Despite a general slump in consumer sentiment during the pandemic, supermarkets and grocery stores witnessed stable demand that came as a boon for those with strong digital capabilities. Walmart Inc. (NYSE: WMT), which has a history of effectively dealing with market headwinds, naviagated the virus crisis aided by its diversified offerings and growing global presence.

The retail behemoth’s stock went through many ups and downs in 2021 — breaching the $150-mark on a few occasions — and ended the year almost flat. However, the softness is unlikely to continue this year, given the improving pandemic situation and relaxation of restrictions. The 12-month target price indicates a 24% growth, which should bring cheer to those waiting for an entry point. The current outlook on WMT is as bullish as ever.

Digital Push

The company enjoys ample liquidity and has successfully reduced its debt over the years. The digital shift triggered by widespread store closures continued this year, while the aggressive omnichannel push drove online sales to record highs. A key initiative that helped the retailer beat the slowdown is the expansion of its grocery business. Facilities like curbside pickup and store automation would enhance customer experience and attract more shoppers to stores in the long term.

Read management/analysts’ comments on Walmart’s Q3 2021 earnings report

At the same time, economic recovery is gaining momentum, and labor market conditions are improving steadily. The positive trend is offsetting the drag on consumer spending, causeed by elevated inflation and the emergence of new COVID variants.

