Shares of Delta Air Lines Inc. (NYSE: DAL) were up 2% on Wednesday. The stock has dropped 25% over the past three months and 13% over the past one month. The airline is scheduled to report its third quarter 2023 earnings results on Thursday, October 12, before market open. Here’s a look at what to expect from the earnings report:

Revenue

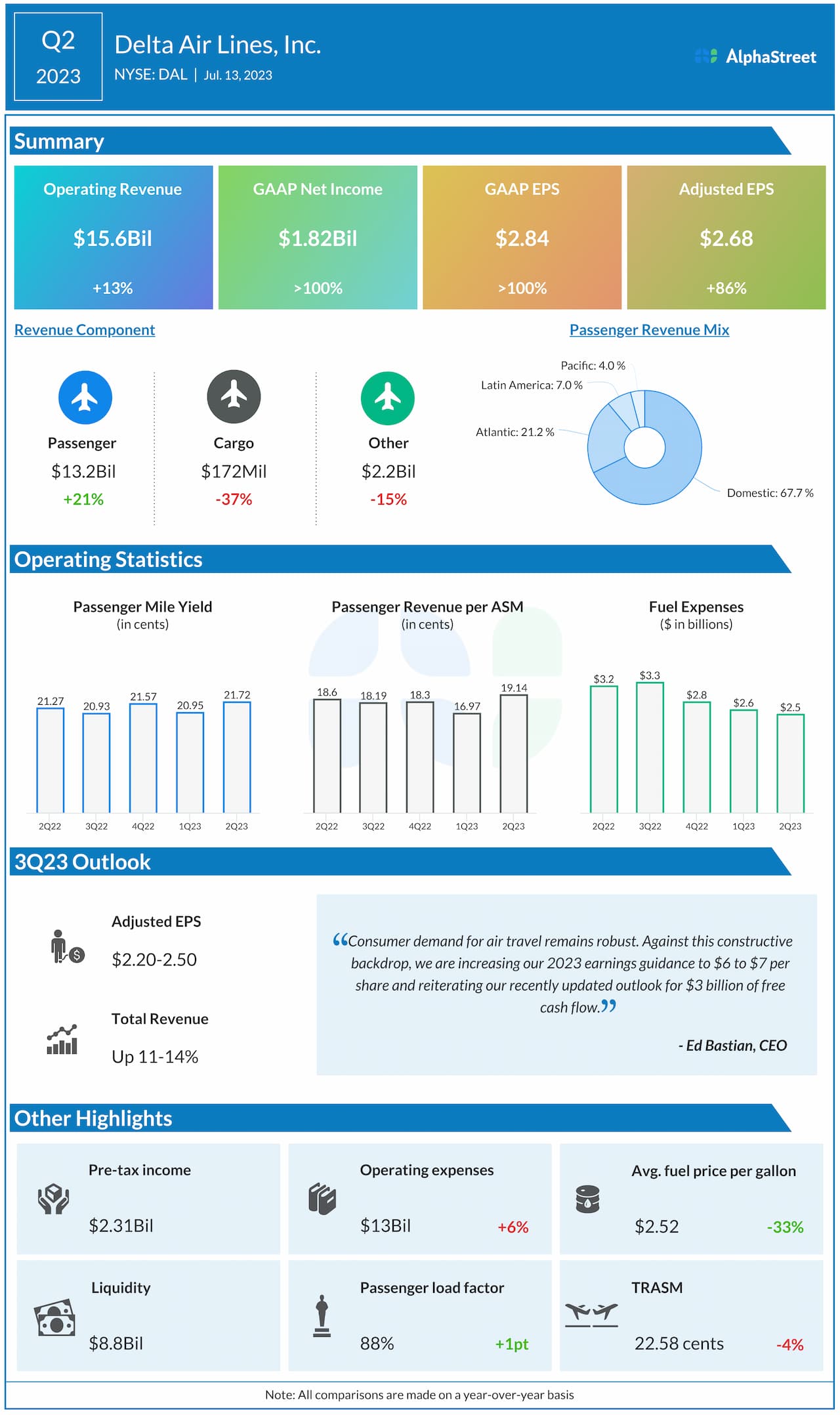

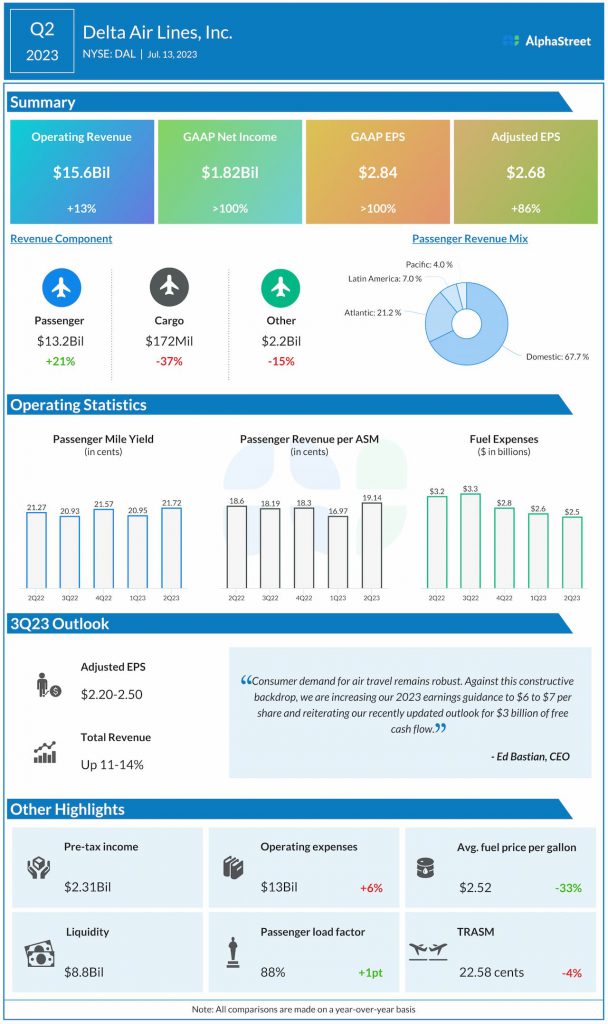

Delta expects revenue for the September quarter to come within the upper half of its initial guidance range of a year-over-year growth of 11-14%. Total revenue is projected to range between $15.4-15.6 billion on a GAAP basis while adjusted revenue is estimated to range between $14.4-14.6 billion for the third quarter of 2023.

Analysts are projecting revenue of $14.5 billion, which represents a 13% growth YoY. In the second quarter of 2023, GAAP revenue increased 13% to $15.5 billion while adjusted revenue increased 19% to $14.6 billion YoY.

Earnings

Delta estimates GAAP EPS to range between $1.70-1.90 for the third quarter of 2023. The company lowered its adjusted EPS guidance to a range of $1.85-2.05 from the previous range of $2.20-2.50 due to higher fuel and non-fuel costs. Analysts are projecting EPS of $1.94 for Q3. In Q2 2023, adjusted EPS increased 86% to $2.68.

Points to note

Delta expects total revenue per available seat mile (TRASM) to be down 2-3% in the third quarter versus its earlier expectation of down 2-4%. The company has been seeing steady demand for domestic travel and encouraging trends for business travel. It has also been seeing strong international demand, led by Transatlantic. Capacity is expected to be up 16% YoY in Q3.

Delta expects operating margin to be approx. 13% in Q3. Fuel and non-fuel costs remain a concern. Last month, at an analyst conference, the company had mentioned that fuel had gone up 30% since early July and that it had been volatile all year. Delta now expects fuel price per gallon for the September quarter to be $2.75-2.90 versus its earlier range of $2.50-2.70.

The airline now expects its non-fuel unit costs for the third quarter to increase 1-2% YoY as opposed to its previous guidance of a reduction of 1-3%. This is due to higher-than-expected maintenance costs. Maintenance expenses are now expected to remain flat in the second half of the year and third quarter in line with the first half.