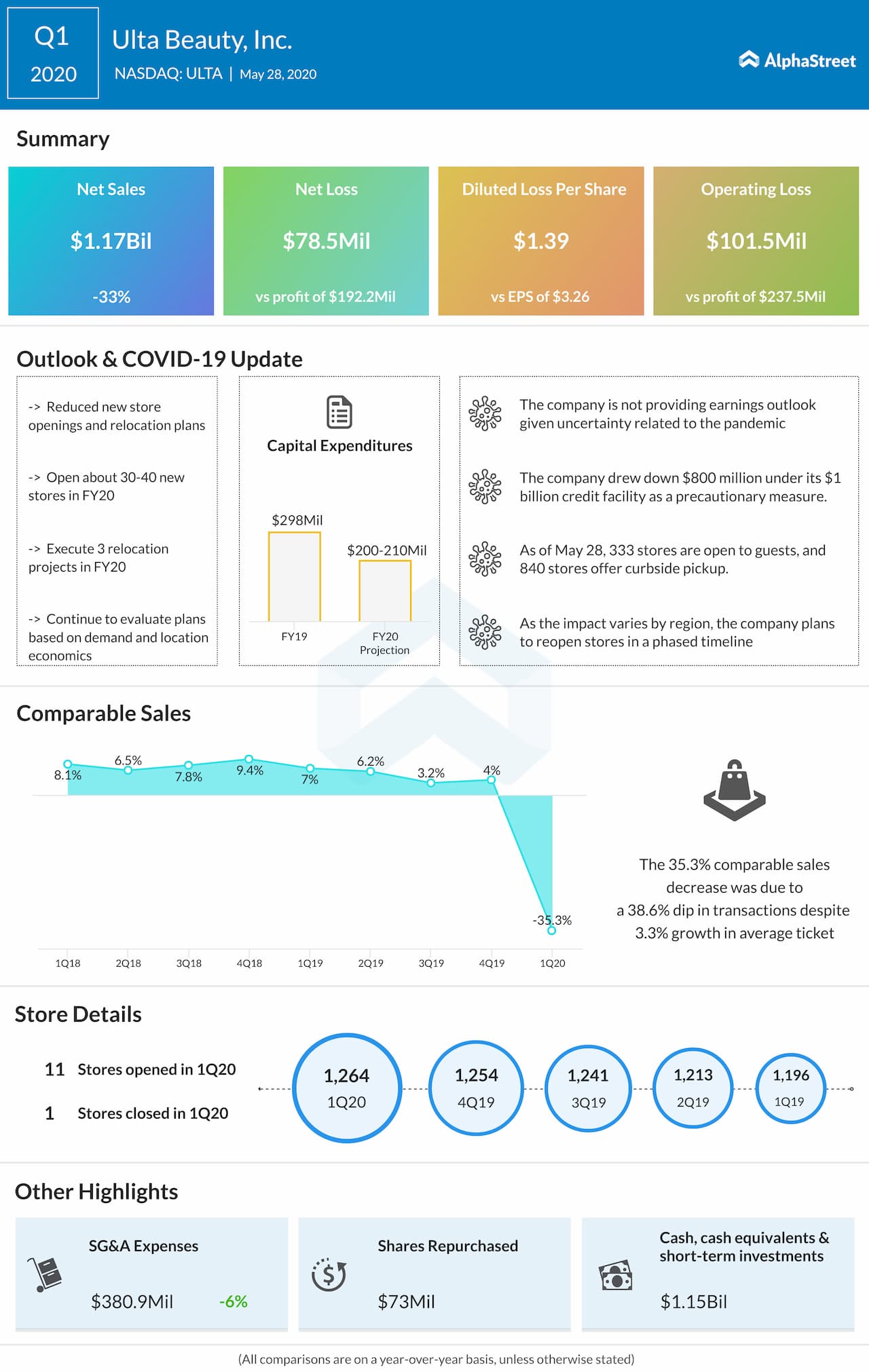

Ulta Beauty Inc. (NASDAQ: ULTA) reported its financial results for the quarter ended May 2, 2020, on Thursday after the market closes. The results missed analysts’ expectations.

The company slipped to a loss in the first quarter of 2020 from a profit last year, due to the temporary store closures in response to COVID-19 pandemic. Despite a good start of fiscal 2020, the rapid escalation of the pandemic resulted in significant disruption to its operations. For much of the quarter, Ulta Beauty operated as a digital-only business. While e-commerce sales exceeded the company’s expectations, it was not enough to fully offset the impact of its store closings.

With safety continuing to guide its decisions, the company has begun to reopen stores, and today more than 800 stores offer curbside pickup and more than 330 stores are open to guests. While it is still early, the company has seen stronger-than-expected sales in reopened stores and is seeing great engagement with its salon services, where available.

Given the uncertainty related to the COVID-19 pandemic, the company is not providing an earnings outlook at this time. The company has reduced its new store opening and relocation plans given the current environment. The company now expects to open between 30 and 40 new stores and execute about three relocation projects. Also, the company cut its capital expenditure plan for FY20 to the range of $200-210 million from the previous range of $280-300 million.