Redefining Retail Pharma

- InventoryRx.com (web-based pharmaceutical exchange platform)

- Pharmabayonline (platform for data analytics/reimbursement benchmarks analysis)

- RxGuru (application for ascertaining trends and pricing variances )

- Integra Pharma Solutions, LLC (for pharmaceutical distribution)

- Community Specialty Pharmacy, LLC (innovative specialty pharmacy for home delivery services)

- Delivmeds.com (application for deliveries related to Alliance Pharma Solutions, LLC)

- Trxademso (technology to help independent retail pharmacies to compete with larger rivals)

- Bonum Health (virtual examination room to facilitate telemedicine service)

The Market

The disruptive business model and technological innovations give Trxade a unique place in the healthcare market, which is becoming increasingly competitive though. The platform is optimized to scale internationally by integrating with global distribution channels. Trxade faces competition from both large players like Amazon.com (NASDAQ: AMZN) and relatively smaller entities like Script Health and Petmed Express Inc. (NASDAQ: PETS). A couple of years ago, Amazon made significant inroads into the pharma retail market by acquiring PillPack. The other major players include Rite Aid Corporation (NYSE: RAD), Walgreens Boots Alliance (NASDAQ: WBA), and UnitedHealth Group (NYSE: UNH).

Key Numbers

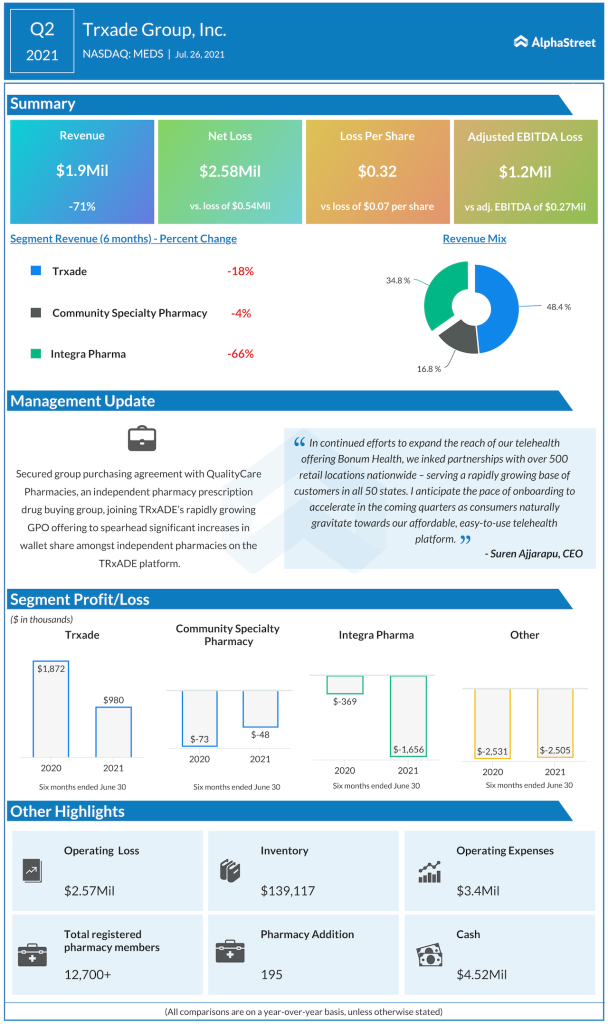

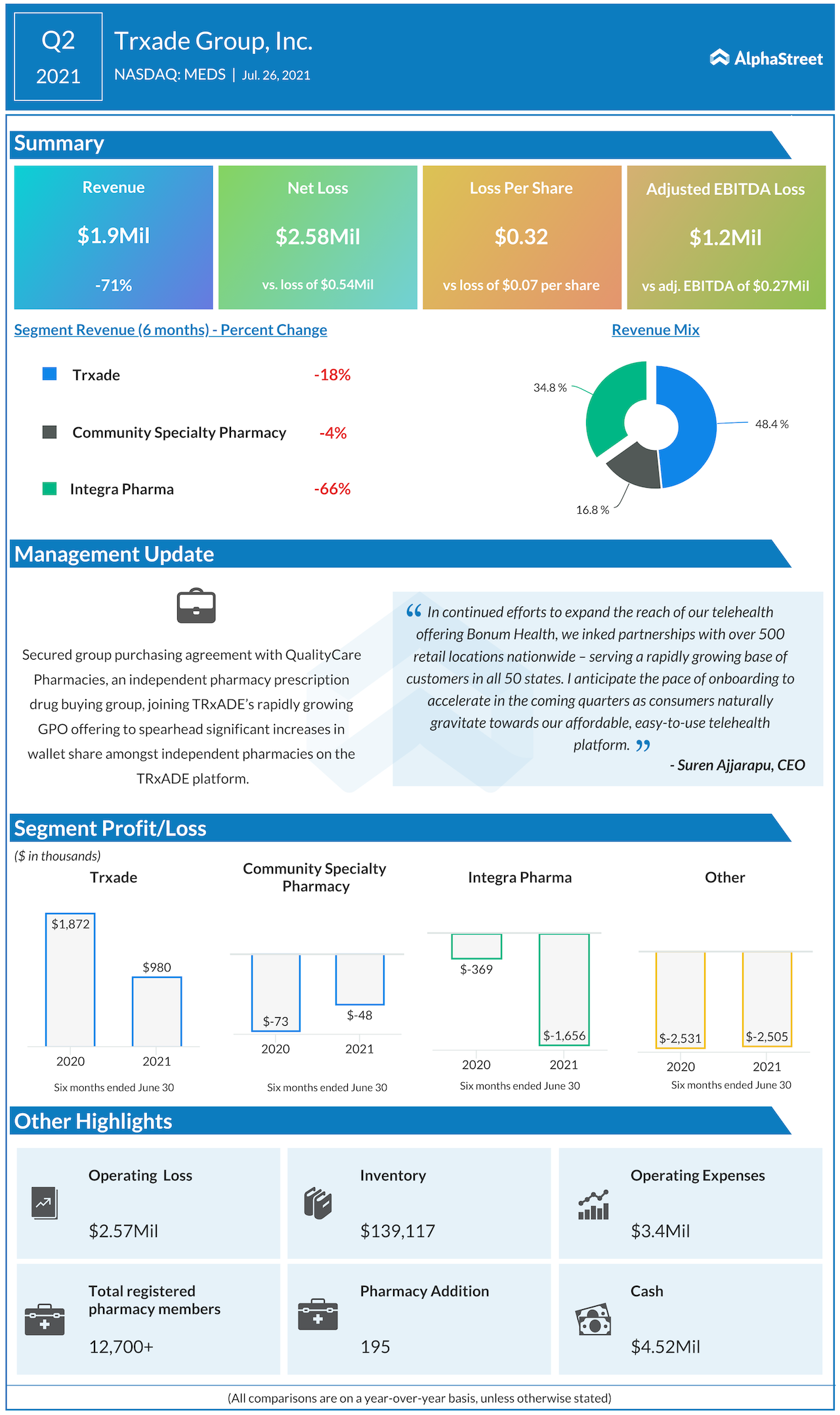

Trxade ended the first half of 2021 on a rather unimpressive note, reporting a 71% fall in second-quarter revenues to $1.9 million, which translated into a wider loss of $0.32 per share compared to $0.07 per share in the prior-year period. The weakness can be attributed to lower sales of PPEs during the quarter, compared to last year when the coronavirus-driven demand growth boosted sales. EBITDA, excluding special items, was a loss of $1.2 million.

Read management/analysts’ comments on Trxade’s Q2 earnings

Meanwhile, the company added 195 registered members in the June quarter, further expanding its market share supported by initiatives like the launch of health passport solution that can expedite post-COVID reopening.

Outlook

