Over the years, The Coca-Cola Company (NYSE: KO) has maintained stable sales and profitability even in times of adversity, thanks to the soft drink giant’s brand value and prudent pricing strategy. The company tackled the recent cost escalation by raising prices, though it had a negative impact on volumes.

Coca-Cola’s stock has been gaining momentum ahead of next week’s earnings, reversing the weakness it experienced in the early weeks of the year. The good news is that the stock is likely to maintain the uptrend beyond the earnings release. That means, for those who have an eye on the stock, the time is ripe to own it. Also, the valuation is reasonable despite the recent gains.

Updates

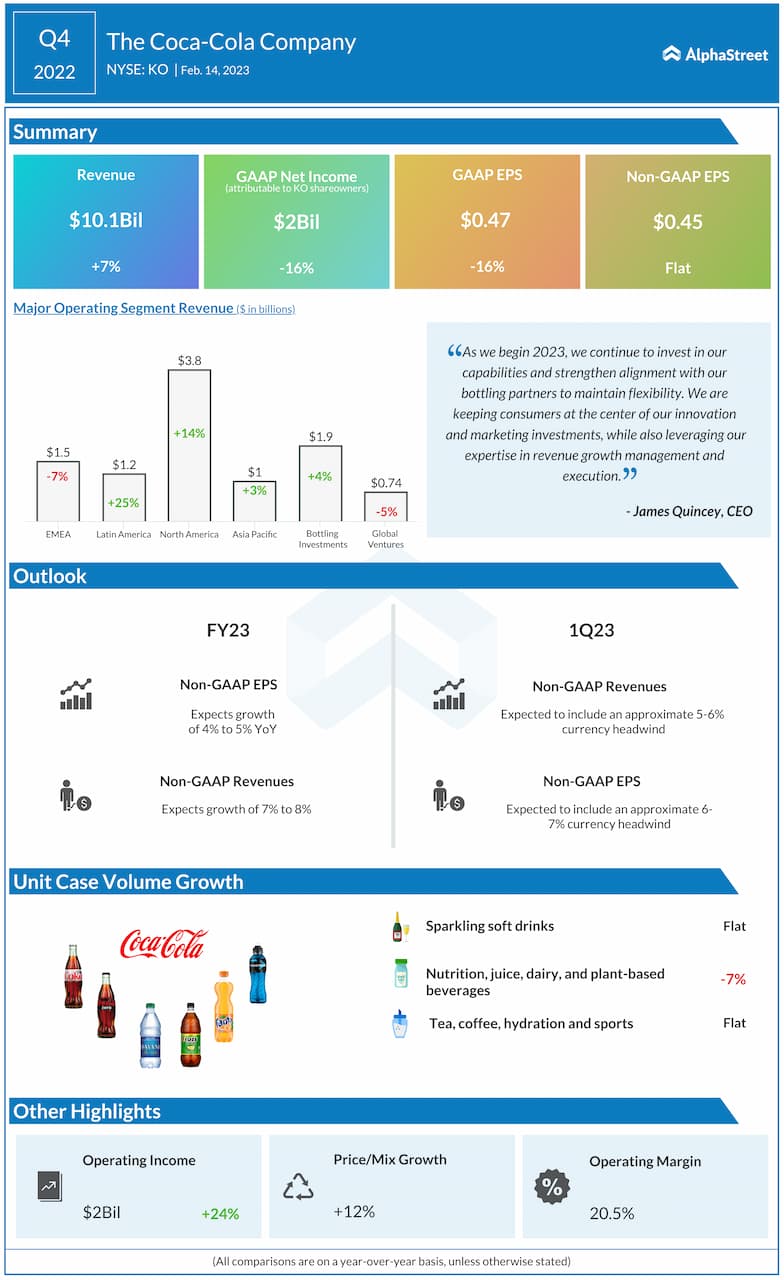

Coca-Cola has consistently created value through continued investment in its brands, and it would not be different this year, though the market environment remains dynamic amid persistent inflation, geopolitical tensions, and pandemic-related mobility restrictions. There are concerns that profitability will be affected by currency headwinds, like in 2022, while volumes would be impacted by the suspension of the company’s Russia operations.

