Buy LLY?

Read management/analysts’ comments on Eli Lilly’s Q1 2022 earnings

Meanwhile, the valuation looks higher compared to the company’s peers in the pharma industry. Analysts predict a 10% upside over the next twelve months. It is worth noting that earnings and revenues beat estimates in recent quarters and the trend is expected to continue.

Strong Pipeline

The top line benefited from strong sales of COVID-19 antibodies in recent quarters, but contributions from that segment are expected to be limited this year due to weakening demand. But the business is unlikely to be impacted by short-term headwinds, rather its future prospects look encouraging, thanks to the strong pipeline.

Recently, an advanced-stage clinical trial on Eli Lilly’s obesity/overweight drug tirzepatide delivered positive results, while the phase-III study on Jardiance for chronic kidney disease is slated for early completion due to positive cues on its efficacy. Mirikizumab, which is indicated for moderately-to-severely active ulcerative colitis, has been submitted for regulatory clearance in the U.S.

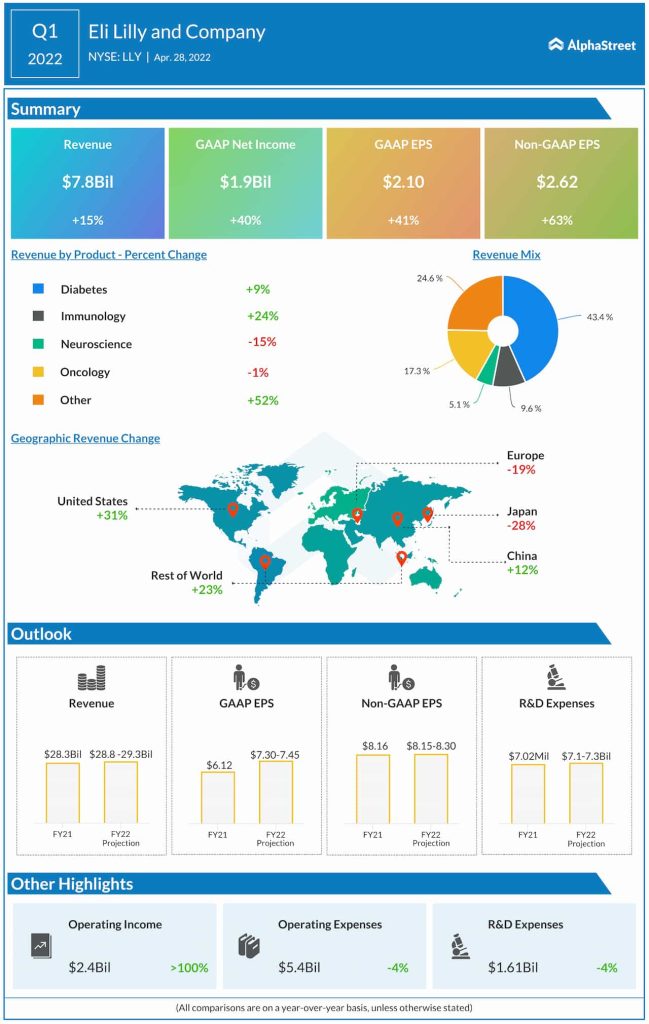

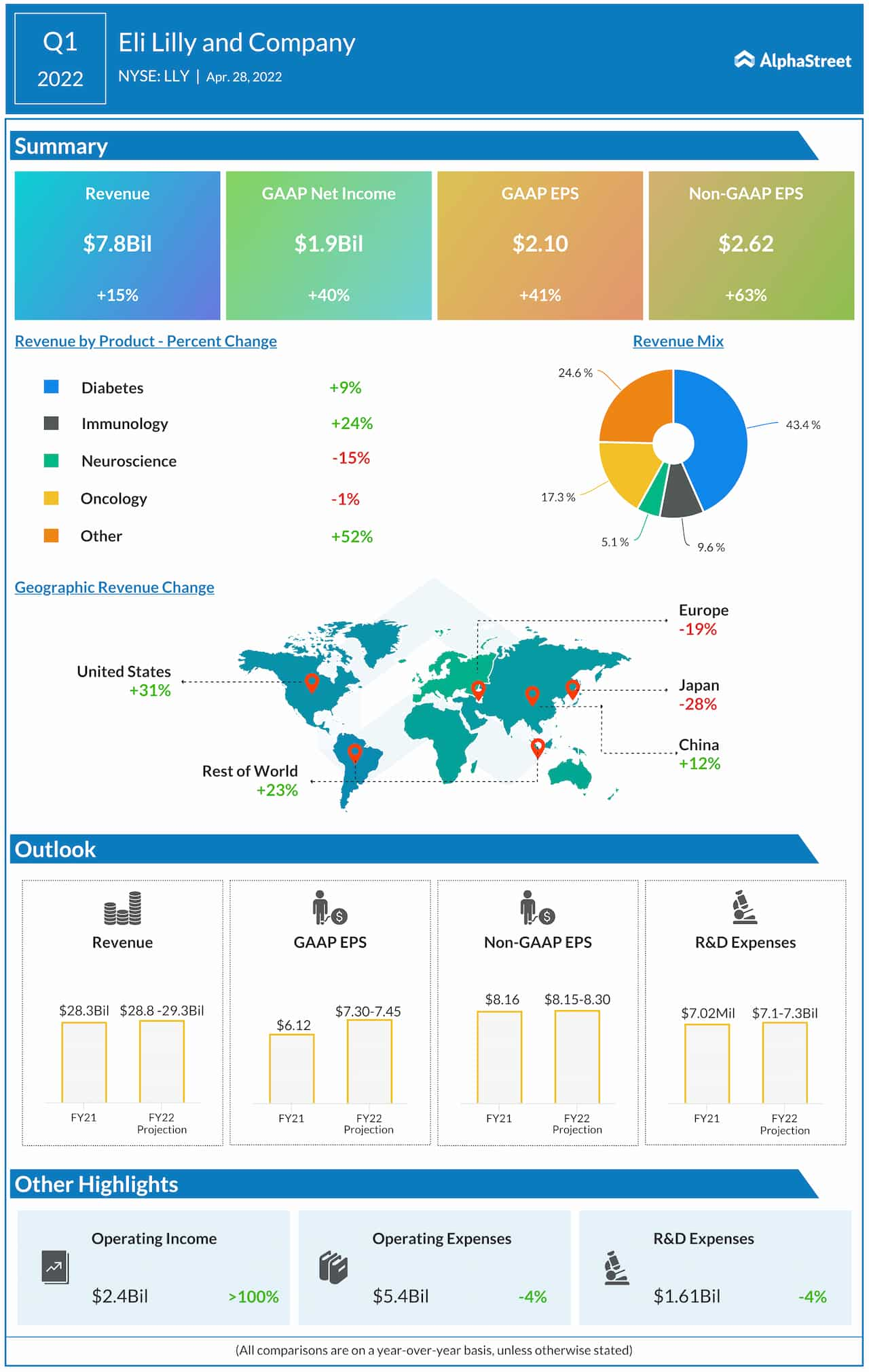

The company started fiscal 2022 on an upbeat note, reporting double-digit earnings and revenue growth for the first quarter. An uptick in the core diabetes and immunology divisions drove up total revenues to $7.8 billion, which is up 15% year-over-year. Consequently, adjusted profit jumped 63% to $2.62 per share. The numbers also topped expectations.

From Eli Lilly’s Q1 2022 earnings conference call:

“We are committed to invest for the long term to advance promising R&D opportunities and support launches to bring groundbreaking therapies to patients diagnosed with some of the most challenging diseases facing humankind, like diabetes, obesity, Alzheimer’s, cancer, and autoimmune disorders. With the progress we’ve seen to date, we remain extremely confident in our long-term growth prospects.”

Outlook

Buoyed by the positive Q1 outcome, Eli Lilly executives raised their sales guidance for fiscal 2022, mainly to reflect additional revenue from the sales of bebtelovimab in the first quarter. The strong performance of the core segment is expected to more than offset the negative impact of unfavorable foreign exchange rates. This week, the board of directors declared a dividend of $0.98 per share for the second quarter, payable on June 10 to shareholders of record on May 16.

All you need to know about Pfizer’s Q1 2022 earnings results

Eli Lilly’s stock has gained about 6% in the past four months, after a series of ups and downs. LLY traded lower in the early hours of Tuesday’s session, continuing its withdrawal from the post-earnings highs.