Except for the long gap between the releases, an area where the company often lags behind Activation Blizzard (ATVI) and Electronic Arts (EA), all the other factors are in favor of Take-Two as 2019 comes to a close. In terms of future growth, the strong portfolio gives the company an edge over others, given the rapid shift to streaming and the emergence of esports.

Mass Appeal

In brief, the New York-based firm’s innovative strategy has been quite successful this year – to offer players highly engaging and technologically advanced content and leverage on the mass appeal. Red Dead Redemption 2, the latest from the company that is sequel to the highly popular original with the same tile, was no exception.

The same degree of fan following can be expected when Grand Theft Auto 6 is released next year, a key revenue spinner for the company. The earlier versions evoked exceptional user interest that is second only to the free-to-play games offered by the likes of Fortnite.

New Game

Going forward, the focus will likely shift to new franchises and extensive updates to the not-so-popular games like Civilization. Reducing reliance on the main franchises is pivotal for Take-Two, in view of the changing preferences of players who are mostly youngsters. Considering the high costs involved in the development of multi-player games, fluctuations in demand could be detrimental to publishers like Take-Two.

Stock on Uptrend

Experts are of the view that the company’s stock would gain more than 8% in the next twelve months to about $135. Currently, the consensus rating on it is buy. Though Take-Two had a dismal start to the year, with the stock falling to a multi-year low in the early months, the trend was reversed as the year progressed. After gaining 18% since the beginning of the year, the stock closed the last trading session close to the all-time highs seen last year.

Also read: NetEase Q3 earnings surge, exceed forecast

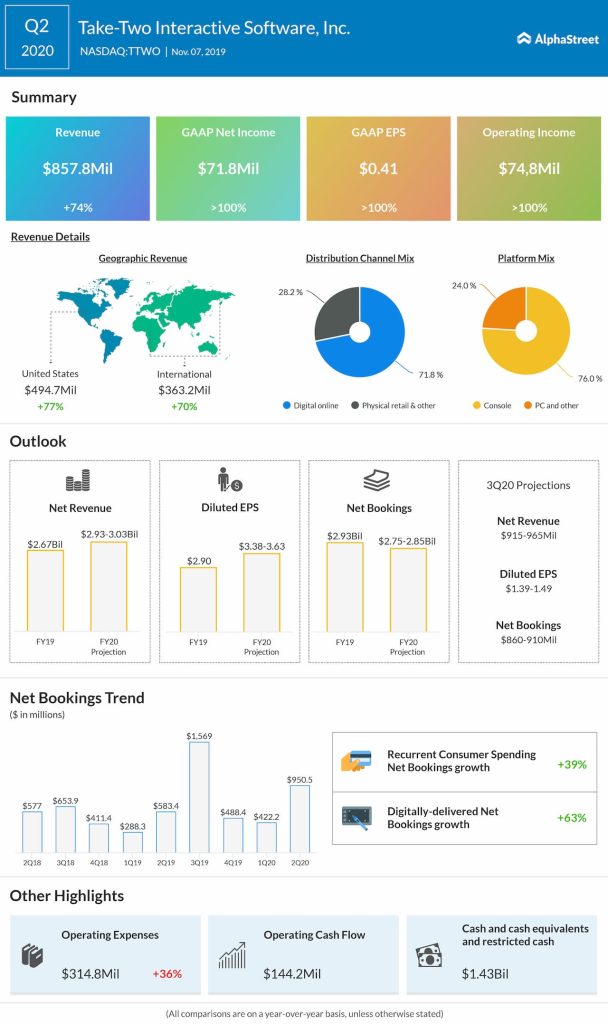

In the second quarter, earnings more than doubled to $0.63 per share, reflecting a 74% growth in revenues to $857.8 million. The results benefited from a surge in net bookings and topped the Street view. The positive outcome prompted the management to raise its full-year guidance. In the past, the top-line maintained the uptrend consistently, while earnings sometimes suffered from high costs.