The transformation of Tesla, Inc. (NASDAQ: TSLA) from a loss-making entity a few years ago into what it is now has been phenomenal and surprised many. The EV giant this week rolled out the first vehicles from the newly completed Gigafactory in Germany, further expanding its footprint in Europe.

Stock Dips

For the Austin-headquartered tech firm’s stock, it has been a roller-coaster ride since reaching a record high in November last year. It has lost about 17% since then, all along experiencing high volatility. There has been a great deal of skepticism about the sustainability of Tesla’s outstanding performance in the stock market, with the stock gaining nearly ten-fold in less than two years.

Read management/analysts’ comments on Tesla’s Q4 2021 earnings

However, TSLA seems to have stabilized and reached a justifiable valuation after the recent market selloff. Though market watchers are bullish on it, they predict only moderate growth for this year. Tesla remains an investors’ favorite as ever, with the cheaper valuation adding to its attraction.

Despite the crippling economic slowdown caused by the pandemic, 2021 was a transformative year for the electric vehicle industry, with traditional automakers making inroads into the EV space and new players entering the market.

Road Ahead

For Tesla, 2022 is going to be an equally important year, with the new factory in Berlin playing a pivotal role in scaling up the business in that region. The U.S operations should get a major boost from the upcoming plat in Austin. That, combined with additional capacity in the California and Shanghai facilities – which are currently operating below capacity due to chip shortage and supply chain issues — is expected to lift vehicle deliveries to new highs this year, probably exceeding the management’s target of 50% growth.

“Capacity expansion will continue through maximizing output of each factory and building new factories and new locations in the future. Although we’re not ready to announce any new locations on this call, but we will through 2022, look at new locations and probably be able to announce new locations towards the end of this year, I expect. In 2022, supply chain will continue to be the fundamental limiter of output across all factories. So, the chip shortage, while better than last year, is still an issue,” said Tesla’s CEO Elon Musk while interacting with analysts after fourth-quarter earnings.

Since turning around a couple of years ago, Tesla mostly reported stronger-than-expected quarterly earnings and revenues. It registered an 87% growth in deliveries in 2021 and ended the year with free cash flows of $2.8 billion. Tesla’s operating margin hit an all-time high in the fourth quarter, reflecting the acceleration in EV adoption.