From Coca-Cola’s Q4 2022 earnings call:

“Our streamlined portfolio of global and local brands and stepped-up consumer-facing investments continue to fuel the competitive edge of the Coca-Cola system to deliver value in any environment. Our network organizational structure enables this strategy. We’ve connected our operating units, our functions and our platform services organization for strong end-to-end coordination, which helps us identify key opportunities for meaningful long-term growth.”

Q1 Report Due

The company is all set to release first-quarter 2023 earnings on April 24, in the morning. The consensus estimate for earnings is $0.64 per share, excluding special items, which is in line with the profit recorded in the year-ago quarter. Experts also predict a 3% increase in sales to $10.8 billion.

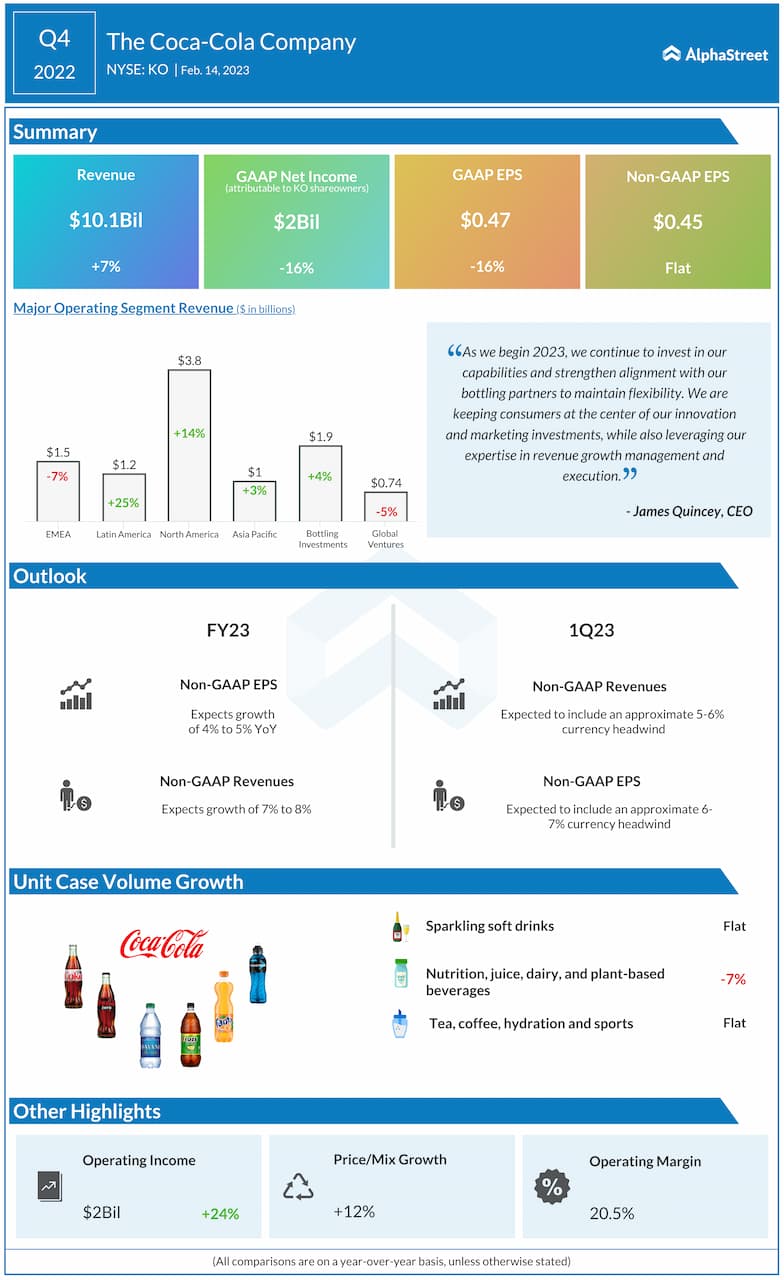

The company had reported flat earnings for the fourth quarter also. At $0.45 per share, adjusted earnings were unchanged year-over-year, while revenues moved up 7% annually to $10.1 billion. North America continues to be the largest market for the company, where sales increased by 14% in the latest quarter. The company has a good track record of beating quarterly earnings estimates. In the latest quarter, both sales and profit topped expectations.

On Tuesday, shares of Coca-Cola traded slightly higher and moved closer to the record highs they had reached a year earlier.