After staying on the upward trajectory since the third-quarter earnings report, shares of Tesla (NASDAQ: TSLA) rose sharply and reached a new high on Monday. The rally was spurred by a bullish statement from brokerage Credit Suisse and reports of the tax credit program for electric vehicles getting an extension.

Related: Tesla gains after Musk reveals plan to launch Cybertruck

While bringing cheer to Tesla shareholders with its bullish comments, Credit Suisse maintained the underperform rating on the stock, which gained about 7% and traded slightly above $380 Monday afternoon. The analyst opined that Tesla’s focus areas – electrification and automotive software – have the potential to decide the future of the industry. Last month, the stock got a major boost after the market overwhelmingly received Tesla’s much-hyped Cybertruck.

Ahead of Others

According to Credit Suisse, Tesla stays ahead of most of its rivals in the various aspects of electric vehicle production, especially the cutting-edge technology used for battery production. The statement assumes significance considering the bank’s typically downbeat outlook on Tesla. Its $200 price target on the stock represents a 44% downside from the current levels.

If another round of tax credit becomes a reality, it would be a boon for Tesla, which has been joined by auto giant General Motors (GM) in persuading the authorities to consider a raise/extension.

Investor Day

The market will be closely following Tesla’s Powertrain Investor Day to be held next year, for updates on its production and delivery guidance, after failing to meet the targets on multiple occasions in the past. The fact that the company launched its China operations as per the schedule and is on track to repeat that in Europe has added to the positive sentiment.

