Revenue

Earnings

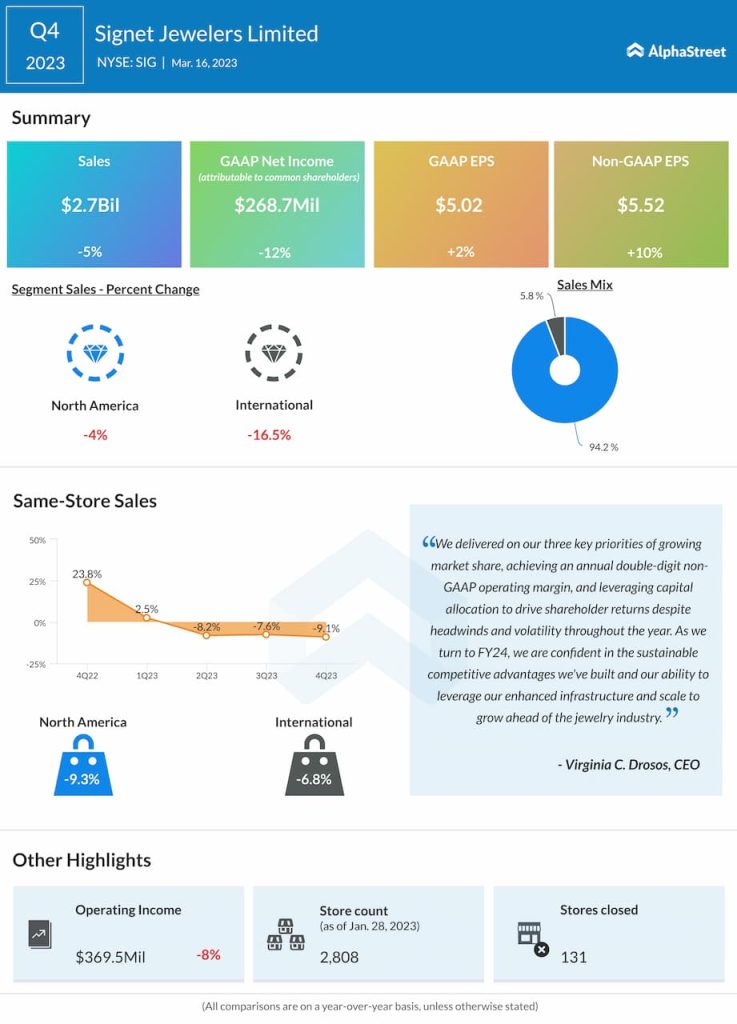

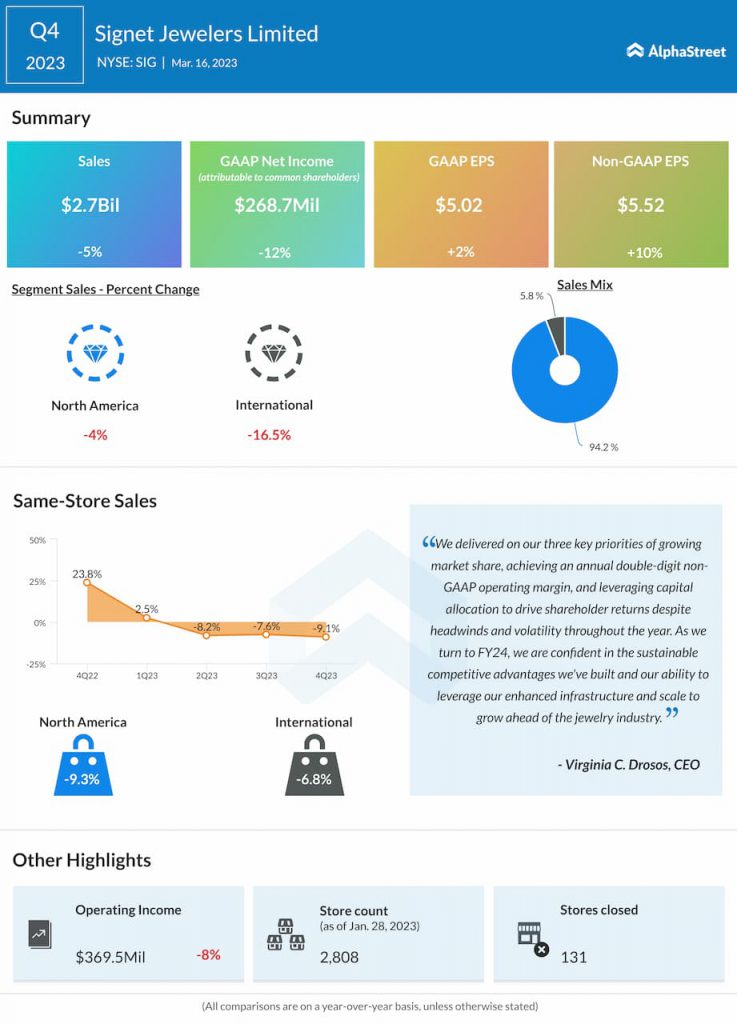

The consensus estimate for EPS is $1.18, which would reflect a drop of 59% from the prior-year period. In Q4 2023, adjusted EPS grew 10% YoY to $5.52.

Points to note

Signet can be expected to benefit from its varied and distinctive portfolio as well as its connected commerce presence. Strength at its higher price points and within its fashion assortment is helping offset the softness in the bridal category.

Signet expects the jewelry industry to witness a decline in FY2024 as it goes through a challenging environment. These headwinds are expected to impact the company’s top line performance for the year as well.

The bridal segment is an important one for Signet. Bridal is divided into two key parts – engagements and weddings. The company saw strong growth in wedding bands and bridal jewelry in FY2023 whereas engagements saw a decline during the year. The jeweler expects to see a low double-digit decline in engagements during FY2024 as well. It expects engagement ring sales to start recovering toward the end of FY2024 and then continue to pick up over the next two years.

Signet’s efforts in optimizing its store footprint and its investments in digital technology can also prove beneficial to its business performance. Its connected commerce presence will continue to provide it with a competitive advantage.