Shares of Visa Inc. (NYSE: V) were up 3% on Friday, a day after the company delivered strong results for its first quarter of 2023. Revenue and earnings beat expectations and the company is seeing favorable trends within its business. Here are three factors that work in favor of this digital payments leader:

Revenue and profit growth

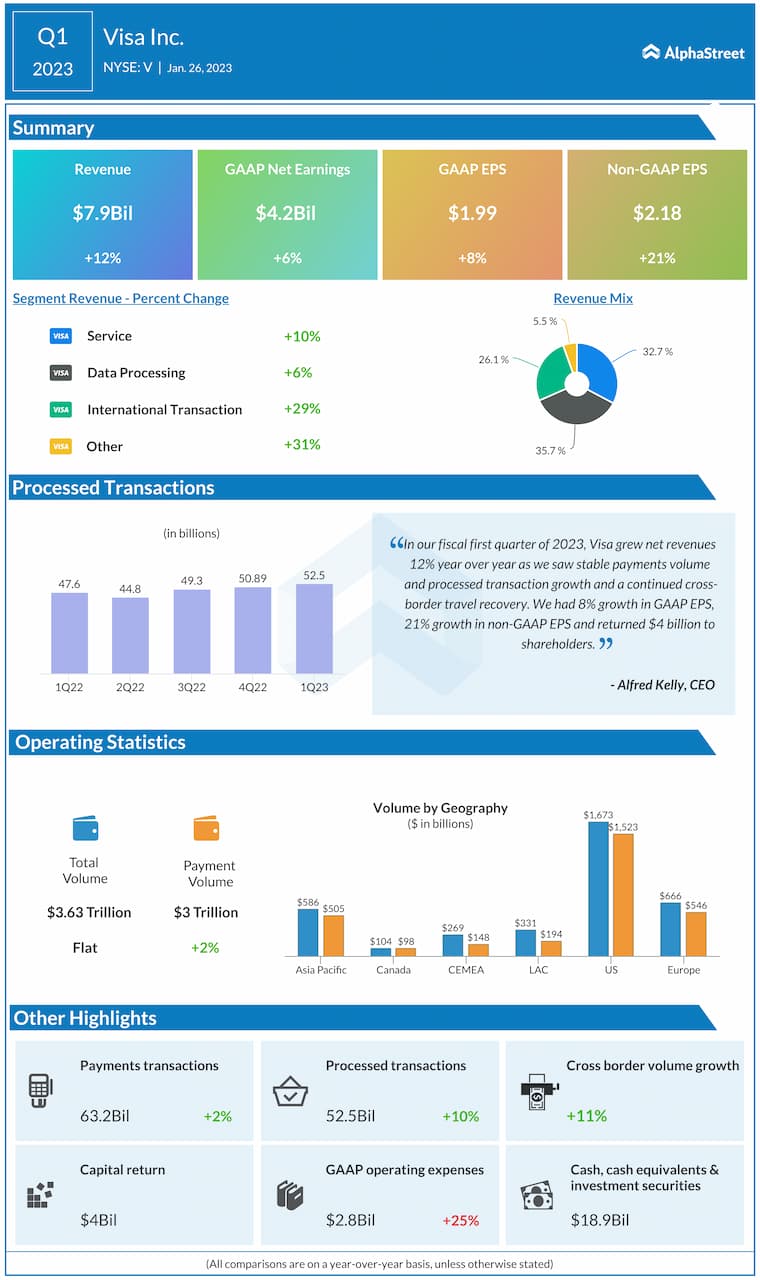

Visa posted strong revenue and profit growth for the first quarter of 2023, which exceeded consensus targets. Net revenues of $7.9 billion increased 12% year-over-year, driven by stable payments volume and processed transaction growth as well as a continued recovery in cross-border travel.

Total payments volume increased 7% in the first quarter compared to the same period last year, helped by a 9% growth in US payments volume and a 15% growth in international volume, excluding Russia and China. Cross-border volumes, excluding intra-Europe, grew 31% YoY. Processed transactions grew 10% YoY.

In Q1 2023, GAAP EPS rose 8% to $1.99 while adjusted EPS was up 21% to $2.18. For the second quarter of 2023, Visa expects to see stable trends in domestic payments volume and processed transactions along with a continued recovery in cross-border travel. The company expects revenue growth in the high single digits for Q2.

Favourable growth trends

During the second quarter, Visa saw strong revenue growth across each of its growth areas – consumer payments, net flows, and value-added services. In consumer payments, credentials grew 8%, with double-digit growth in the US, India and Brazil. Excluding Russia, growth was 11%. Tap-to-pay penetration of face-to-face transactions was 72% worldwide, excluding the US and Russia. In the US, transactions exceeded 30%.

Net flows revenue grew over 20% in constant dollars, driven by strong growth in B2B payments volume and Visa Direct transactions. Visa Direct transactions grew 39% YoY to 1.9 billion in Q1, excluding Russia. Value-added services generated $1.7 billion in revenue in Q1, up over 20% in constant dollars.

Valuable partnerships

Visa has entered into several strategic and valuable partnerships that can help drive further growth. In Q1, it renewed its partnerships with Bank of America and Commerce Bank in the US as well as payment solutions provider Cuscal in Australia and Kiwibank in New Zealand. The company entered into a new agreement with one of the largest banks in Panama, Banco Nacional de Panama.

In Latin America, it renewed its relationships with ICBC Argentina and Banco do Brasil while also striking a new deal with fintech platform Tigo Money. These partnerships, along with many more, provide Visa with significant opportunity for additional growth and expansion.

Click here to read the full transcript of Visa’s Q1 2023 earnings conference call