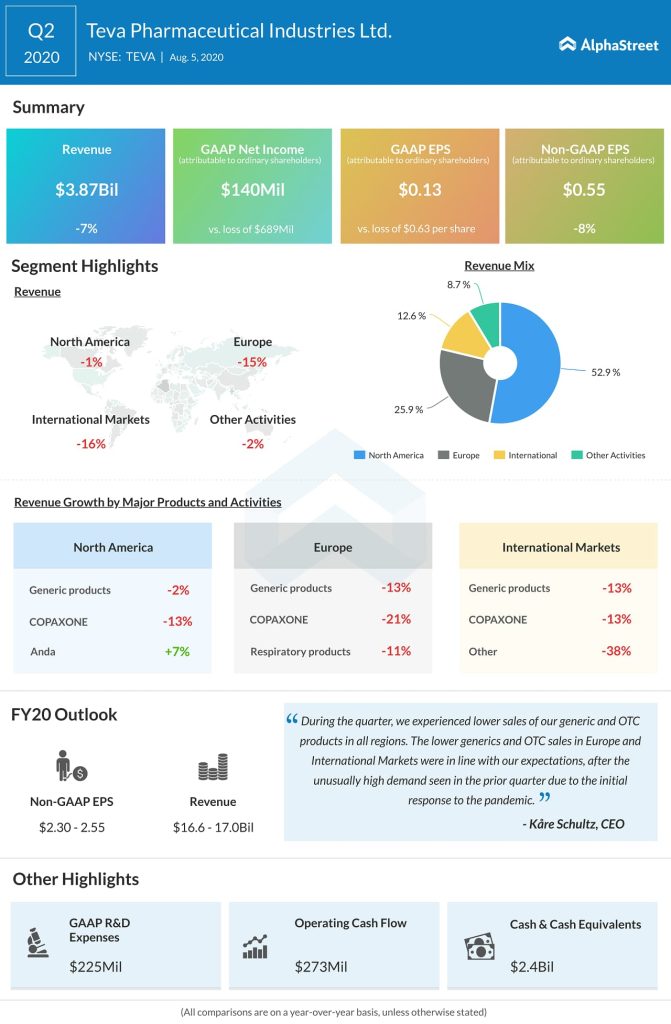

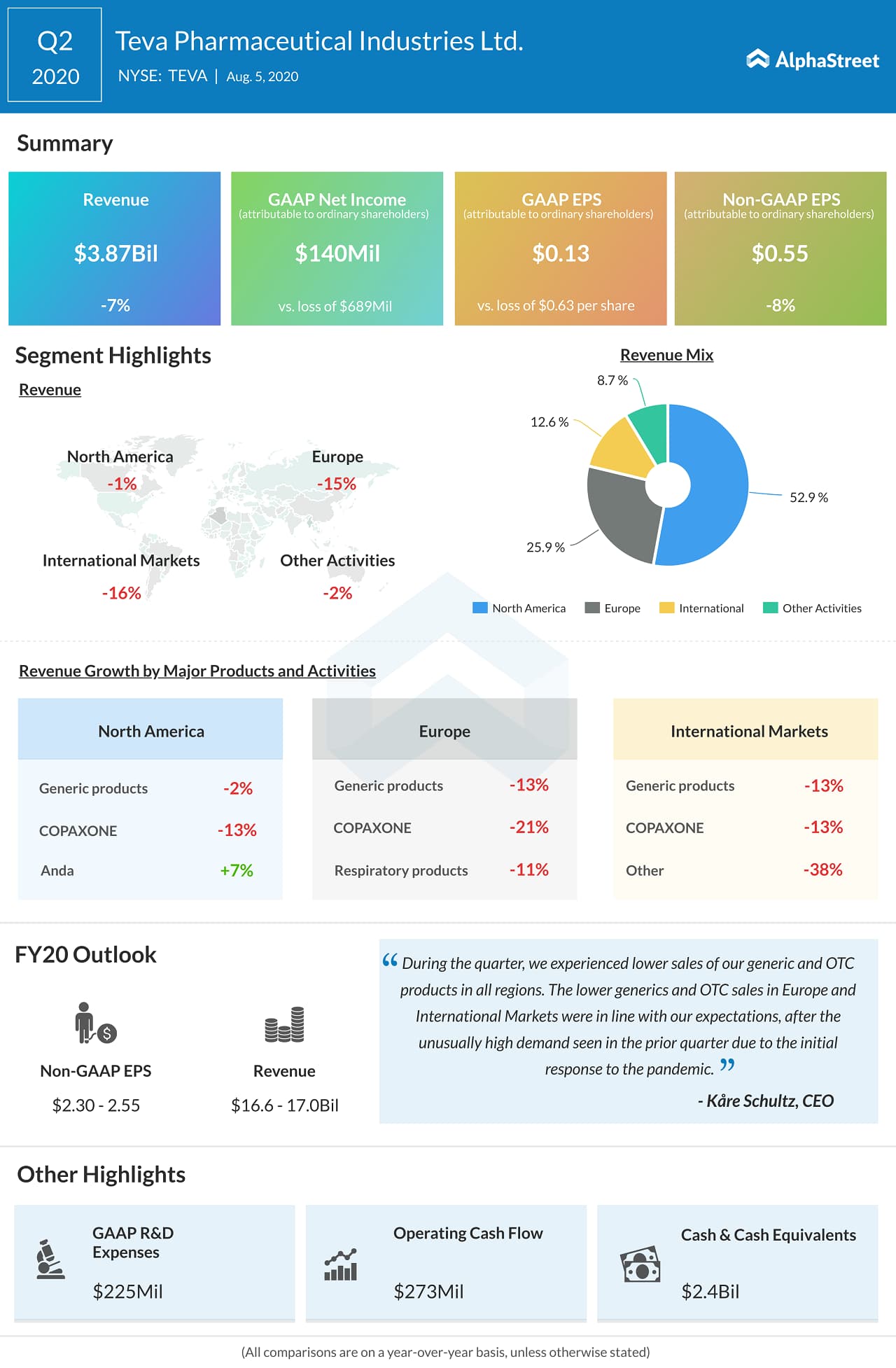

Revenues slipped 7% year-over-year due to lower revenues from generics, OTC and COPAXONE in all regions and lower revenues from QVAR and BENDEKA/TREANDA in North America segment. Also, demand reduced for certain Teva products, resulting from the impact the COVID-19 pandemic had on purchasing patterns.

[irp posts=”68053″]

“During the quarter, we experienced lower sales of our generic and OTC products in all regions. The lower generics and OTC sales in Europe and International Markets were in line with our expectations, after the unusually high demand seen in the prior quarter due to the initial response to the pandemic,” said CEO Kare Schultz.