Teva Pharmaceutical Industries Ltd. (NYSE: TEVA), a market leader in generic drugs, reported lower revenues for the third quarter of 2021, citing a slowdown in North American sales. Meanwhile, earnings increased slightly but missed analysts’ estimates.

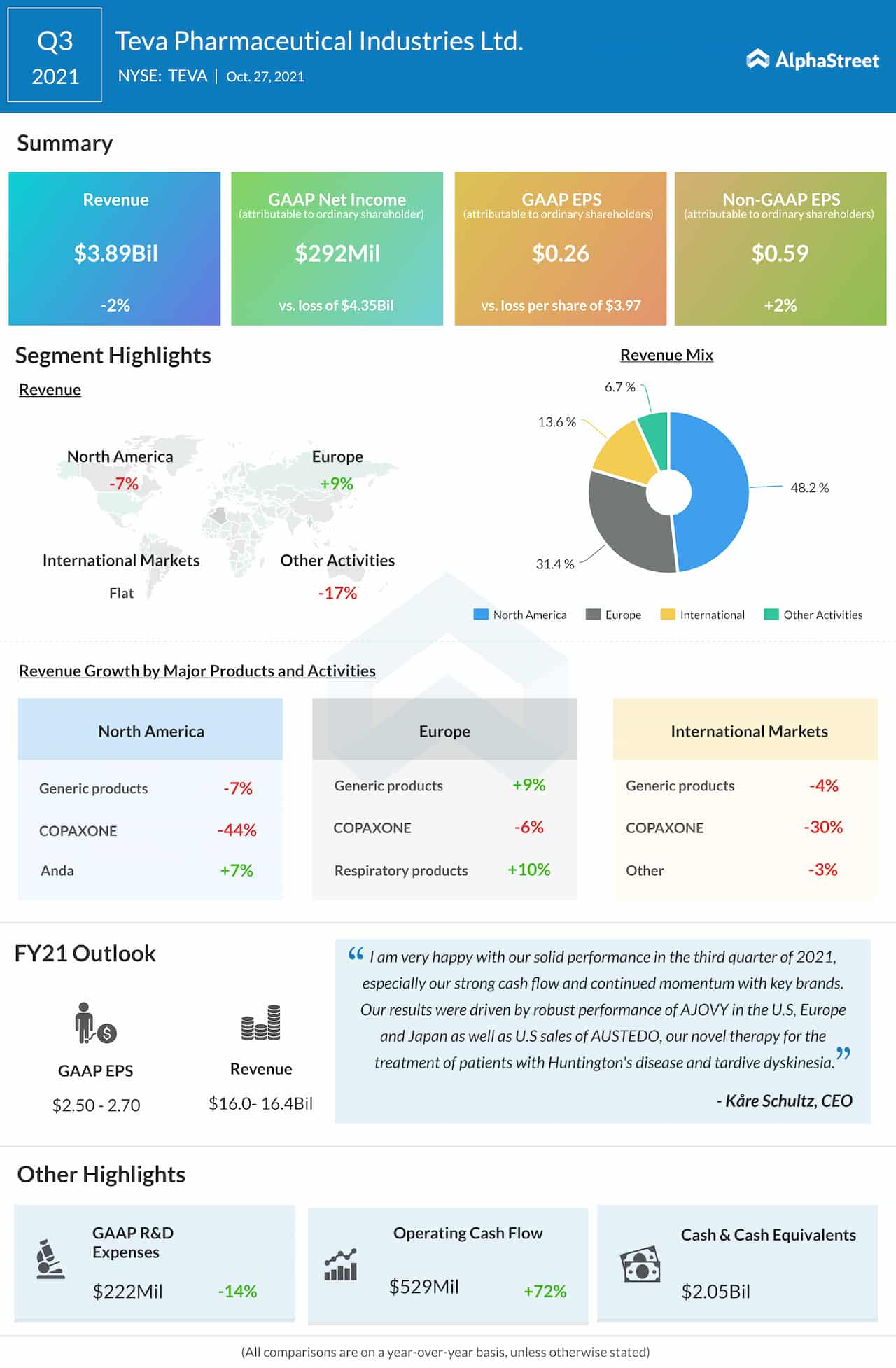

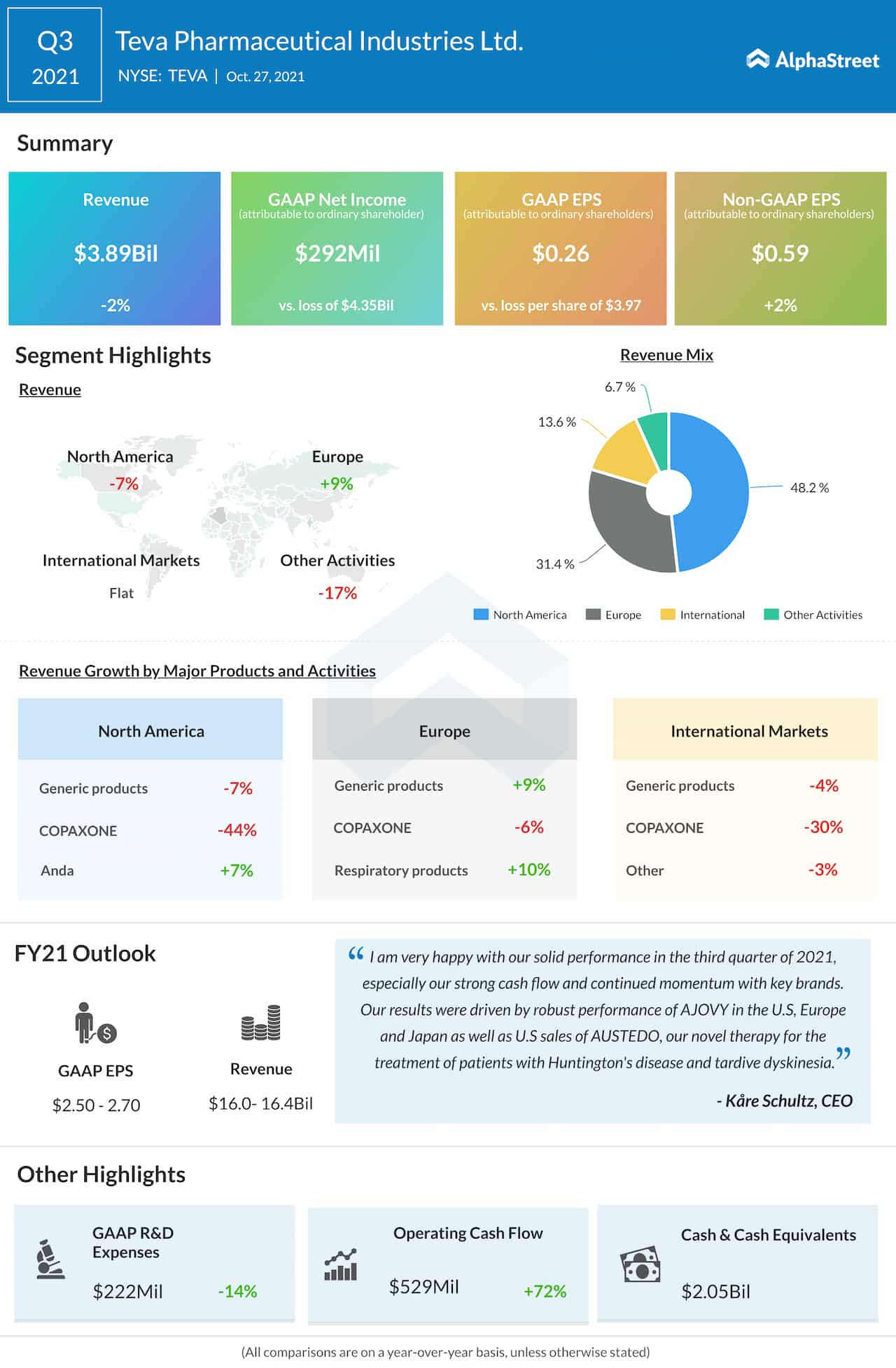

Earnings of the Israel-based drugmaker, on an adjusted basis, edged up to $0.59 per share in the September quarter from $0.58 per share in the prior-year period but fell short of Wall Street’s expectations. On an unadjusted basis, the company reported a net profit of $292 million or $0.26 per share, compared to a loss of $4.35 billion or $3.97 per share in the third quarter of 2020 when the bottom-line was negatively impacted by charges related to goodwill impairment.

Meanwhile, revenues declined 2.3% year-over-year to $3.89 billion in the most recent quarter. Analysts were looking for stronger growth. The management expects that the business would benefit from the ongoing market reopening and return to the pre-pandemic levels soon. Teva executives reaffirmed their full-year 2021 revenues guidance at $16.0-16.4 billion and earnings per share outlook in the $2.50-2.70 range.

“Throughout the year, our revenue has continued to be negatively impacted by the ongoing COVID-19 pandemic. We have seen its impact on our markets and on customers talking and purchasing patterns. Certainly, some geographic regions, product launches, and mix of products have struggled more than others to return to their pre-COVID patterns, nor has this been more apparent than in the U.S. market,” said Eli Kalif, the chief financial officer of Teva.

Read management/analysts’ comments on quarterly reports

Shares of Teva have been on a losing streak since the beginning of the year, falling about 24% during that period. The stock closed the last trading session at $8.25, after losing about 1% during the session.