Record Quarter

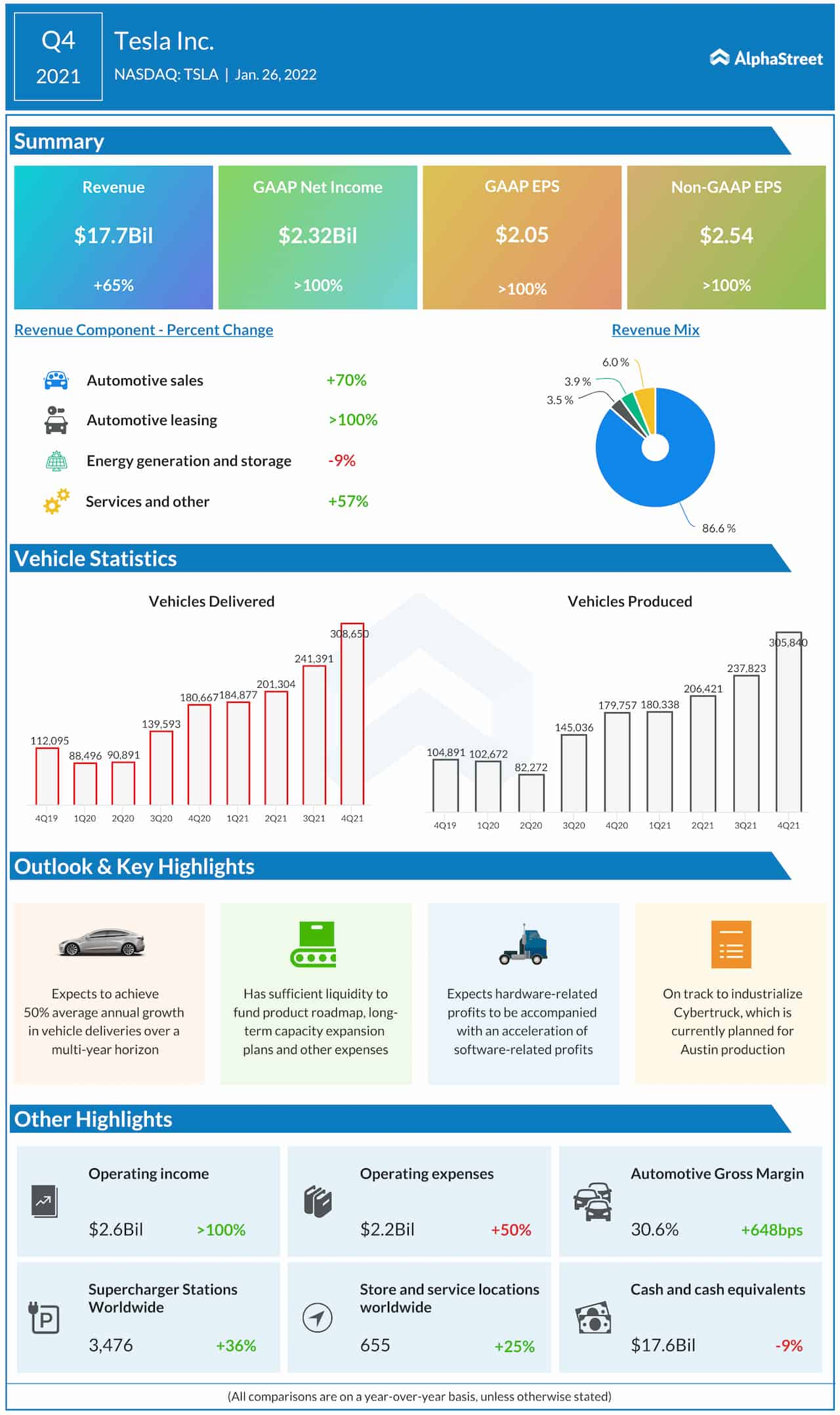

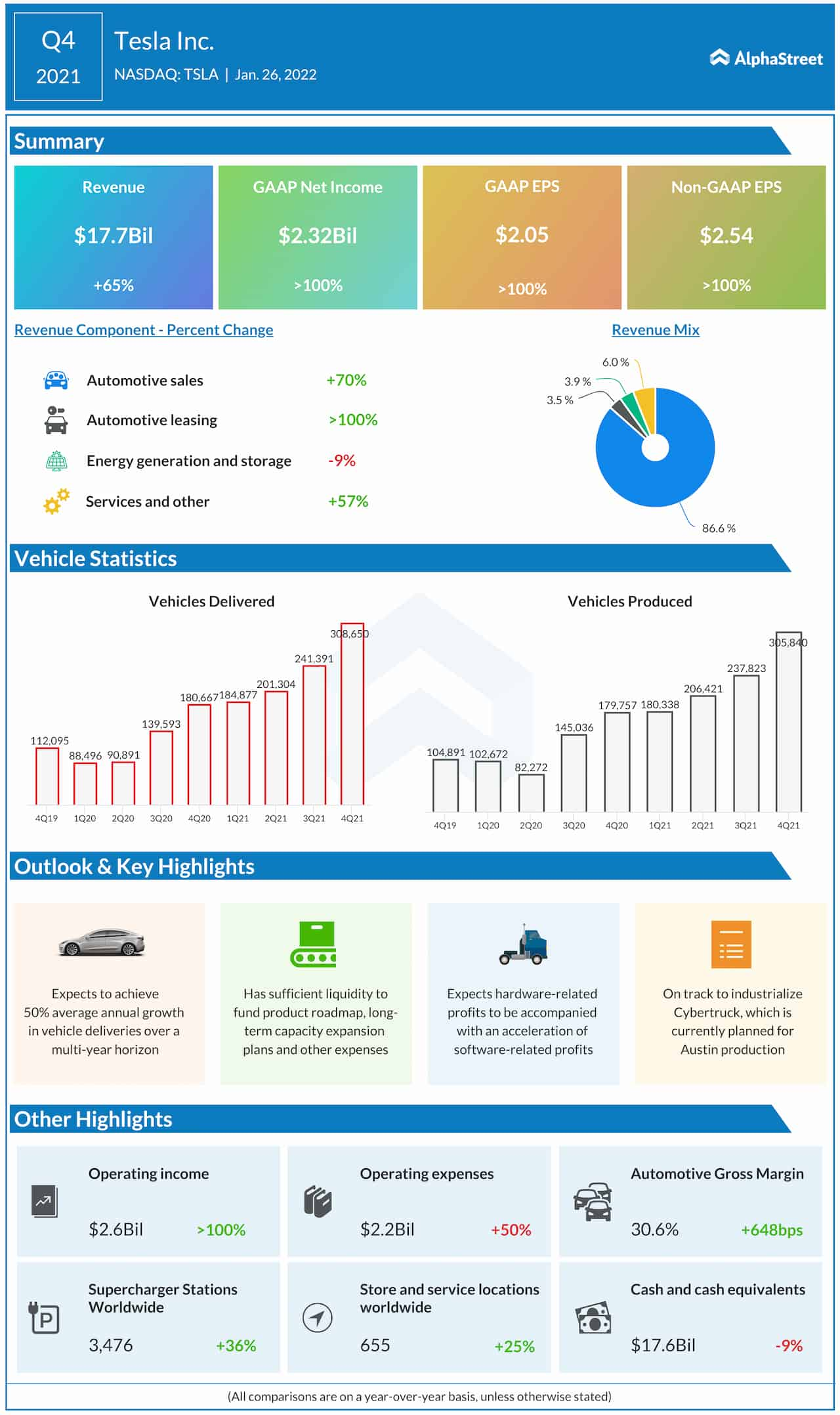

Adjusted earnings more than tripled to $2.54 per share in the fourth quarter and topped expectations. At $17.7 billion, total revenues were up 65% year-over-year, with most of that coming from vehicle sales. Among the other segments, automotive leasing and services revenues also rose sharply, while the energy division contracted slightly.

Infographic: Highlights of Ford Motor’s Q4 2021 earnings report

That said, several factors should fall into place for Tesla to achieve its near-term production and shipment goals, such as an uninterrupted supply of microprocessors, a fully functional supply chain, and a further improvement in the COVID situation.

Shares of Tesla traded lower Friday afternoon, after staying almost flat in the past few sessions. The stock has gained about 63% since last year, often outperforming the market.