Q4 Report on Tap

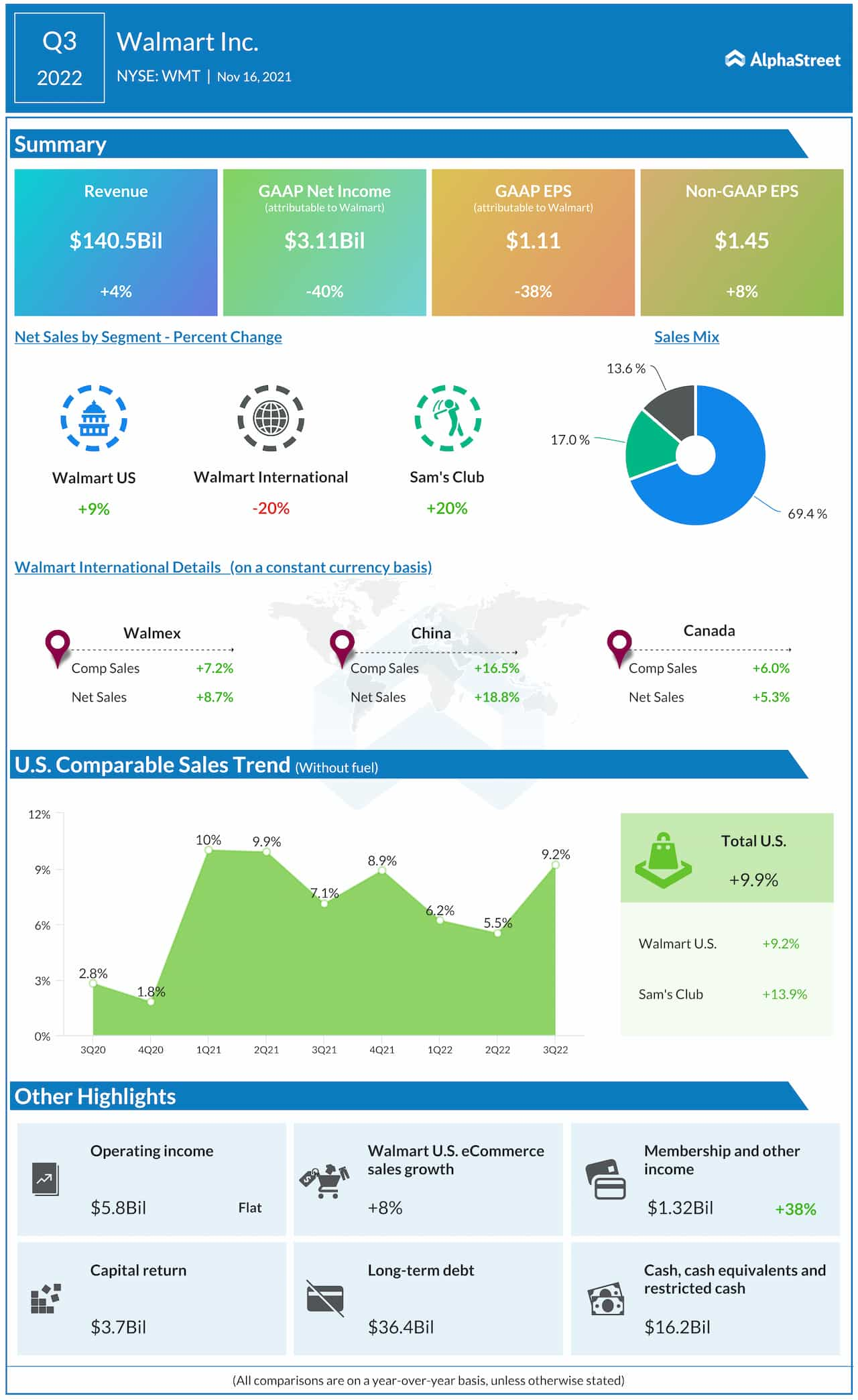

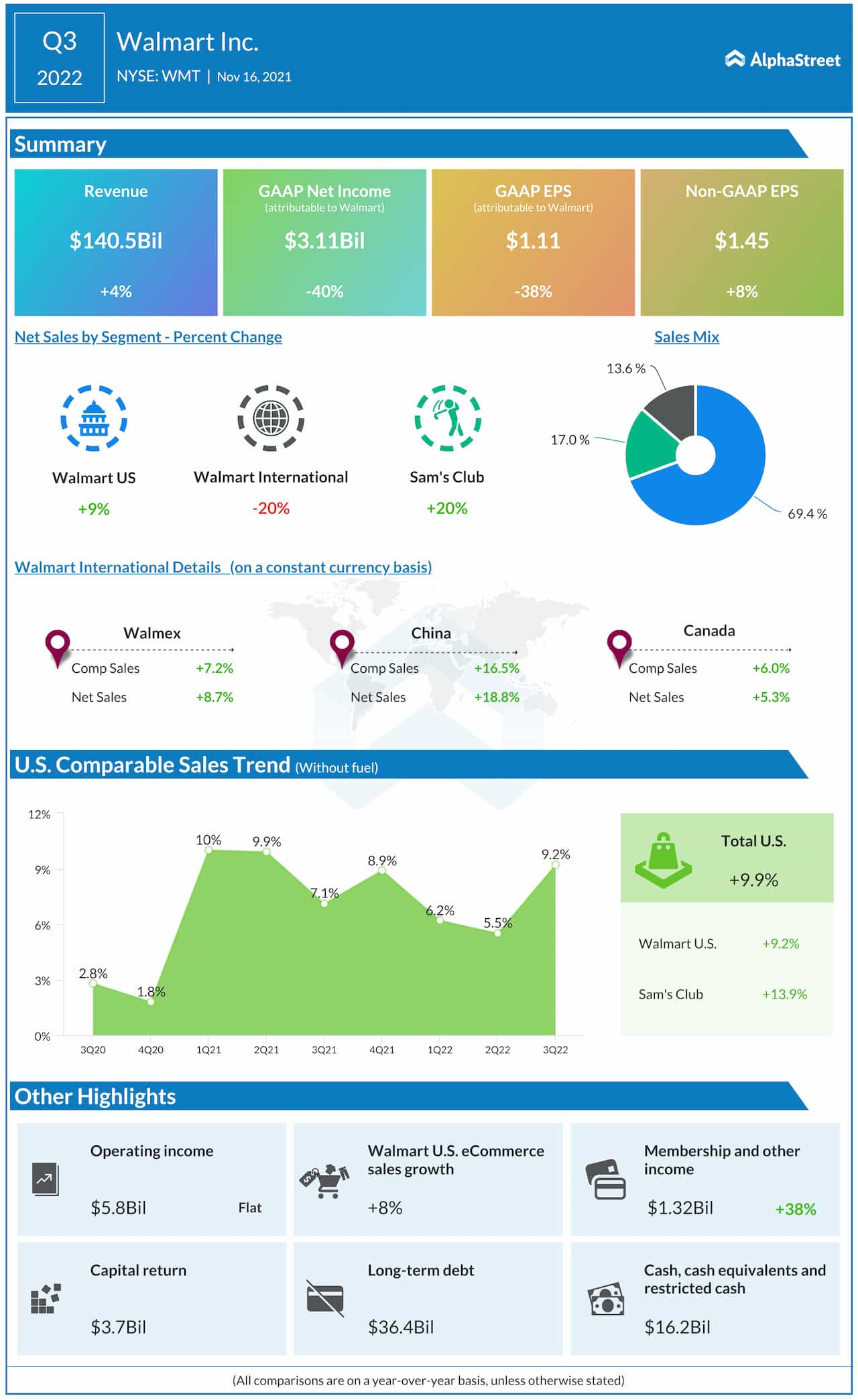

Walmart is scheduled to publish fourth-quarter results on February 17 before the opening bell. Analysts will be looking for earnings of $1.50 per share, up 8% year-over-year, on revenues of $151.56 billion. In the third quarter of 2022, strong growth in the Walmart-US and Sam’s Club segments, amid solid comparable-store sales, more than offset weakness in the international business. Total revenues rose 4% to $141 billion, supported by an 8% increase in eCommerce sales. At $1.45 per share, adjusted earnings were up 8%.

From Walmart’s Q3 2022 earnings conference call:

“We’re moving quickly to add and expand more digital businesses, including e-commerce and payments, to create new business models. We’re innovating for our customers like the recent expansion of Flipkart SuperCoins across platforms. We’re also making important investments for the future while delivering profitable growth today. You see examples of these investments in our supply chain in India and Mexico, new clubs in China, and store remodels in Canada. The team is delivering on its purpose of driving long-term sustainable growth for the Company.“

Risks

Meanwhile, the recent dip in shareholder returns, compared to last year, has dented investor sentiment to some extent. In the long term, the sustainability of Walmart’s business would depend on competing effectively with Amazon.com’s digital empire and the warehouse network of legacy retailer Costco Wholesale Corporation (NASDAQ: COST). It needs to be noted that in-store visits moderated since the shelter-in-place orders came, but net sales increased consistently.

AMZN Earnings: All you need to know about Amazon’s Q4 2021 earnings results

The value of WMT nearly doubled in the past five years, outpacing most of its peers. However, it lost about 7% so far this year. The stock traded higher on Tuesday afternoon, after closing the previous session lower.