Shares of Lennar Corporation (NYSE: LEN) turned red in midday trade on Friday. The stock has gained 17% over the past three months. The homebuilder is scheduled to report its first quarter 2024 earnings results on Wednesday, March 13, after markets close. Here’s a look at what to expect from the earnings report:

Revenue

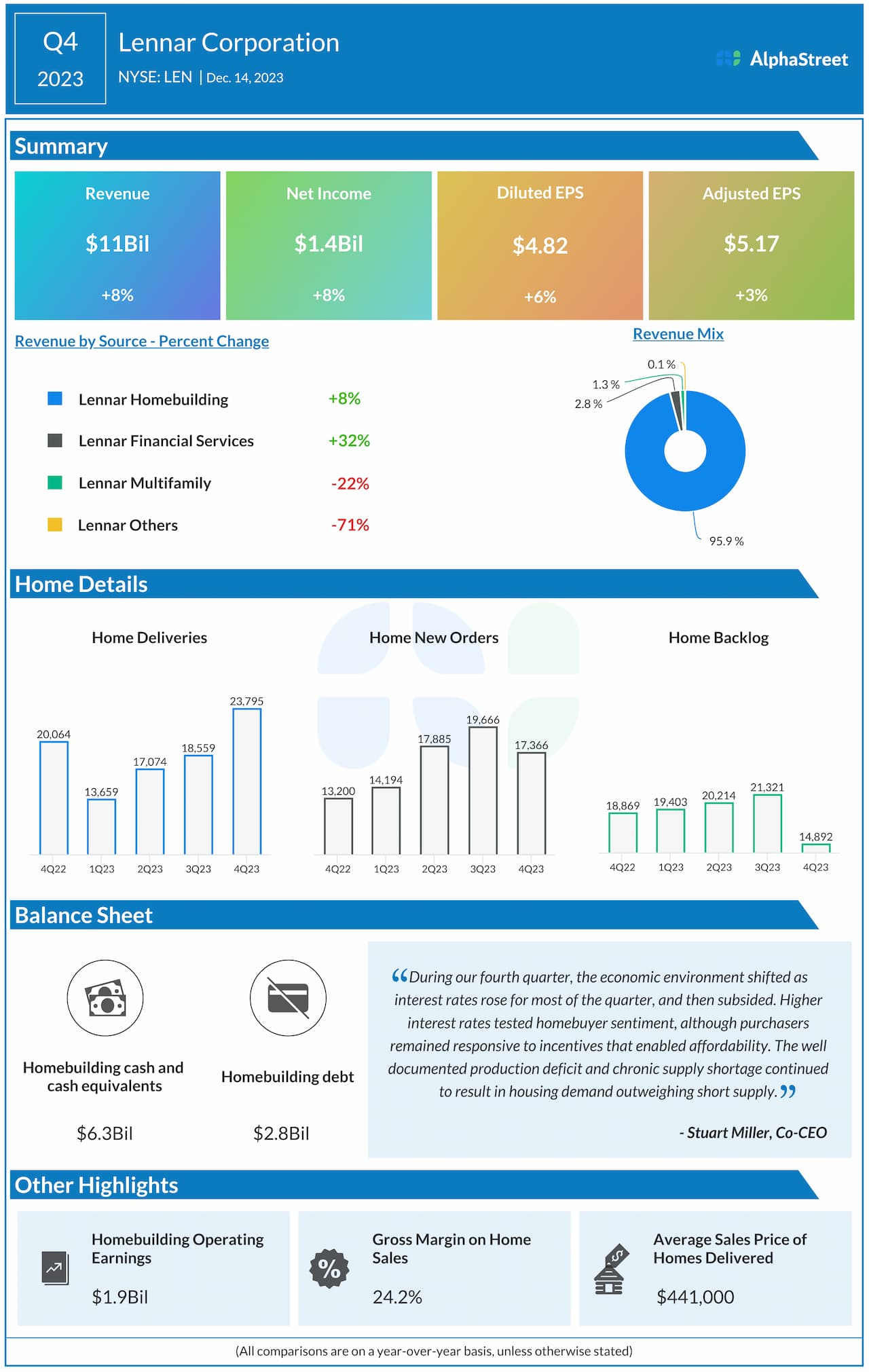

Analysts are projecting revenue of $7.4 billion for Lennar in the first quarter of 2024. This compares to revenue of $6.5 billion in the same period a year ago. In the fourth quarter of 2023, revenues totaled $11 billion.

Earnings

Lennar has guided for EPS of $2.15-2.20 for Q1 2024. Analysts are predicting EPS of $2.20 in Q1, which compares to EPS of $2.06 reported in the prior-year quarter. In Q4 2023, adjusted EPS was $5.17.

Points to note

Throughout 2023, Lennar saw higher interest rates take a toll on homebuyer affordability. There has been strong demand for and short supply of affordable homes. The existing home market remained quiet as homeowners stayed on the sidelines owing to high mortgage rates. However, existing home sales witnessed a pickup earlier this year, which could be a positive sign for the housing market.

Against this backdrop, Lennar adopted the strategy of driving volume and production to meet demand, and using price adjustments and incentives to enable affordability. The use of price and incentives impacted margins but the company believes these can be recovered once interest rates moderate.

By closely aligning its production pace and sales pace, Lennar delivered 23,795 homes in Q4 2023, which was up 19% year-over-year. Its new orders rose 32% to 17,366 homes last quarter. As it continues this strategy, the company expects deliveries of 16,500-17,000 homes and new orders of 17,500-18,000 homes for the first quarter of 2024.

Lennar’s average sales price dropped 9% to $441,000 last quarter due to price adjustments and the use of incentives. Gross margin also dipped to 24.2% in Q4 from 24.8% in the prior-year period. The company expects average sales price to be about $420,000 in Q1 2024. Gross margins are expected to range from 21% to 21.25% in Q1.