It is estimated that the affordability and convenience offered by the Trxade platform would continue to attract members to it in the coming months, supported by the digital health passport facility. That, combined with the continued strength of the core exchange business and new tie-ups with group purchasing organizations, should catalyze the ongoing transition to a diversified, profitable company.

Updates

Last month, Bonum Health launched an electronic gift card that would allow uninsured and under-insured consumers to gain access to healthcare through a low-cost digital pre-paid pass. The e-Gift card offers a streamlined system for enterprises to provide critical healthcare services as a gift to employees and others. Earlier, Bonum had clinched a deal with Big Y Pharmacy & Wellness Center for telemedicine service distribution in the latter’s outlets in Massachusetts and Connecticut.

Risks

The primary headwind facing the prescription drug market is the absence of transparency in pricing and lack of innovation. Despite the steady growth, the market remains inefficient and disorganized. Also, the strong influence of monopolistic pharmacy benefit managers and retail chains makes it challenging for healthcare technology firms to strengthen their footing in that space. Similarly, the availability of ample resources and strong cash balance put market leaders like Walmart (NYSE: WMT) in an advantageous position in terms of market share growth.

At the Bourses

After making notable gains in the early weeks of 2020, following Trxade’s entry into the NASDAQ stock exchange, the company’s shares maintained the momentum but experienced some volatility this year. The stock traded slightly above $5 at the end of August 2020, valuing the company at $40 million. MEDS, which mostly languished below the $1-mark in the pre-COVID era, looks poised to stay on the growth path in the foreseeable future.

Trxade CEO: Will see consistent margins ahead

Conclusion

Like other businesses, the health industry also witnessed a major transformation after the coronavirus outbreak, with the highlight being the rapid adoption of digital technology in all areas of care delivery. The trend bodes well for Trxade, considering the high relevance of its products and services in a market that remains largely untapped. From the exchange platform to telehealth solutions, the portfolio is strong enough to drive long-term growth, thereby enabling the company to achieve sustainable profitability.