Also read: Tesla Q3 2019 Earnings Conference Call Transcript

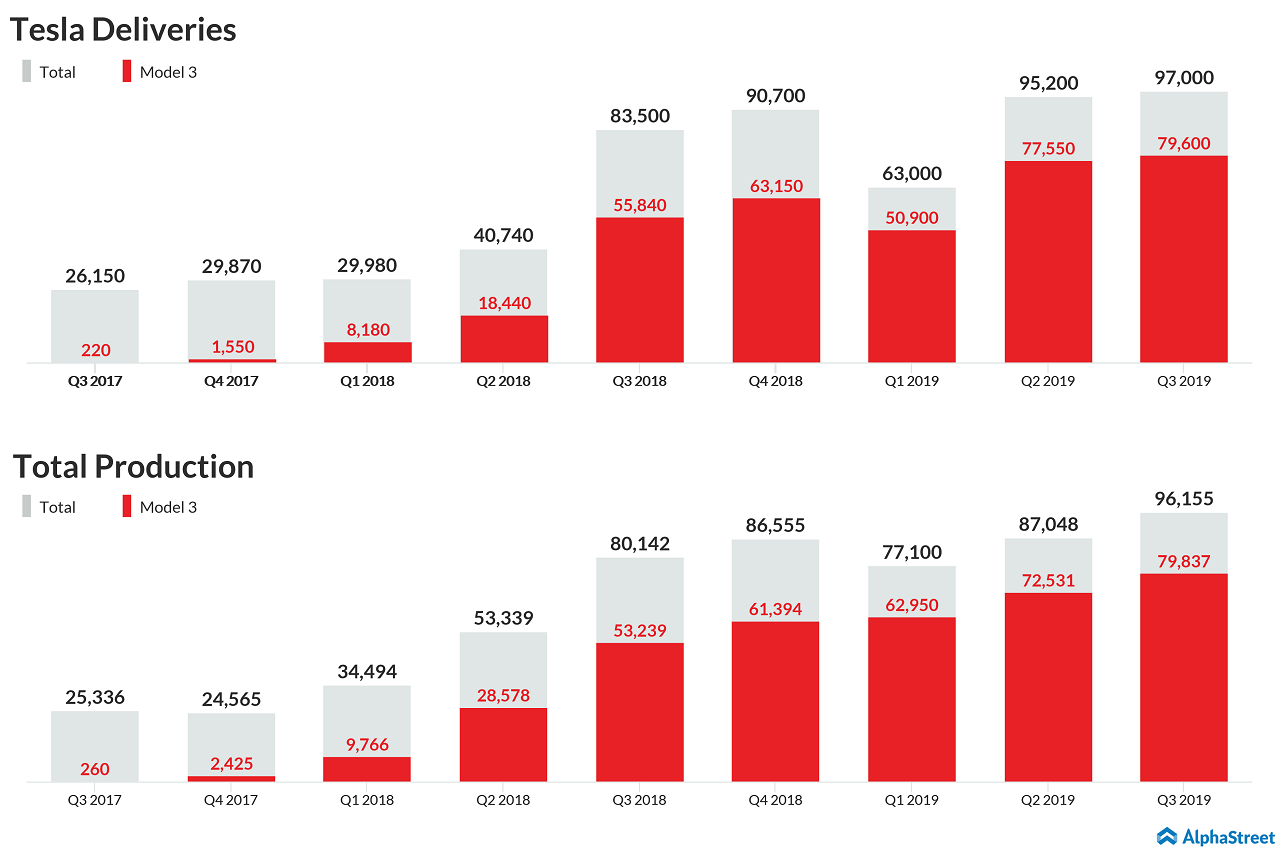

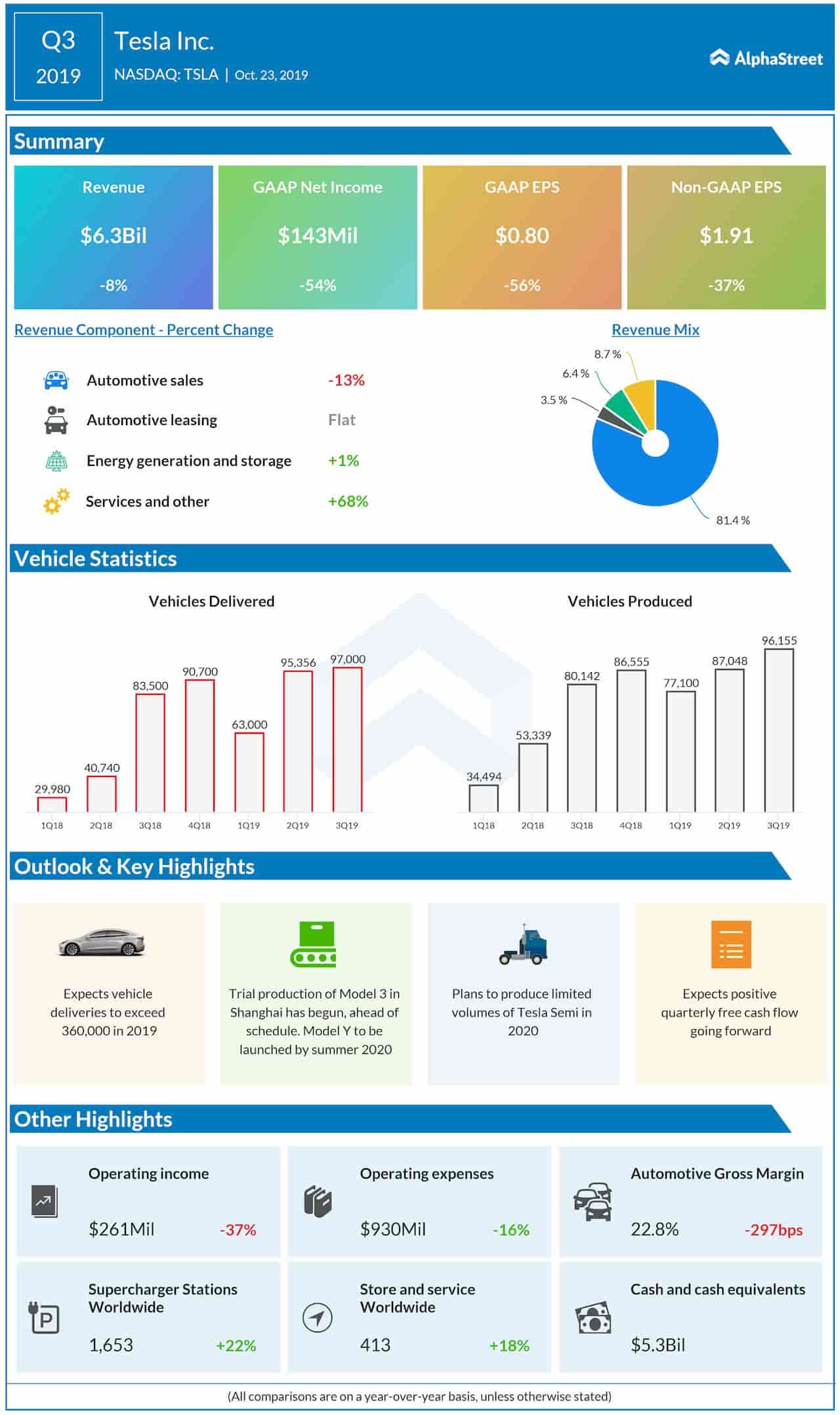

Two months ago, the Silicon Valley car maker surprised the market when it reported stronger-then expected profit of $1.91 per share for the third quarter, despite an 8% fall in revenues. The company also reaffirmed its production goals for the new Gigafactory at Shanghai, despite the lingering uncertainties related to the Sino-US trade war.