Buy PYPL?

The valuation is the lowest in the past several years, which would have attracted investors to the stock if experts’ outlook on the company was more positive. The general view is that the stock would continue underperforming the broad market for some more time even as tech stocks, in general, remain under pressure due to interest rate hikes and uncertainties related to the Russia-Ukraine war. Currently trading below its 12-month average, however, PYPL is expected to make decent gains in the long term, to the extent of breaching the $150-mark by early next year.

The factors that weigh on the company’s stock market performance are mostly temporary. On the positive side, PayPal is a market leader in payment services with strong fundamentals and is estimated to be controlling nearly half of the global payment processing technology market. It is better positioned than others to tap into unfolding opportunities in the rapidly evolving industry, thanks to the expansive network and technological prowess. There is every reason to believe that PYPL would regain the lost glory in the foreseeable future. Investors who are patient enough to wait for that would not miss this unique opportunity to own the stock.

From PayPal’s Q1 2022 earnings conference call:

“We continue to have many opportunities in front of us, given the scale of our two-sided network and the ongoing growth in digitized payments. We will advance our leadership in Checkout, continue our work to become the pre-eminent digital wallet and bring PayPal’s tools to more in-person contexts, all the while investing in our foundational technologies. Hundreds of millions of consumers and tens of millions of merchants value our comprehensive set of products and services.”

Mixed Results

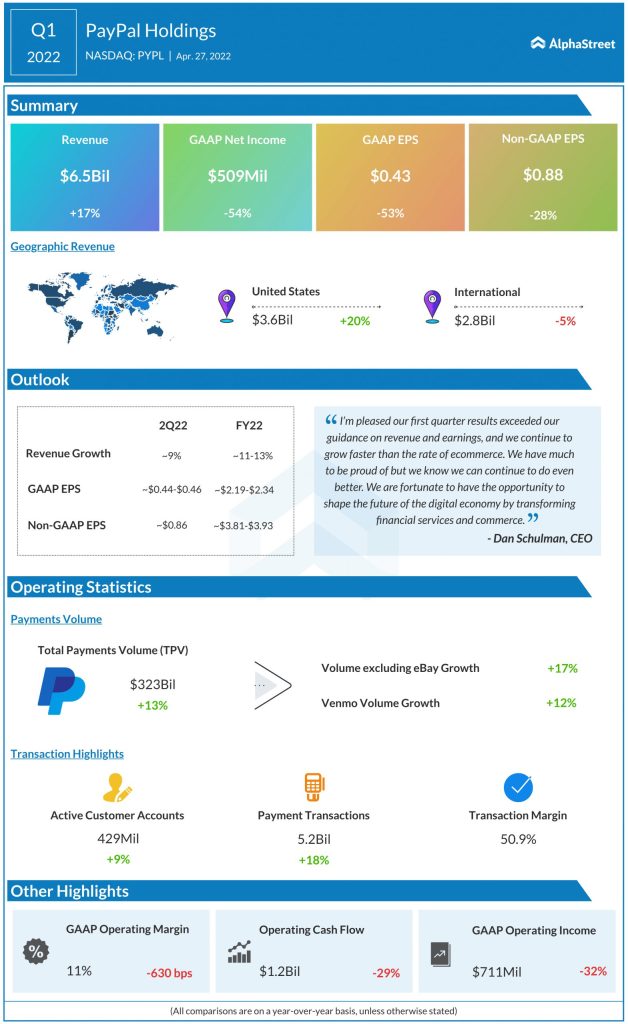

In the first quarter of 2022, PayPal’s earnings declined and came in line with analysts’ forecast, while revenues beat the estimates. At $0.88 per share, the adjusted profit was down 28% year-over-year. Revenues moved up 17% annually to $6.5 billion as weakness in the international market was more than offset by double-digit growth in the domestic market. At $323 billion, total payments volume was up 13%. There were around 429 million active customers at the end of the quarter, which is up 9%. The company sees a slowdown in customer addition next year, though it is bullish on revenue growth and the bottom-line performance.

MA Earnings: Mastercard Q1 2022 profit, revenue beat estimates

While the rapid adoption of digital payment services continues, the sector is also witnessing increased competition. PayPal has been battling for market share with the likes of Stripe and Google Pay, but the main threat to the business seems to be coming from Block, Inc. (NYSE: SQ), formerly known as Square.

Shares of PayPal traded lower throughout Friday. It had closed the previous session higher, extending the post-earnings rally.