Shares of Southwest Airlines Co. (NYSE: LUV) were up 1% on Wednesday. The stock has gained 16% over the past three months. The airline company is set to report its second quarter 2023 earnings results on Thursday, July 27, before market open. Here’s a look at what to expect from the earnings report:

Revenue

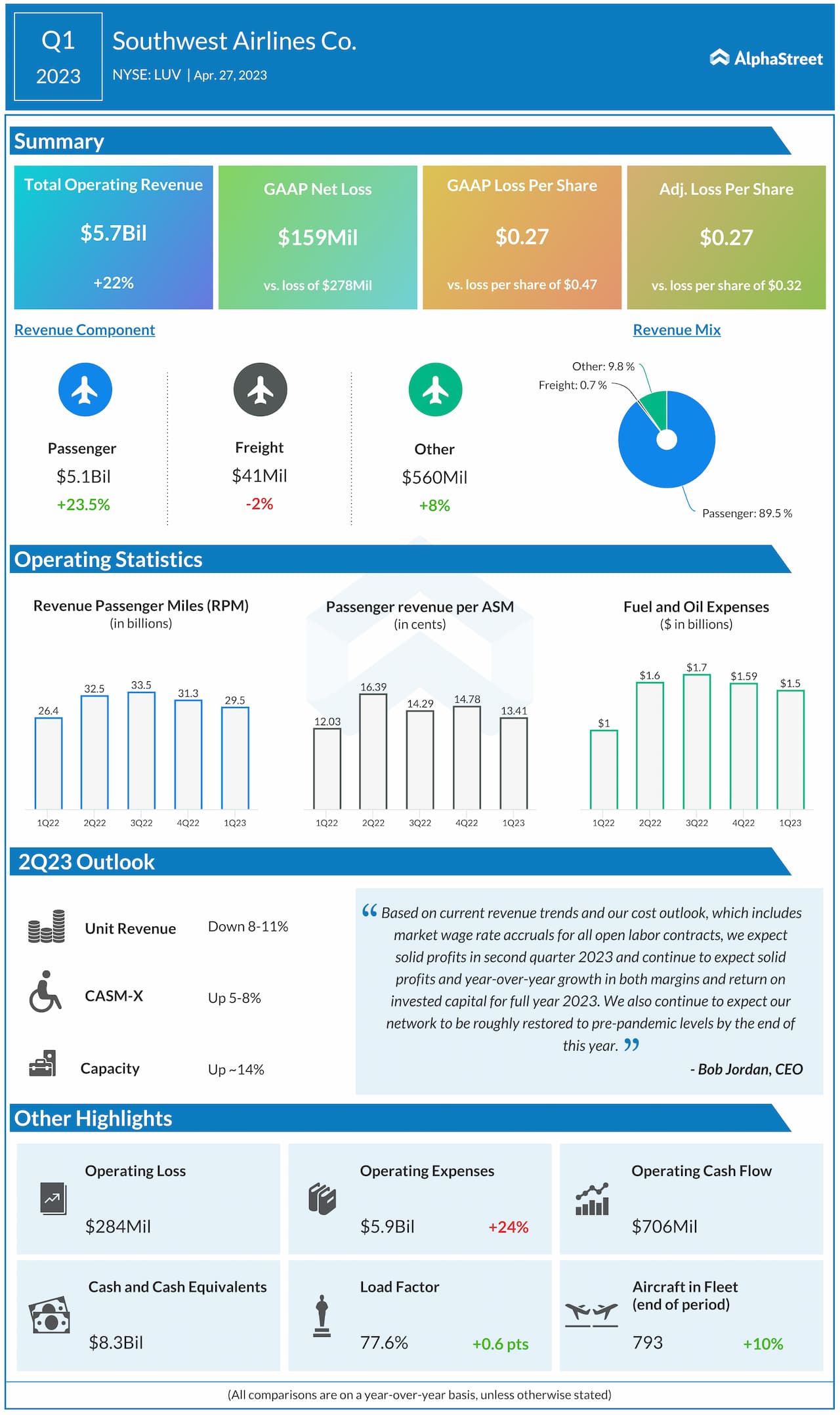

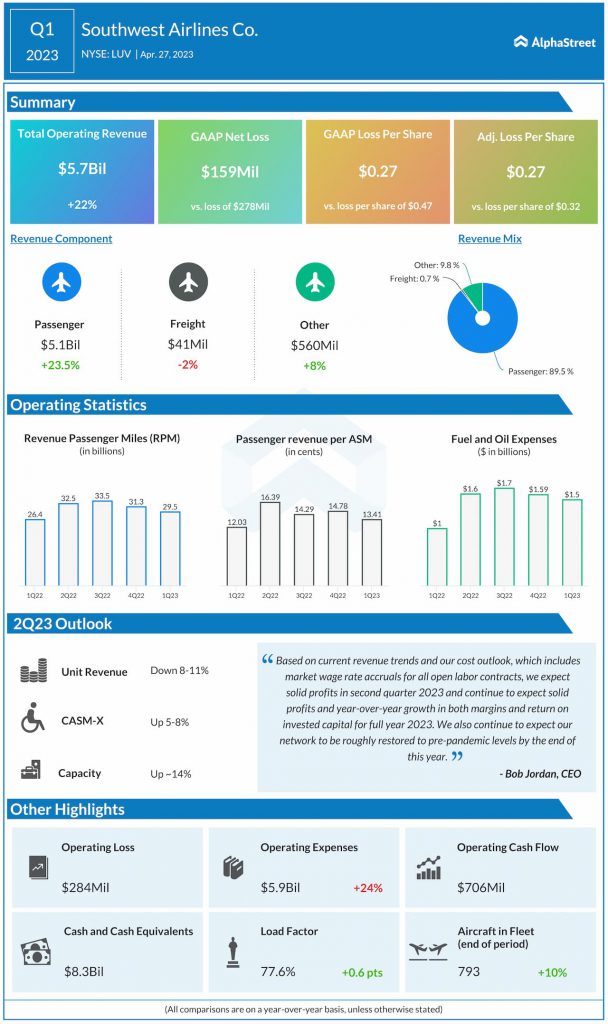

Analysts are projecting revenues of $6.9 billion for Southwest in Q2 2023. This would represent a growth of over 3% from the same period a year ago. In Q1 2023, operating revenues increased 22% year-over-year to $5.7 billion.

Earnings

The consensus estimate is for earnings of $1.10 per share in Q2 2023, which compares to earnings of $1.30 per share reported in the year-ago quarter. In Q1, the company reported an adjusted loss per share of $0.27.

Points to note

Like its peers, Southwest is expected to benefit from strong travel demand. Leisure travel remains robust while managed business trends are expected to improve sequentially. The company expects unit revenues for Q2 to be down 8-10% year-over-year with capacity up around 14%.

Operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing, or CASM-X, is expected to be up 5-8% YoY in Q2. Economic fuel costs per gallon is estimated to be around $2.55.