Shares of Tyson Foods Inc. (NYSE: TSN) remained in red territory on Tuesday. The stock has dropped 29% since the beginning of this year. The company reported better-than-expected results for the fourth quarter of 2020 a day ago. Tyson saw strong demand on the retail side but experienced weakness in foodservice due to the COVID-19 pandemic.

Looking ahead, the company expects to see improvements but these will still depend on how the pandemic and related restrictions play out as well as the availability of a vaccine.

Quarterly performance

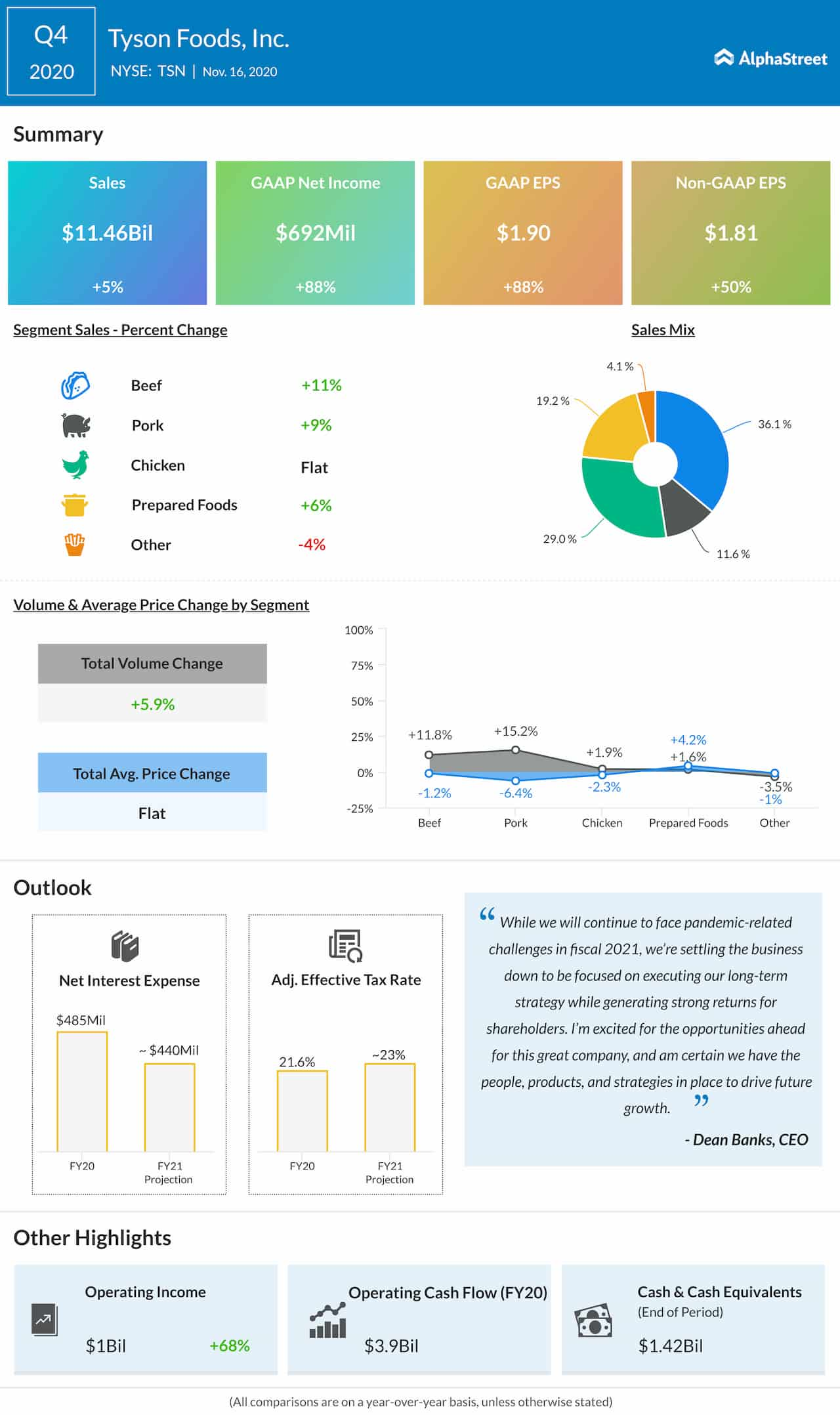

Sales increased 5% year-over-year to $11.4 billion while adjusted EPS jumped 50% to $1.81 per share. The company recorded growth across its Beef, Pork and Prepared Foods segments while Chicken remained flat. The Other segment saw a drop of 4% in sales.

Strength in retail and ecommerce

The operating environment remained similar in the US and Europe. Demand remained strong in the retail channel while foodservice trends were weak amid the pandemic. The volume levels at quick-service restaurants were either on par with or better than pre-pandemic levels but full-service restaurants operated at lower levels.

