Revenue

Earnings

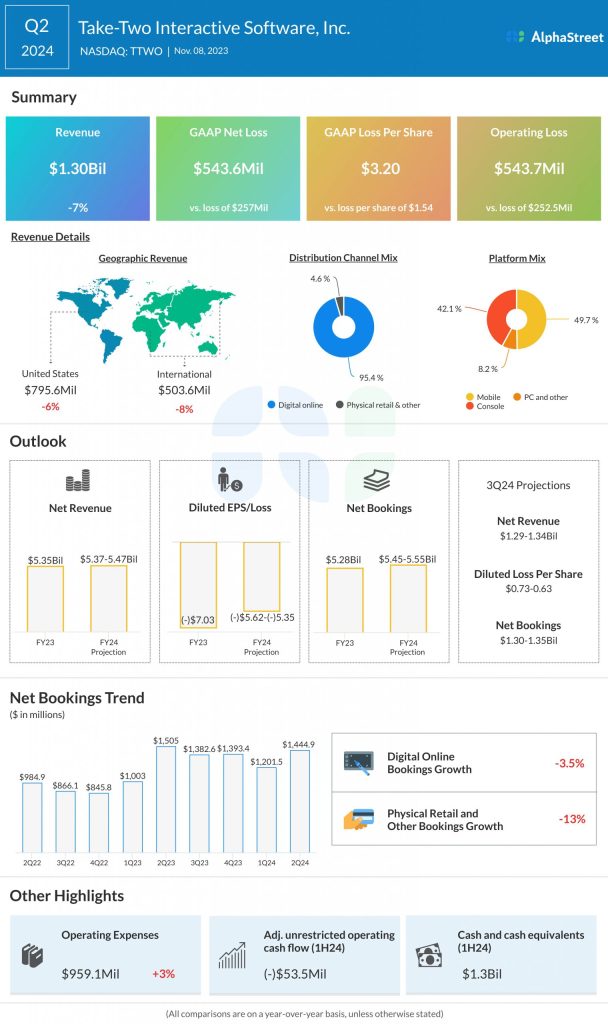

TTWO has guided for net loss per share of $0.73-0.63 for Q3 2024. Analysts are estimating earnings of $0.72 per share for the quarter. This compares to a loss of $0.91 per share reported in Q3 2023. In Q2 2024, net loss amounted to $3.20 per share.

Points to note

For the third quarter of 2024, Take-Two expects net bookings to range between $1.30-1.35 billion. This compares to net bookings of $1.38 billion reported in Q3 2023. In Q2 2024, net bookings decreased 4% YoY to $1.44 billion.

In the second quarter, TTWO’s top line was impacted by a 9% drop in recurrent consumer spending, which is generated from ongoing consumer engagement and includes virtual currency and in-game purchases. The weakness in recurrent consumer spending, along with a broader dullness in consumer spending on video games caused by a challenging macro environment, are causes of concern.

The company has forecasted recurrent consumer spending to decrease by approx. 5% in the third quarter of 2024, assuming a modest decline in its mobile business.

However, the strength of its popular franchises are expected to positively impact Take-Two’s business performance. The company expects NBA 2K, Grand Theft Auto, Red Dead Redemption, Empires & Puzzles, Toon Blast, Words With Friends, Merge Dragons, Zynga Poker, and its hyper-casual mobile portfolio to be the largest contributors to net bookings in the third quarter.

In addition to gains from established titles, TTWO is expected to benefit from new releases such as Top Troops, Match Factory, and Rollerdrome. Updates on the performance of these new games are worth watching.