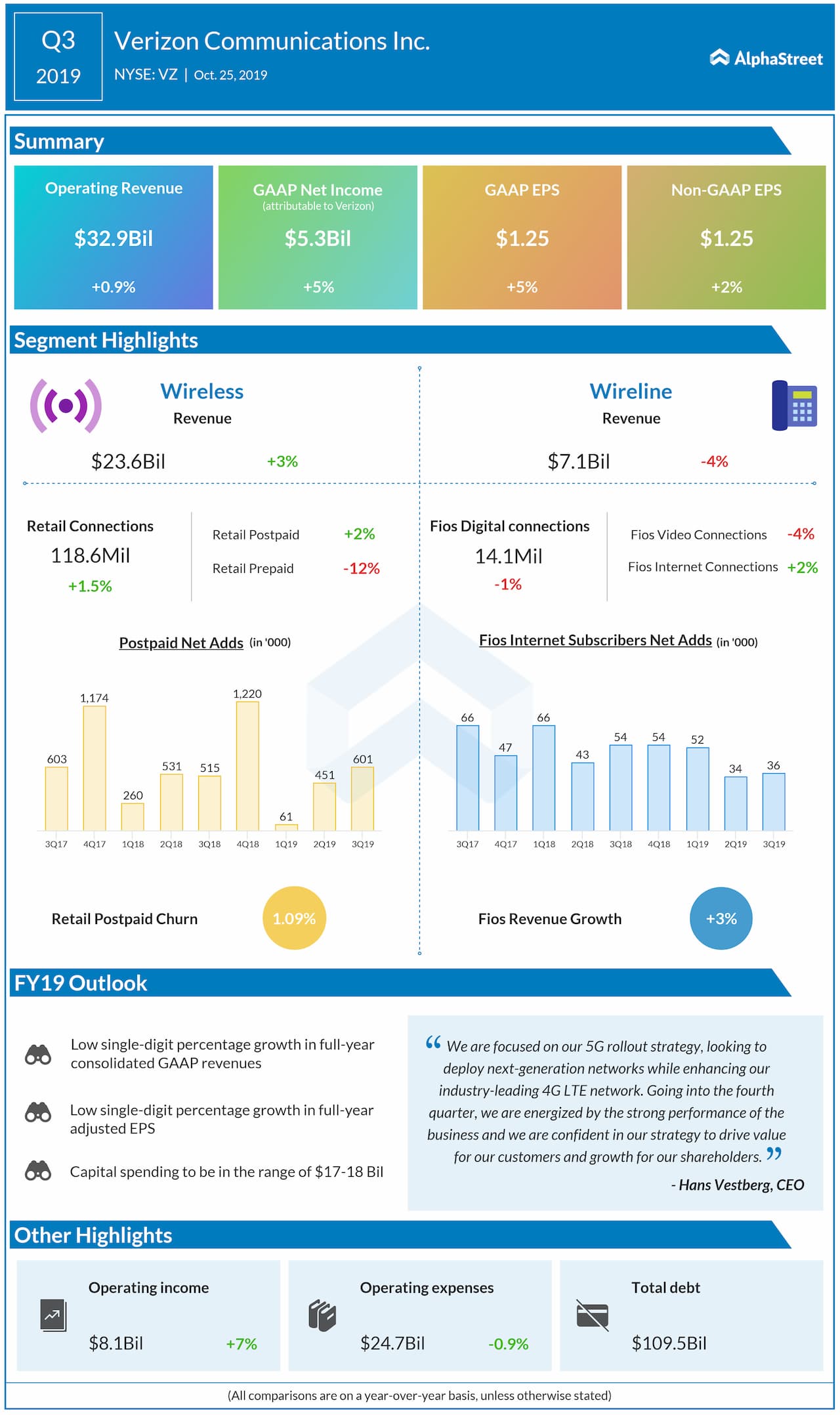

GAAP net income grew 5% year-over-year to $5.3 billion, or $1.25 per share. Adjusted EPS was $1.25, above forecasts of $1.24.

Wireless revenues, on an adjusted basis, grew 2.6% year-over-year to $23.6 billion while wireline revenues dropped 3.8% to $7.1 billion.

Consumer segment revenues grew 1.4% year-over-year to $22.7 billion, driven by growth in wireless service revenue and Fios service offerings. Wireless retail postpaid net additions totaled 193,000 during the quarter. Phone net additions more than doubled year-over-year to 239,000.

The company saw a growth in postpaid smartphone net additions, driven by a 10% increase in phone gross additions. Consumer wireless service revenues rose 2.1%, driven by customer step-ups to higher-priced plans and an increase in connections per account. Total retail postpaid churn was 1.05%.

In the Business segment, revenues remained flat year-over-year at $7.9 billion, as growth in wireless revenue was offset by declines in wireline products. Wireless retail postpaid net additions rose 12.1% to 408,000. Retail postpaid churn was 1.22%.

Media revenues dropped 2% to $1.8 billion versus the prior-year period, as gains in mobile advertising were offset by declines in desktop advertising.

For the full year of 2019, Verizon expects a low single-digit percentage growth in both adjusted EPS and GAAP consolidated revenues.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.