The positive sales momentum seen during the pandemic days can be attributed mainly to stay-at-home trends like working and learning from home. When the Minnesota-based company reported a three-fold growth in e-commerce sales for its most recent quarter, the market’s response was skeptical amid fears that the growth might be short-lived. Underscoring those concerns, the management withheld its full-year guidance.

Factors to Check

Best Buy’s ability to sustain the current momentum will depend on factors like the new stimulus package, variations in the job market, and how the pandemic situation evolves. While the reopening of stores in recent months is catalyzing sales growth, costs related to fulfillment and logistics could impact margins. Performance might also be affected by the continued pressure on inventory, which would require measures to revitalize the supply chain.

From Best Buy’s second-quarter 2021 earnings conference call:

“As we look forward, the environment is still evolving and our operating model and supporting cost structure is evolving as well. The pandemic has accelerated the evolution of retail and compelled us to change our operating model in the best interest of our customers and employees. It has also allowed us to expedite some planned strategic changes, that will set us up to emerge from this time even stronger.”

Turnaround Program

The long-term outlook on the company is bullish, thanks to the unique assortment that includes a wide range of electronics and home appliances. Also, the company has come a long way since the days of losing ground to the online invasion of Amazon (AMZN). Currently, it is cashing in on the revamped online platform and the ongoing drive to convert stores into pickup and delivery spots. The management’s turnaround strategy called Renew Blue has been executed effectively with focus on stabilizing revenue streams, reducing costs, optimizing store space, and broadening digital sales.

Record Comps

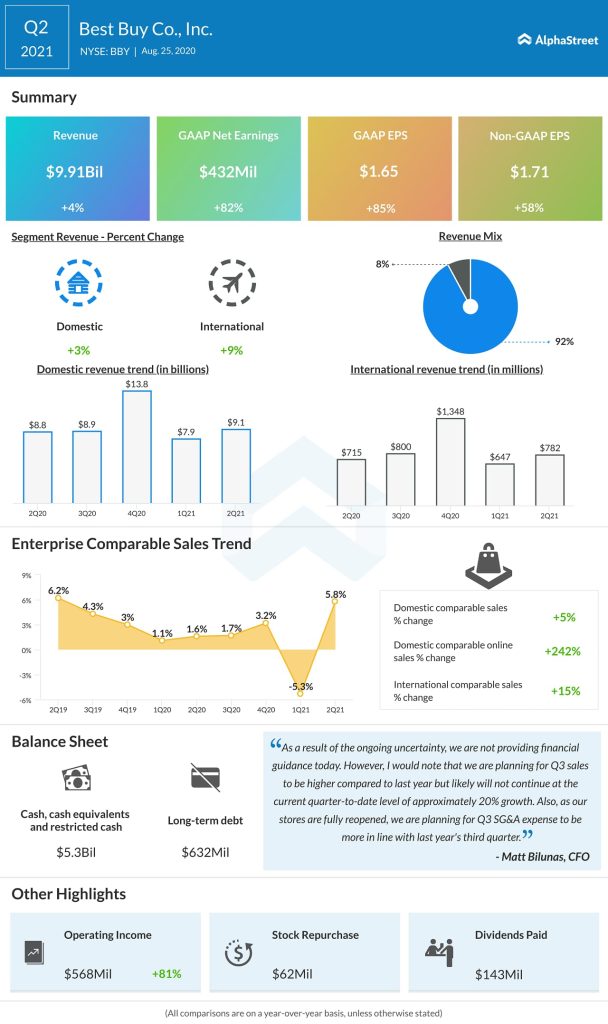

Despite the widespread disruption, comparable-store sales grew at a record pace in the second quarter, driving up revenues by 4% to about $10 billion. As a result, adjusted earnings climbed 58% to $1.71 per share. The numbers also topped the Street view. When the company reports its third-quarter results on November 24, market watchers will be looking for a 46% increase in earnings to $1.65 per share. Revenues are seen growing about 11% to $11 billion, benefiting from the strong traffic to the website.

Read management/analysts’ comments on Best Buy’s Q2 20201 earnings transcript

Best Buy’s stock traded lower in the early hours of Tuesday, after closing the previous session higher. It has gained 34% since the beginning of the year and 63% in the past twelve months. Currently, the shares are hovering near the all-time highs seen at the beginning of the month. They have outperformed the S&P index and the broad market this year.