Recovery trends

Delta’s booking volumes are also more than 100% recovered versus 2019 levels and the company anticipates travel demand to continue to pick up going forward. Delta is seeing improvements in corporate travel even though a full recovery is expected to take some more time. At a domestic level, corporate travel is about 30% recovered and the company expects to see a continued recovery over the coming months.

Encouraging outlook

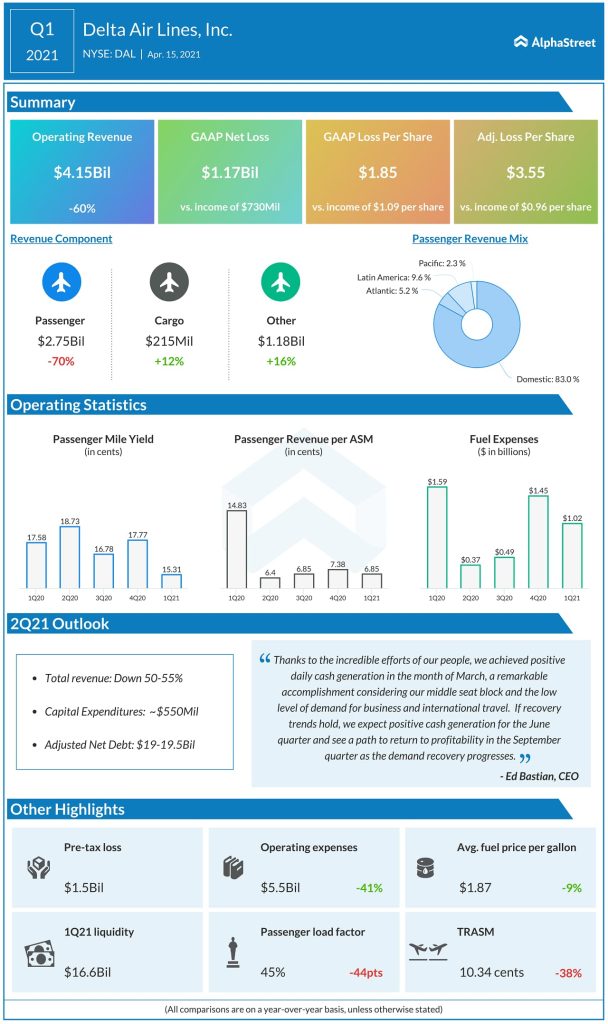

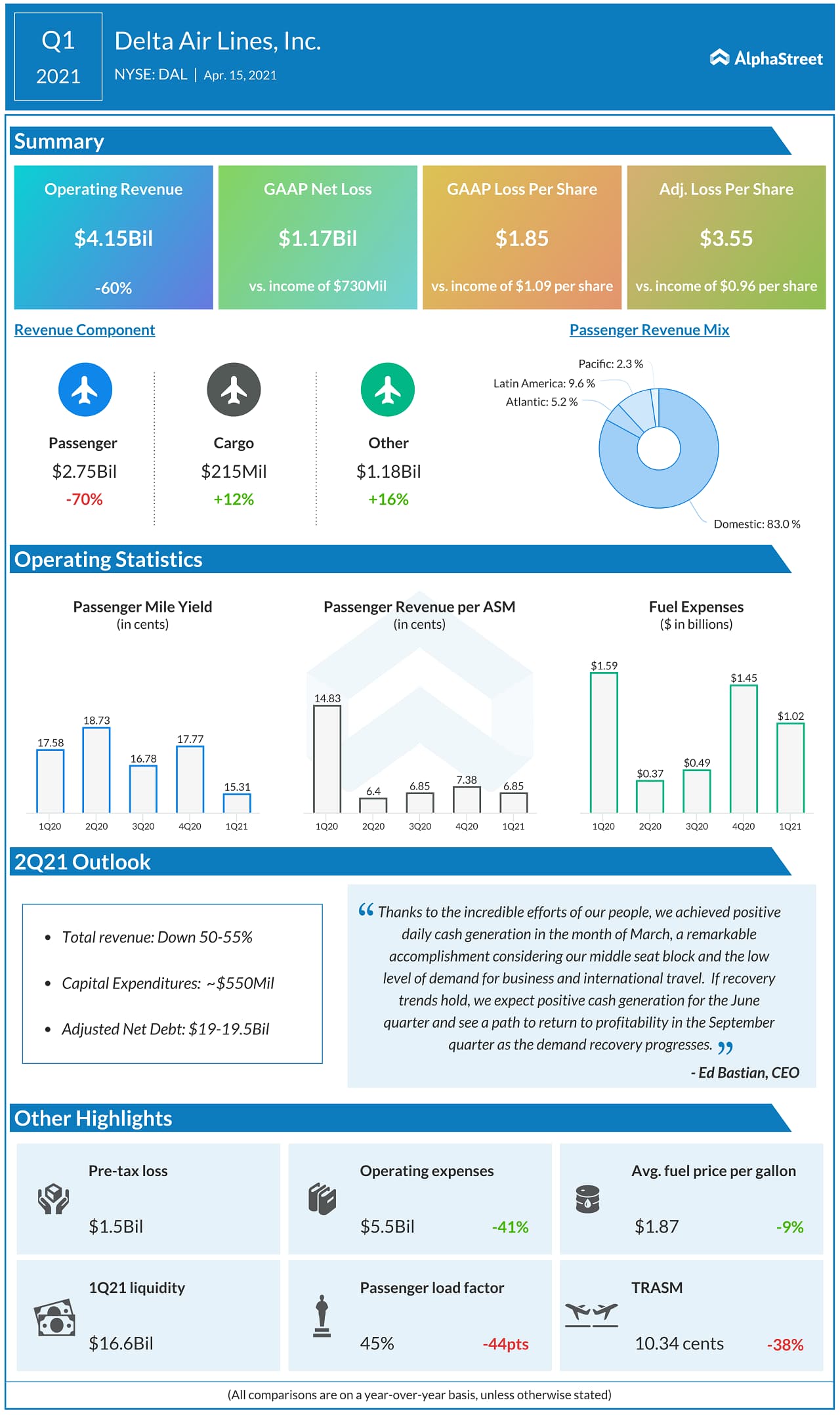

The healthy pickup in demand allowed Delta to revise its revenue guidance for the second quarter of 2021. Revenues are now expected to range between $6-6.2 billion, which reflects a 50-52% drop from 2019 levels. The company had previously anticipated a decline of 50-55%.

Delta expects pre-tax loss for the second quarter of 2021 to range between $1-1.2 billion versus the previous range of $1-1.5 billion. The company also expects to achieve pre-tax profitability for June and for the latter half of 2021.

Cost reduction efforts

Delta has been working to reduce its costs through various efforts including fleet simplification. The company is replacing its older aircraft with ones that are over 25% more efficient. It is also working on driving greater seat cost efficiency by utilizing larger gauge aircraft. The company also significantly reduced its headcount. These measures are expected to help bring non-fuel unit costs below 2019 levels by the end of 2021, despite Delta being at about 15% less capacity for the comparable quarter.

Click here to read the full transcript of Delta’s Q1 2021 earnings conference call