Quarterly performance

Trends

Kroger is seeing customers have more meals at home due to factors such as health, convenience, and affordability. These trends fueled demand for the company’s Simple Truth and Private Selection brands. The company launched 142 new items under its Our Brands line while also expanding its Simple Truth Plant Based line.

Kroger’s digital channel has witnessed significant growth in recent times. Digital sales rose 13% in Q2 and 114% over the last two years. Kroger has seen customers shift between in-store shopping and online shopping during the quarter as COVID-19 cases continued to ebb and flow. The company has managed to double its ecommerce household penetration since 2018 and during Q2, it added over 340,000 new customers to its digital platforms.

As part of its efforts to improve its digital capabilities, Kroger launched its Kroger Delivery Savings Pass in Florida, which offers customers unlimited delivery for an annual fee of $79. The company has also expanded to 2,239 pickup locations and 2,546 delivery locations covering 98% of Kroger households.

Like many of its peers, Kroger has been facing supply chain constraints and higher warehouse and transportation costs. In the back half of the quarter, the company saw higher inflation in some categories. Kroger expects supply chain costs to remain elevated in the second half of the year and it believes inflation for the full year will be higher than what was originally anticipated. For the second half of 2021, Kroger expects inflation to be between 2-3%.

Outlook

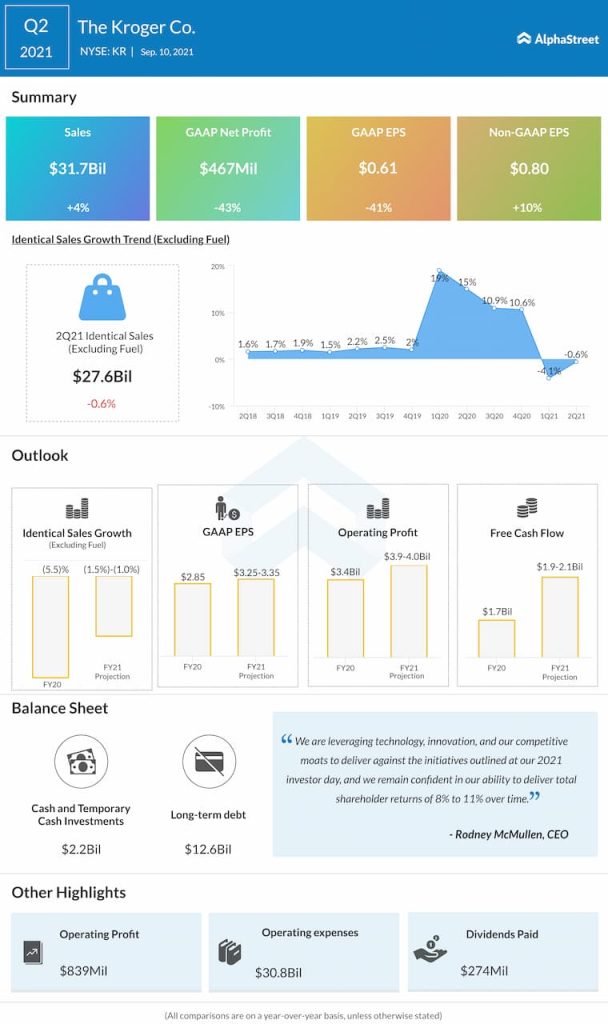

The stable trends in at-home food consumption and the momentum in its results has allowed Kroger to revise its guidance for the full year of 2021. The company expects identical sales to drop 1.0-1.5% compared to the previous outlook for a decline of 2.5-4.0%. This is better than what analysts had been estimating. The company expects its two-year identical sales stack to be 12.6-13.1%. Kroger now expects adjusted EPS to range between $3.25-3.35 for the full year versus the previous outlook of $2.95-3.10.

Click here to read the full transcript of Kroger’s Q2 2021 earnings conference call