Stable Demand

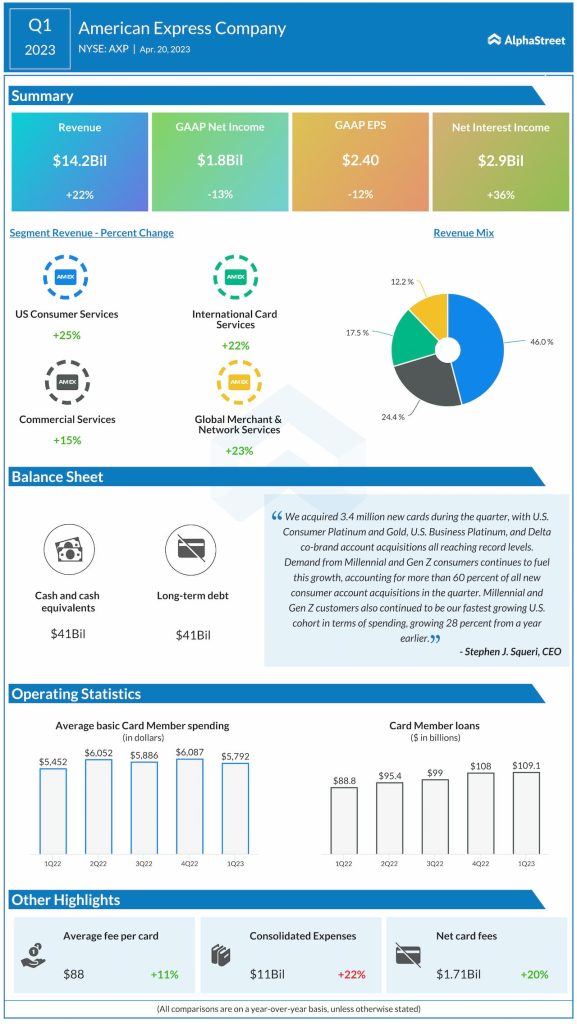

The company acquired around 3.4 million new cards in the first three months of the fiscal year, mainly due to high demand from millennials and Gen-x customers. At the same time, average cardmember spending remained almost stable in recent quarters, while loans keep increasing. Interestingly, the management reaffirmed its full-year guidance after reporting mixed Q1 results, indicating that the recent drag on profit is temporary.

American Express CEO Stephen Squeri said at the last earnings call, “Back in January, we laid out our guidance for 2023 of 15% to 17% revenue growth and double-digit earnings per share growth. Our first quarter results are tracking to this full-year guidance. Revenues were a record $14.3 billion in the quarter, up 22%, which is well above our full-year expectations. Stronger spending growth outside the U.S. and in T&E offset some softness in U.S. small business spending.”

Business Model

American Express’ business is slightly different from others and its volumes are much lower compared to those of Visa and Mastercard. The company, which follows the closed-loop model with focus on travel and holiday services, has a loyal customer base, thanks to the reward program and other offers. Being able to access important data on customers’ spending habits allows the company to customize its rewards and offers effectively.

With the hospitality industry regaining momentum steadily after the post-pandemic recovery, American Express should witness a major increase in volumes in the coming quarters. However, persistent recession fears and strained consumer confidence remains a concern as far as the company’s near-term prospects are concerned.

What’s in Cards

The second-quarter report is scheduled for release on Friday morning, July 21, and it is expected that the company would report higher earnings and revenues. Wall Street’s consensus estimate is for earnings of $2.81 per share, compared to $2.57 per share last year. Revenues are expected to grow by 15.6% to $15.48 billion.

In the first quarter, net income decreased 12% to $2.40 per share despite a 22% growth in revenues to $14.2 billion. Earnings also fell short of expectations — the second miss in a row — while the top line exceeded estimates. Revenues benefitted from double-digit growth across all business segments. Margins were negatively impacted by a 22% jump in operating expenses.

AXP traded higher on Tuesday afternoon after closing the previous session up 1.2%. It has gained 19% since the beginning of 2023.