Overview

2019 performance

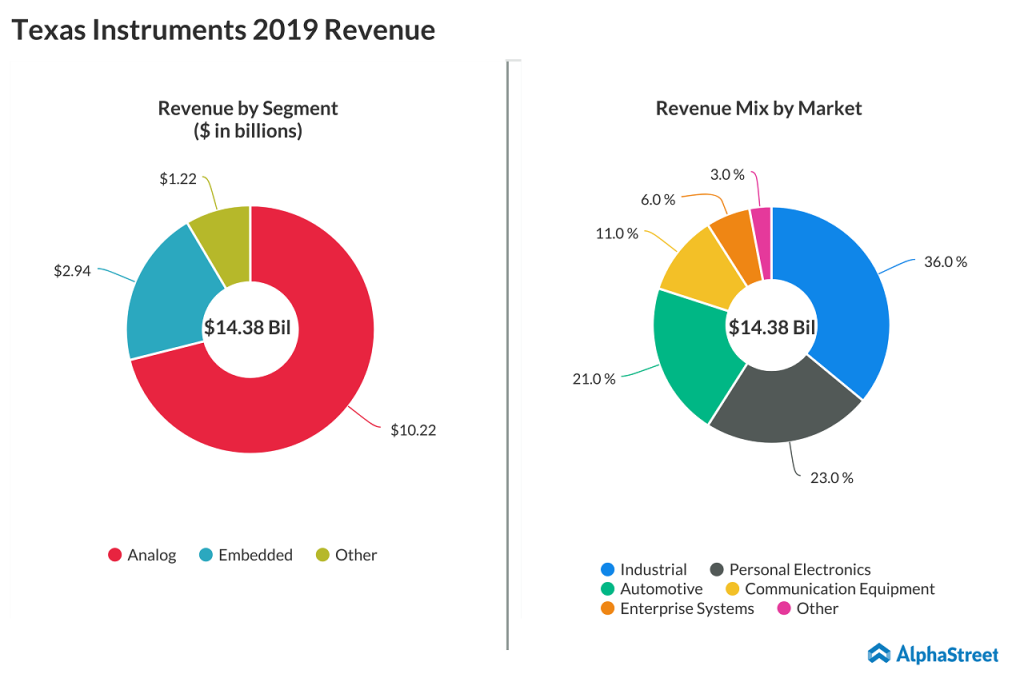

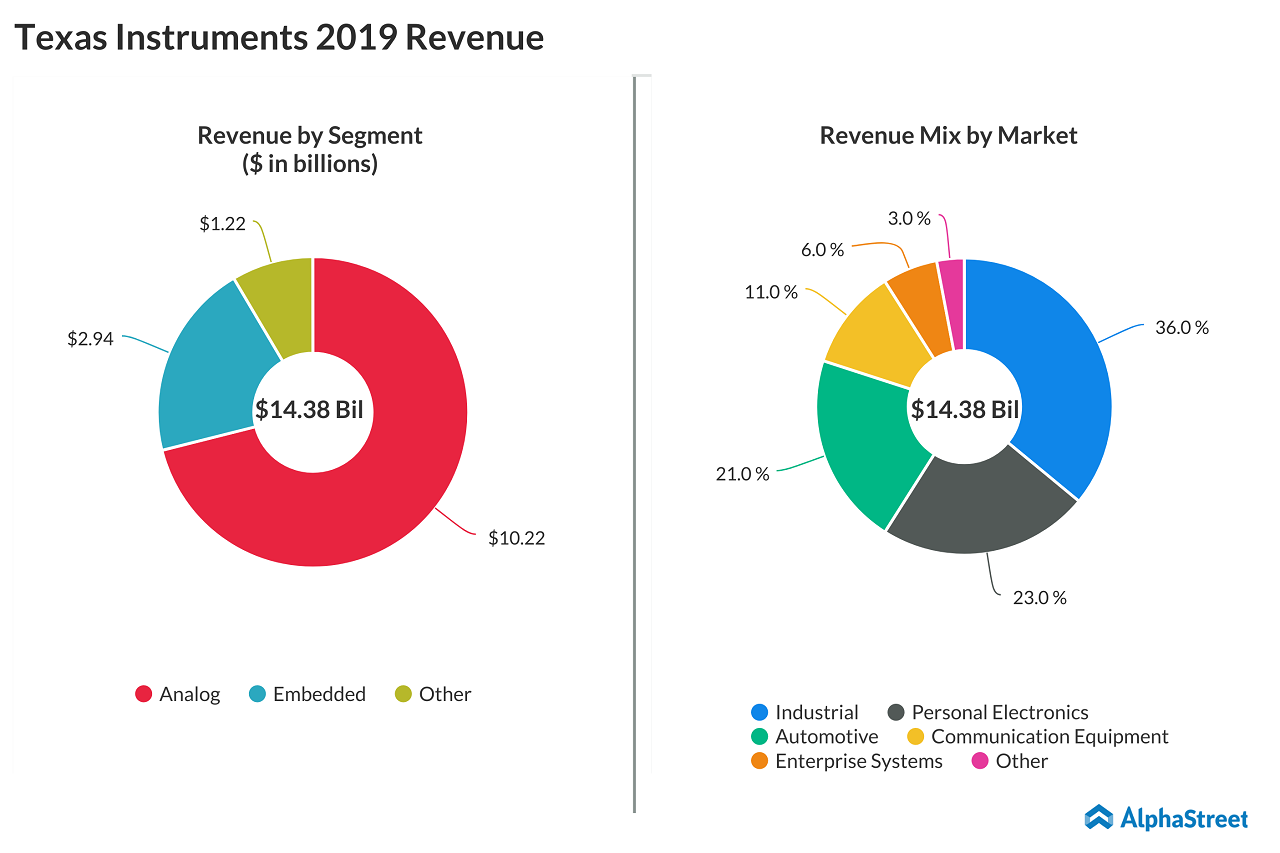

For the fiscal year ended December 31, 2019, TI’s revenue declined 9% to $14.38 billion, primarily due to lower revenue from Analog and Embedded Processing segments. Earnings dropped to $5.02 billion or $5.24 per share in 2019 from $5.58 billion or $5.59 per share in the prior year. Revenue from Analog, Embedded Processing and Other businesses, decreased 5%, 17%, and 15%, respectively.

[irp posts=”57408″]

COVID-19 impact

As a result of the pandemic, TI reported a 7% year-over-year drop in revenue and EPS declined 2% in the recently ended first quarter. During the first quarter earnings call, the company pointed out how it bounced back from the 2008 recession. Using the 2008 financial crisis as a model and with the reduced visibility in customer demand, TI expanded the guidance range for its second quarter of 2020.

Competition

TI competes fiercely with other large and small companies, including both broad-based suppliers and niche suppliers all over the world. Competitors also include emerging companies, particularly in Asia, that sell products into the same markets in which it operates. Recently, rival Analog Devices (NASDAQ: ADI) acquired Maxim Integrated Products (NASDAQ: MXIM) in a $21 billion transaction. This merger would create a stronger Number 2 player in the non-customized analog chip market behind TI.

What’s next?

TXN stock reached its 52-week high ($135.70) in January this year. Hurt by the COVID-19 related recession, shares of TI plummeted to yearly low in March. However, it bounced back and is currently trading near the 52-week high mark. The Dallas, Texas-based company is expected to announce its Q2 financial results on July 21.

[irp posts=”57628″]

There is no doubt that TI will continue to face the pressure for the rest of the year, but it has got enough strength to handle these turbulent times. TI’s strong cash flow generation of $5.64 billion in trailing 12 months, a shareholder return of $2.5 billion in the second quarter ($841 million in dividends and $1.6 billion in stock repurchase) and $4.74 billion of cash at March end shows how profitable the company is in this volatile environment. Like how TI bounced back from the 2008 financial crisis, it is expected to perform better once the current dust settles down. Since the digital based businesses are here to stay, TXN will be a worthy semiconductor stock to have in your portfolio.

DISCLAIMER: This article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone.