Stock Dips

Read management/analysts’ comments on quarterly reports

Currently, Kohl’s is in the process of evaluating its real estate on a regular basis to maximize asset value, drive long-term profitability, and optimize the portfolio. At the same time, it is taking measures to enhance traffic through partnerships and to remodel the stores for improving customer experience.

Q4 Report Due

On average, analysts expect Kohl’s fourth-quarter earnings to be $0.98 per share, sharply below the $2.2/share profit the company recorded a year earlier. Signaling broad-based weakness, sales are expected to decline by 3.5% to about $6 billion. The company will be publishing the results on March 1, before regular trading starts.

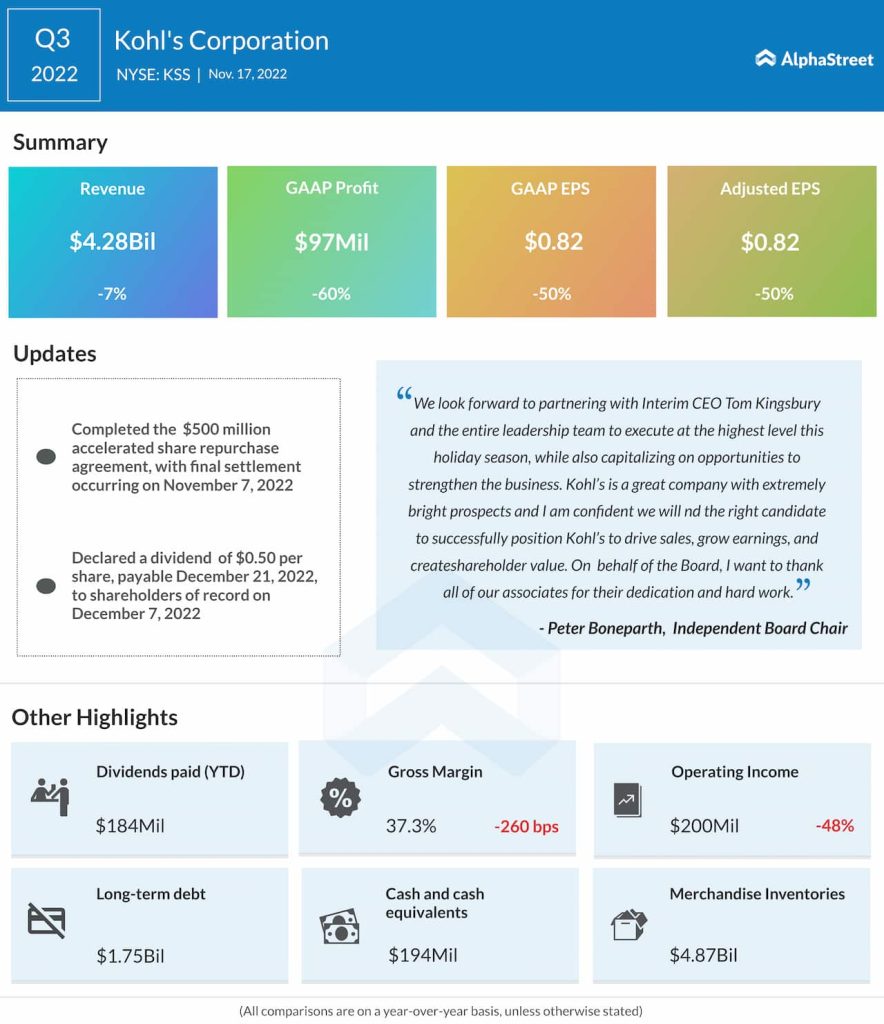

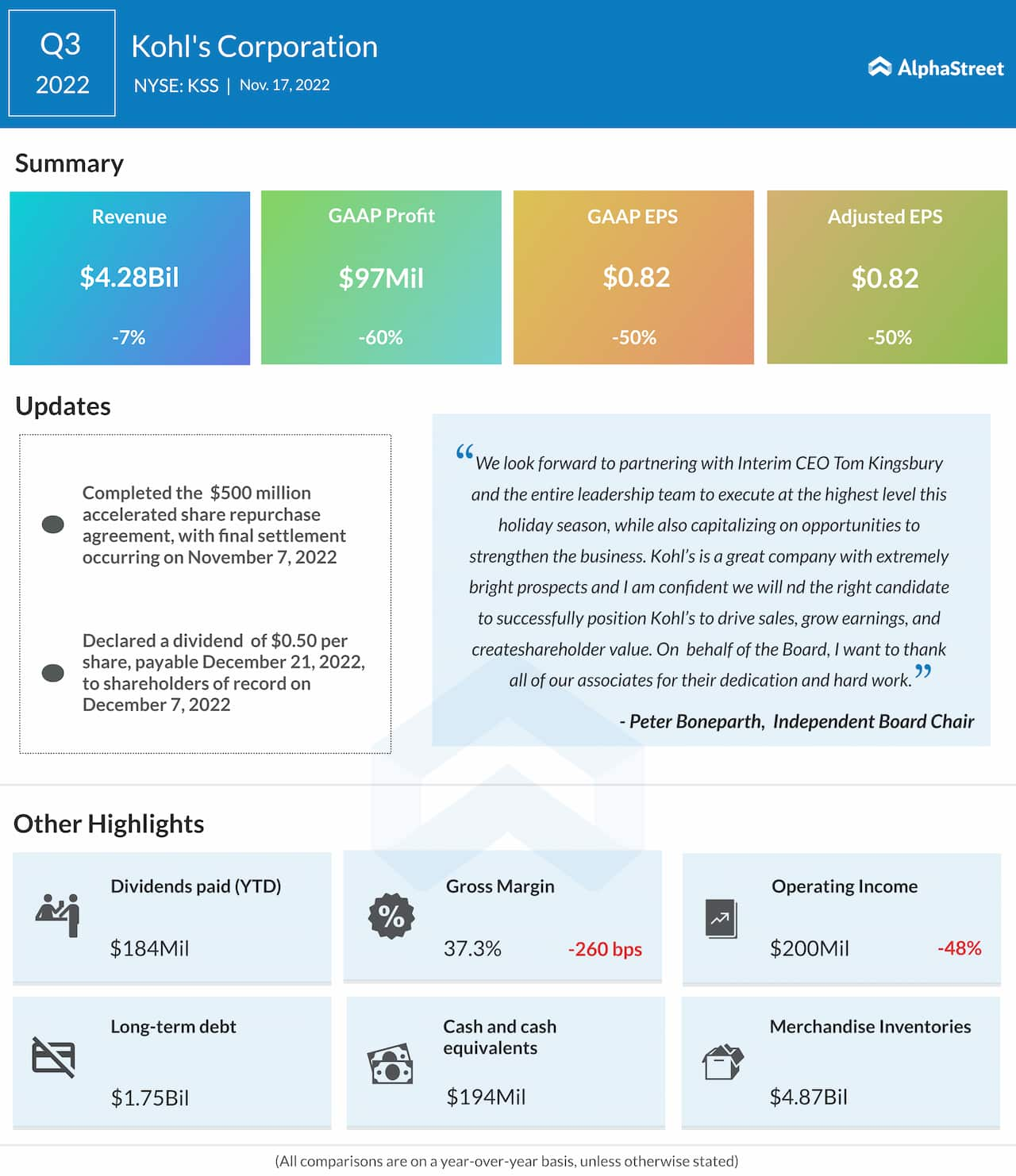

In the third quarter, adjusted earnings exceeded estimates after two consecutive misses, but dropped 50% to $0.82 per share. The decline can be attributed mainly to a 7% decrease in net sales to $4.28 billion. Meanwhile, the management withheld furth-quarter financial guidance and withdrew the full-year outlook issued earlier, citing macroeconomic uncertainties and an unexpected CEO transition.

Earnings: Walmart Q4 results beat estimates; US comps up 8.3%

From Kohl’s Q3 2022 earnings conference call:

“Looking forward, our capital allocation actions will prioritize the dividend, followed by returning our balance sheet to its historical strengths. We plan to pay down our two bond maturities totaling $275 million in 2023. We are not planning on repurchasing any additional shares until our balance sheet is strengthened on a path toward our leverage target of 2.5 times. We used the recently completed $500 million ASR as a pull forward from 2023.”

Leadership Change

Kohl’s is gearing up for a major leadership change – the departure of chief executive officer Michelle Gass later this year to join another company. Director Tom Kingsbury will serve as interim chief executive officer until the company finds a new chief.

On Friday, the stock traded below $30 and lost further during the session. Currently, KSS is trading close to where it was six months ago, languishing at a multi-year low.