Stock Recovers

On the positive side, there has been an improvement in the company’s cost structure. As the year comes to a close, Expedia’s business is more stabilized than earlier — after being battered by the pandemic in the first half — thanks to the improvement in bookings aided by a modest rebound in summer travel.

Losing Streak

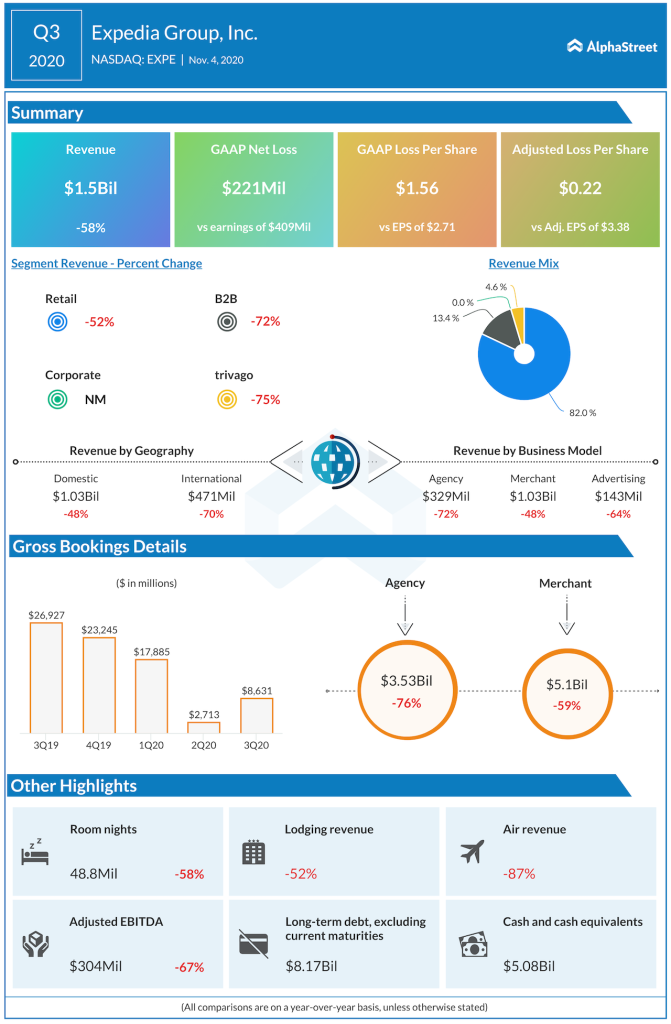

Continuing the losing streak that started at the beginning of the year, the company reported a loss of $0.22 per share for the third quarter, which marked a deterioration from the year-ago period when it generated earnings of $3.38-per share. All the key business segments witnessed weakness during the quarter, resulting in a 58% fall in total revenues to $1.5 billion. Gross bookings were down 68%. The numbers, however, topped the market’s expectations.

The management is bullish about the recently-rebranded vacation rental platform Vrbo, which is designed to provide customers a better booking experience. The company also looks to benefit from its ongoing efforts to recalibrate the technology infrastructure to optimize the platform for multi-brand operation, once normalcy returns to the market.

Roadblocks

More recently, the resurgence of coronavirus infections in key markets and reports of a mutant version of the virus spreading in the U.K dampened the recovery hopes. International airline traffic, the primary revenue source for the accommodation industry, continues to be affected and recovery is expected to be slow due to the fresh restrictions. Moreover, Expedia is operating in a highly competitive segment.

We’re trying to be very prudent here while we rebuild everything on the theory that we will be at our end state by the time COVID is over or more precisely, travel trends come back to more normal levels. And we believe, as I said before, that once that plumbing is rebuilt and once we’re ready for multi-brand that we will be able to not only maintain but grow share at similar or better profitability as we have had before.

Peter Maxwell Kern, chief executive officer of Expedia

TripAdvisor Q3 2020 Earnings Call Transcript

Currently, Expedia’s stock is trading sharply above the levels seen during the March-selloff, after making steady gains since then. It has gained 56% in the last six months alone, all along outperforming the market. At $126.67, the shares traded slightly higher on Thursday.