Tyson saw strength in retail and ecommerce as at-home consumption levels remained high. During the quarter, ecommerce sales increased 126% and the company’s online sales penetration through its e-commerce channel partners is now estimated at over $1 billion. Tyson expects to see further growth from its ecommerce channel going forward.

Another area of growth is alternative protein. Tyson increased its Raised & Rooted brand offerings and expanded to 10,000 stores in less than a year. It rolled out its products to the quick service restaurant channel while also launching them in Europe. Retail sales for the company’s plant-based products jumped over 250% in the past year and this momentum is expected to continue going forward.

Outlook

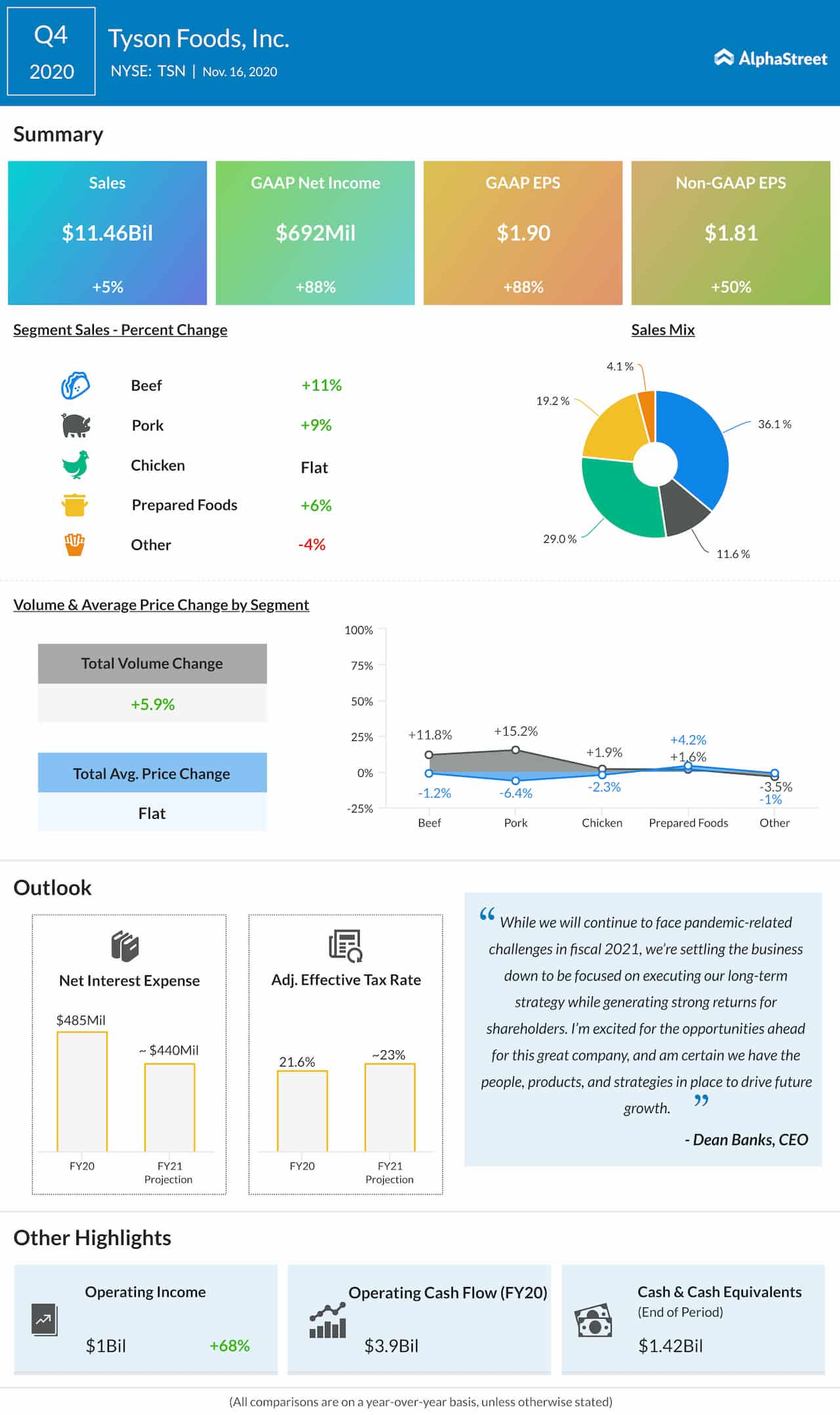

Looking ahead to fiscal year 2021, Tyson expects revenues to range between $42-44 billion. The trend of having meals at home is expected to continue through the year which implies that the strength in retail and ecommerce is likely to stay strong going forward. The foodservice channel is expected to see a gradual recovery unless any further restrictions are implemented.

In general, the trade environment faces uncertainty from the elections and its effects on trade policies. There could be some increases in grain costs as well during the coming year. The company is seeing an increase in freight costs and it is working to reduce this effect. Tyson expects to see further improvements in its business as the pandemic subsides.

Click here to read the full transcript of Tyson Q4 2020 earnings conference call