Cisco Systems Inc. (NASDAQ: CSCO) has dominated the network hardware market for a long time and has an impressive track record of staying resilient to adverse market conditions.

The San Jose-based company’s stock made one of the biggest single-day gains this week following the earnings announcement. Besides the strong results, the market was also impressed by the management’s bullish guidance for the current fiscal year. Still, CSCO is trading well below the record highs seen towards the end of last year. However, the outlook on the stock is quite bullish, with experts predicting further gains that would drive it beyond $50 in the coming months.

On Growth Path

Overall, the fourth-quarter report came as a reassurance to stakeholders that the market-leading tech firm’s prospects are as bright as ever. Given the solid demand for technological innovations across the globe and rapid growth of computer networking, marked by the emergence of new technologies like 5G, Cisco looks on track to scale new heights.

Cisco Systems Q4 2022 Earnings Call Transcript

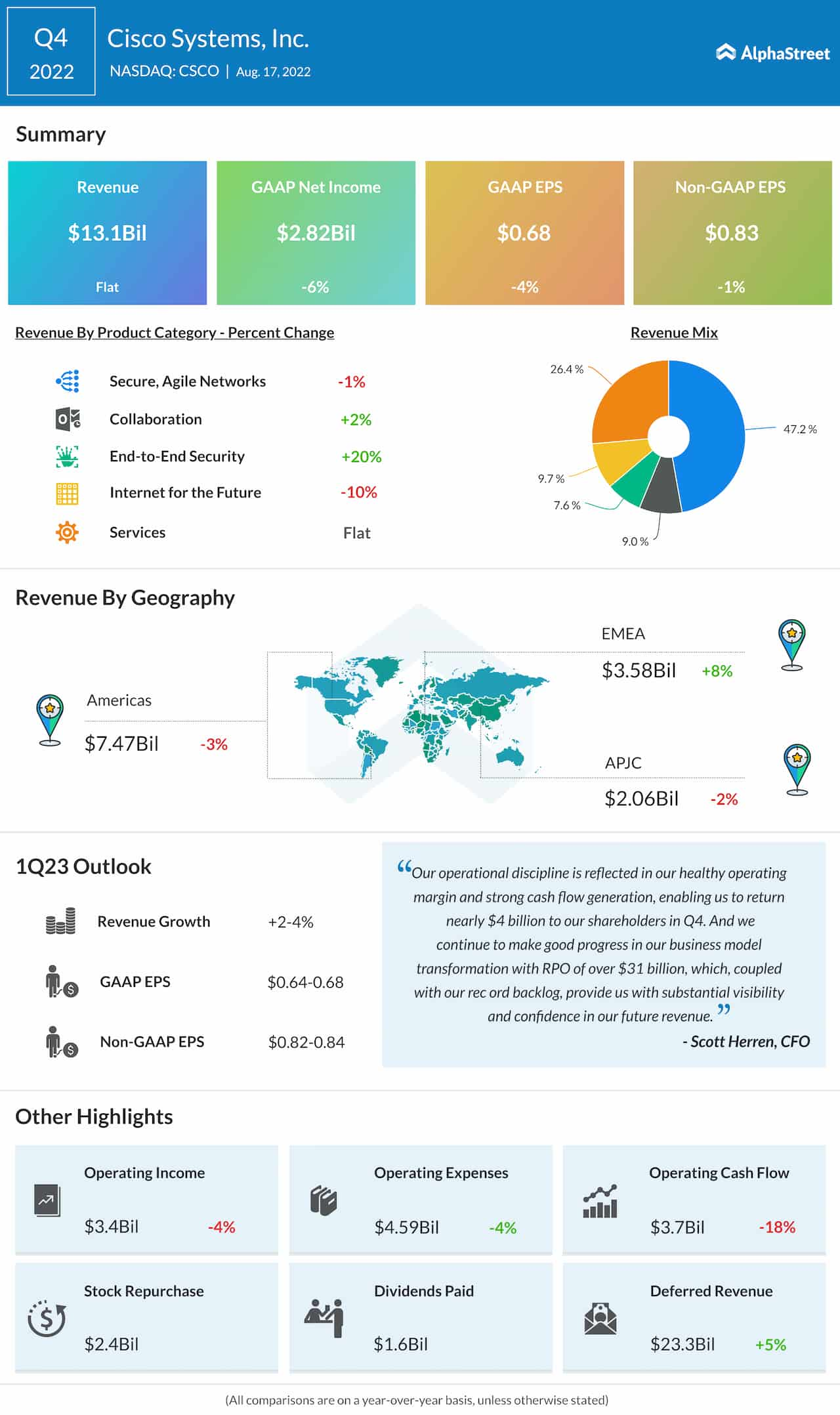

When it comes to profitability, Cisco enjoys the rare distinction of beating analysts’ quarterly earnings forecasts regularly for over a decade. However, the topline was not consistent in that respect but mostly maintained a steady uptick during that period. At $13.1 billion, revenues were broadly unchanged year-over-year in the final three months of 2022 but topped expectations. Earnings per share, adjusted for one-off items, dropped by a cent to $0.83.

Outlook

Encouraged by the strong backlog and order pipeline, the company said it expects continued revenue growth in the first quarter. It is expected that better price rise realizations and improvements in logistics would drive growth going forward. Nevertheless, the lingering supply chain disruption and macroeconomic challenges like inflation would put pressure on margins in the near future. Also, the slowdown in the core routing/switching business is something that needs to be checked, though the management’s strategy of constant diversification can ease those concerns to a large extent.

From Cisco’s Q4 2022 earnings conference call:

“We had strong subscription revenue this quarter, driven by our growing portfolio of recurring offers. While our software revenue was down slightly, once supply constraints improve and we begin to increase product shipments, we expect to see an improvement in software, subscription, and services that are attached to hardware products in our backlog. The investments we’ve made in innovation are paying off as our competitive position is very strong.”

Microsoft remains a good bet after mixed Q4 performance

The shares of Cisco closed the last trading session up 5%, which is slightly below the $50-mark. Over the past 30 days, they gained about 16%.