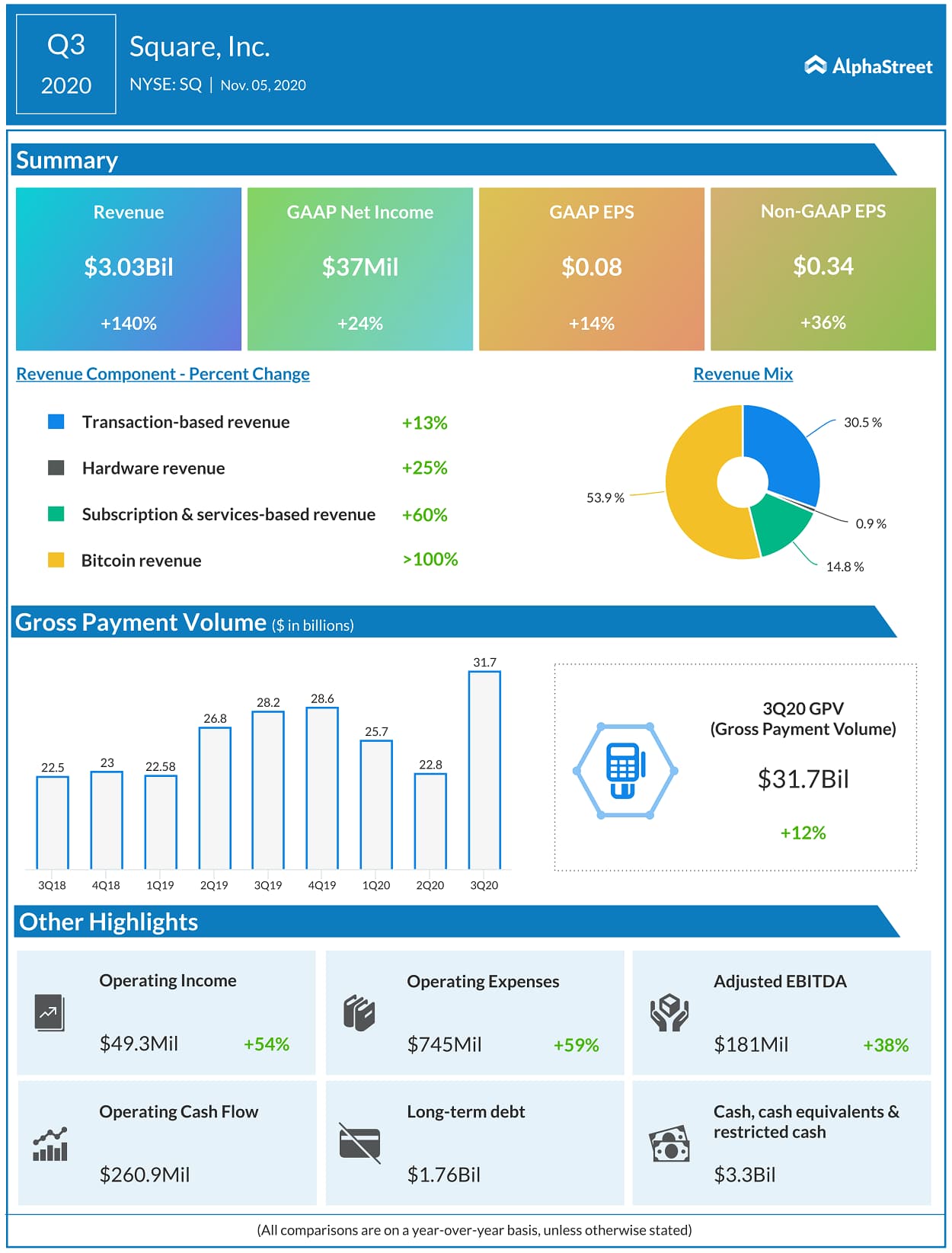

Revenues increased 140% year-over-year to $3.03 billion while adjusted EPS increased 36% to $0.34. Square saw double-digit growth across all its segments along with a huge rise in bitcoin revenue. Gross payment volume rose 12% to $31.7 billion.

The company benefited from the addition of new customers to its platform as well as the rising adoption of higher-value products such as Cash Card and direct deposit. Customers who adopt two or more products contribute significantly to gross profits.

Ecosystems

Both the Seller and Cash App ecosystems have gained strong momentum during the quarter. Square believes these ecosystems will continue to see benefits from rises in omnichannel commerce, contactless payments and digital wallets for consumers.

The company is focused on investing in product development as well as customer acquisition and believes there is significant opportunity for further expansion both domestically and internationally. During Q3, Seller gross payment volume (GPV) rose 46% year-over-year in markets outside the US.

Within Seller, Square Card is witnessing strong adoption and during the third quarter, sellers spent more than $250 million on their cards. The company also rolled out two new features for Payroll – Instant Payments and OnDemand Pay – which make it easier for merchants and employees to manage their money.

The company is also placing emphasis on omnichannel capabilities as they complement the broader ecosystem. GPV growth from online channels rose over 50% year-over-year during the quarter.

Square is witnessing strong adoption for Cash App. During the quarter, daily transacting actives almost doubled year-over-year. The company benefited from increased inflows into Cash App which remain high compared to pre-pandemic levels.

Within Cash App, the stock brokerage product witnessed rapid adoption as more than 2.5 million customers have bought stocks using Cash App since the rollout of this feature less than a year ago. Cash App has also made business management easier through Cashtag payments, higher weekly limits and tax reporting assistance.

Outlook

For October, Square expects gross profits for Cash App to grow more than 160% year-over-year. Gross profit in Cash App is expected to decelerate during the rest of 2020 and into 2021 depending on government inflows and the normalization of customer behavior. Seller gross profit is expected to surpass the third quarter level of 12% in October. Seller GPV rose 8% year-over-year in October. Square will continue its long-term investments across both ecosystems during the fourth quarter and in 2021.

Click here to read the full transcript of Square Q3 2020 earnings conference call