Investing in K

Margins came under pressure from production delays caused by the strike at the company’s cereal plants in the U.S., and that segment continues to feel the pinch. The impact of the slowdown, aggravated by the supply chain issues, is unlikely to ease before the second half. Kellogg has been losing market share to rival food company General Mills (NYSE: GIS) for quite some time.

Read management/analysts’ comments on quarterly reports

On the positive side, Kellogg is a good dividend stock suitable for income investors, with a quarterly payout of $0.58 per share at a yield of 3.2% which is one of the best in the sector. The Battle Creek-based company, which owns popular food brands like Corn Flakes, Rice Krispies, and Pringles, reported stronger-than-expected earnings and revenues for each of the past five quarters helped by broad-based sales growth.

Q1 Outcome

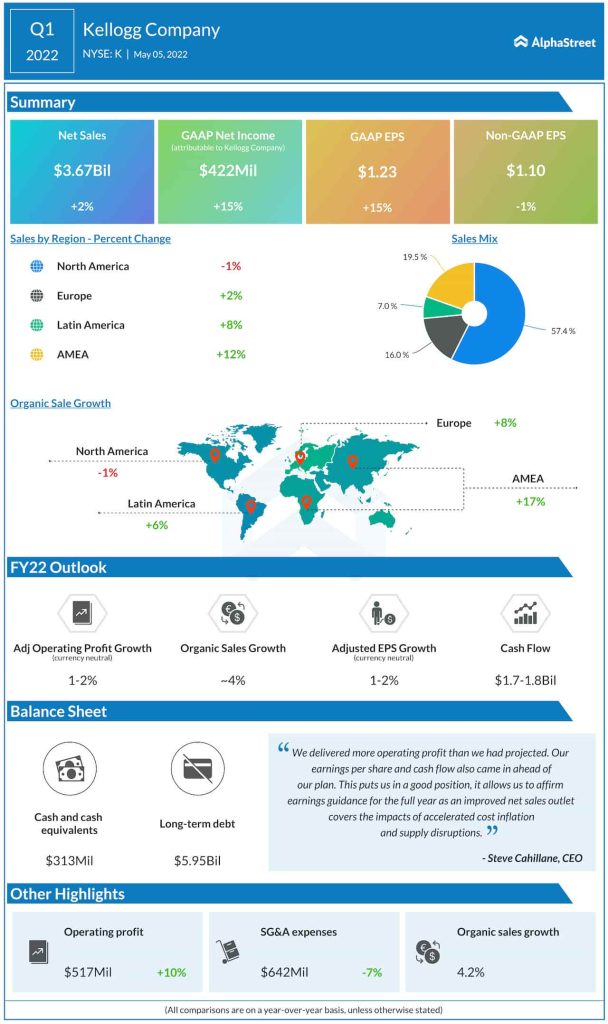

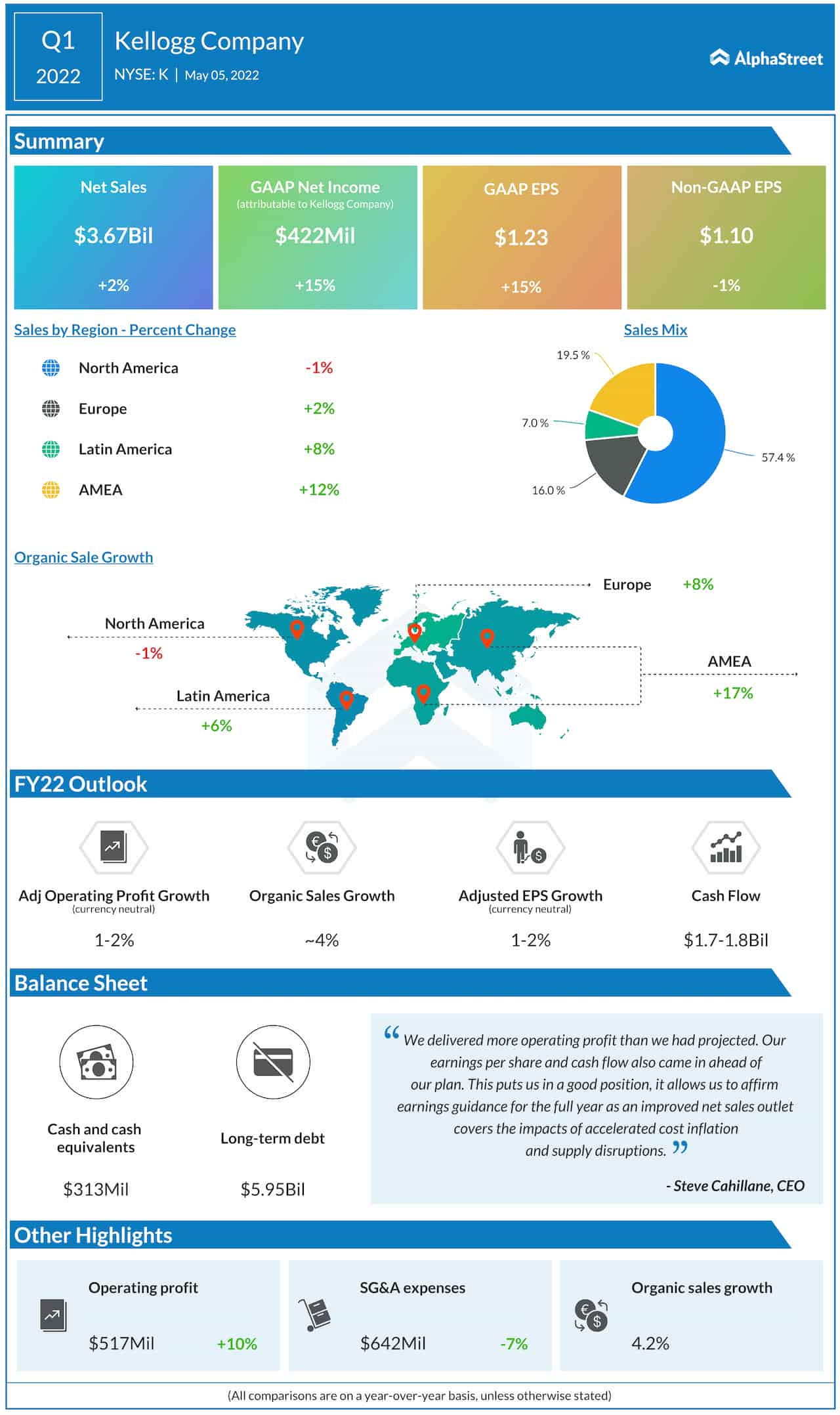

In the first quarter of 2022, net sales moved up 2% year-over-year to $3.67 billion amid strong organic sales growth. Meanwhile, adjusted earnings edged down 1% from last year to $1.10 per share, but came in above the consensus forecast. The management reaffirmed its full-year guidance, anticipating that the sale momentum would continue, offsetting the impact of inflation on margins.

Stock Watch: Domino’s Pizza looks poised for a strong recovery

From Kellogg’s Q1 2022 earnings conference call:

“Sticking to our strategy and focusing on execution is resulting in sustained top-line momentum, we had restored top-line growth in 2019 experience the pandemic related acceleration in 2020, and yet sustained the strong growth in 2021, despite what we were lapping, and in quarter one of this year, even with difficult comparisons, we continue to exceed our long-term target of 1% to 3% net sales growth with organic growth of more than 4%.”

The stock ended the last trading session slightly lower, after paring a part of the recent gains. K has maintained a steady uptrend so far this year, gaining about 12% during that period.