The business world is looking at an uncertain future as the pandemic continues to wreak havoc on the global economy, showing little signs of improvement. But the virus outbreak turned out to be an unexpected opportunity for some industries, and e-commerce is one of them. Shopify Inc. (NYSE: SHOP), the Canada-based online retailer, is a beneficiary of the mass shift to the online marketplace after the shelter-in-place orders came into effect.

In general, experts are of the view that Shopify’s stock is overvalued, given the scale of the rally the tech sector witnessed earlier this year. That, combined with the deepening uncertainty in the market, is a call to wait as far as investing in SHOP is concerned. If the latest target price is any indication, it isn’t the right time to sell either as the value could go up further in the future. Though Shopify has the potential to create long-term shareholder value, some prospective buyers might find it unaffordable.

Bullish View

The sentiment is quite bullish ahead of the third-quarter financial report – slated for October 29 – with market watchers predicting a rebound from last year’s negative earnings, aided by an estimated 65% growth in revenues. However, like every other industry, the future of e-commerce would also be determined by the course of the pandemic, which has left several small and medium merchants in dire straits.

Related: Amazon is headed for a busy second half

It looks like the management is exploring ways to sustain the current growth momentum, leveraging the ongoing adoption of e-commerce by merchants and the shift in people’s shopping behavior, so that the company can compete more effectively with rival retailer Amazon (AMZN). After introducing financial products Shopify Balance and Shop Pay Installments, as part of the expansion plan, a slew of new products like Buy-Now-Pay-Later is currently in the pipeline – to be rolled out later this year.

Fulfillment Push

One of the key growth drivers would be the recently launched Shopify Fulfillment Network, an ambitious initiative aimed at expanding the quick-delivery service across the U.S. Having added fulfillment automation specialist 6 River Systems into its fold a year ago, Shopify plans to invest big in that area over the next five years. It is estimated that a number of conventional retailers would embrace e-commerce in the coming months and use their store network as order fulfillment centers.

Meanwhile, Shopify will keep its facilities closed for the remainder of the year to make the necessary modifications to promote contactless transactions and to adapt to the emerging new normal. As a result, there would be a reduction in expenses going forward, mainly those related to travel and real estate footprint.

From Shopify’s second-quarter 2020 earnings conference call:

“With the ongoing COVID-19 pandemic, the continued uncertainty in our macroeconomic environment, and the growing momentum in the fight for quality, Shopify’s role to level the playing field for all entrepreneurs has never been more clear. Our mission has always been to make commerce better for everyone, and Shopify is working harder than ever to pull entrepreneurs forward into the future that is emerging.”

Record GMV

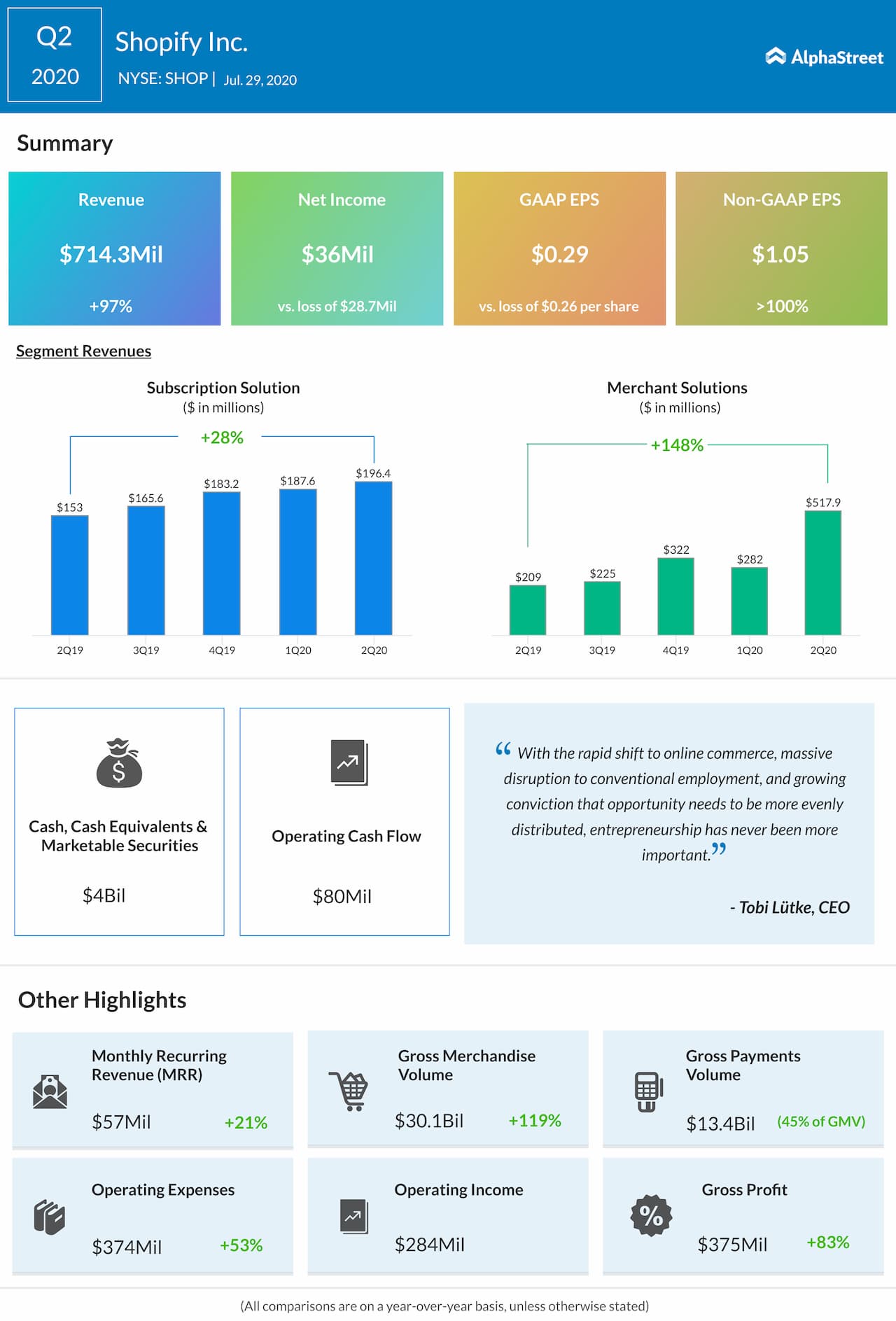

The company ended the first half on an upbeat note, recording strong second-quarter earnings that more than doubled year-over-year to $1.05 per share. Driving the growth, revenues moved up almost at the same pace to $714.3 million. The numbers also surpassed market watchers’ prediction, as they did in the past three quarters. Gross merchandise value surged to the highest level since the company’s Wall Street debut five years ago.

Read management/analysts’ comments on Shopify’s Q2 earnings

Shopify’s shares hit an all-time high in early September but retreated later in the month when the entire tech sector was hit by a selloff. However, the stock has returned to the growth path and is currently hovering near the recent peak. It opened Wednesday’s trading at $1,111 and traded lower throughout the session.