After reporting below-consensus production numbers a few weeks ago, Tesla, Inc. (NASDAQ: TSLA) reported profit for the third quarter, on an adjusted basis, defying analysts’ estimate for a loss. Revenues, meanwhile, declined 8%. The company’s stock gained sharply during Wednesday’s extended trading session, following the announcement.

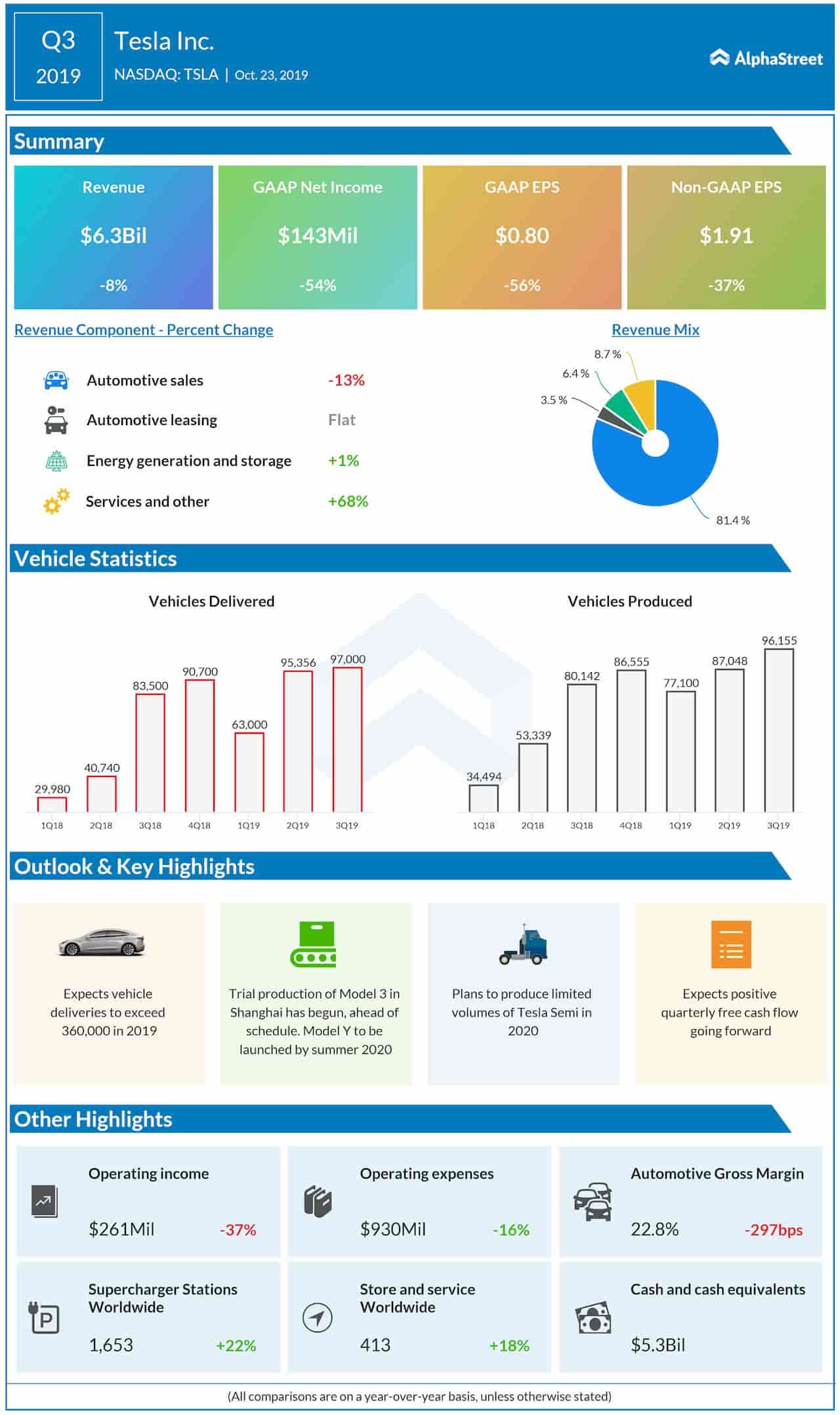

During the September-quarter, revenues dropped 8% annually to $6.3 billion, hurt by softness in vehicle shipments. The top line came in broadly in line with the market’s expectations.

Turnaround

The Silicon Valley-based electric carmaker reported adjusted earnings of $1.86 per share for the quarter, compared to $2.9 per share last year. Analysts were looking for a loss. Unadjusted profit was $143 million or $0.78 per share, compared to last year’s profit of $311 million or $1.75 per share.

Earlier, there was caution among the stakeholders after the company reported third-quarter production numbers that fell short of expectations, despite year-over-year growth. It produced 96,155 vehicles and delivered around 97,000 units, led by the Model 3 sedan, as usual. Tesla’s stock suffered this year due to its inability to meet the production targets.

Updates

The company said the setting up of its Gigafactory in Shanghai is progressing ahead of schedule and trial production has started. Production of Model Y is expected to start by summer 2020. Tesla’s energy segment achieved record storage deployment of 477 Mwh, with a 48% sequential solar growth.

Also see: Tesla Q1 2019 Earnings Conference Call Transcript

After falling to a multi-year low a few months ago, the stock made modest gains and traded slightly above the $250-mark. It lost about 24% so far this year as the company continued to struggle with its production and delivery goals. The shares gained about 17% Wednesday evening, following the earnings report.