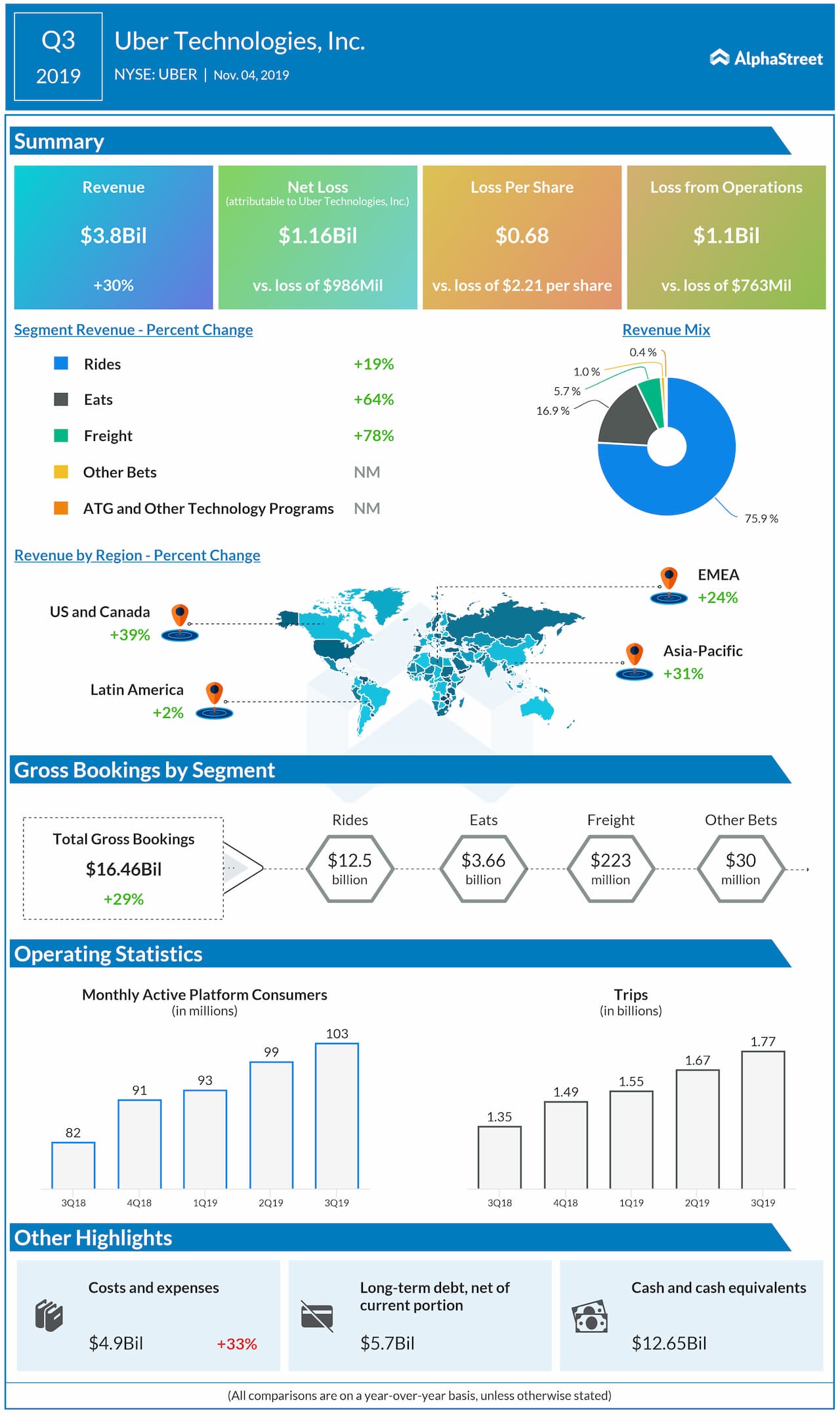

However, revenue grew by 30% year-over-year to $3.81 billion on strong contributions from Uber Eats and other bets. Adjusted net revenues climbed by 33% to $3.53 billion.

Gross bookings surged 29% to $16.47 billion in the third quarter. Monthly active platform consumers (MAPCs) increased by 26% to 103 million, while trips in the quarter jumped 31% to 1.77 billion.

The top line showed double-digit growth in Rides, Eats, Freight and other bets segments. Geography-wise, the majority of the revenue growth came from the US and Canada, which jumped by 39%. Revenue from EMEA climbed by 24% and that from APAC advanced by 31%. However, revenue from Latin America showed a lesser growth of 2%.

Rides crossed $1 billion of weekly gross bookings during Q3 2019 with the help of higher-margin Uber for Business that had grown over 65% to $4 billion in annualized gross bookings. Rides premium products, including Comfort and Black, generated significant growth with 41% gross bookings growth globally and 53% growth in the US year-over-year.

Read: Lyft Q3 earnings review

Looking ahead, the company expects adjusted net revenue growth to accelerate again in the fourth quarter and continues to focus on financial discipline. As such, the company is improving its full-year adjusted EBITDA guidance by $250 million to a loss of $2.8-2.9 billion.

Uber is currently testing its updated app that will combine Rides, Eats and other offerings side-by-side in hundreds of US and international cities. The company also launched a suite of subscription programs for Riders and Eaters. The company’s consumer loyalty program, Uber Rewards, has 20 million global subscribers six months after the US nationwide launch in May and a recent rollout in Brazil and Mexico.