After a fruitful 2020, chipmakers continue to thrive on the unusually high demand and rapid adoption of 5G, thanks to the virus-driven digital shift. Qualcomm, Inc. (NASDAQ: QCOM), which has played a key role in the smartphone revolutions with its innovative microprocessors, has been struggling to meet the high demand, mainly due to supply constraints related to the shutdown. With deliveries being affected, sales fell short of expectations early this year and caused the company’s shares to retreat from their peak.

QCOM Overvalued?

The stock, which is yet to recover from the sell-off, looks poised to bounce back to where it was a few weeks ago and scale new heights this year. But, analysts are a bit cautious in their outlook, citing the high valuation after the strong gains over the past year. They are divided in their recommendations, which gives the stock an average rating of moderate buy. However, being part of the rapidly growing smartphone industry, Qualcomm has good long-term prospects and that is something investors can count on. Moreover, it has long been a favorite among dividend investors.

Read management/analysts’ comments on Qualcomm’s Q1 results

Investors will be closely following the chipmaker’s second-quarter earnings announcement, which is expected on Wednesday after the regular trading hours, to track its stock-market performance. On a bullish note, experts predict that earnings would more than double to $1.67 per share on revenues of $7.62 billion, which represents a 46% growth.

Mobile Prowess

Qualcomm’s dominance in the smartphone market gives it an edge over rivals in terms of tapping 5G opportunities because all major smartphone makers are likely to come up with their 5G variants in the coming months. The management also banks on the prospects of extending the company’s product offerings to adjacent industries like automotive and the impressive performance of its 5G-focused RAF front-end portfolio.

From Qualcomm’s first-quarter 2021 earnings conference call:

“We are executing extremely well in our strategy to address many of the technical challenges of delivering a true modem-to-antenna 5G experience and capture a higher dollar share of content in smartphones. We are also well-positioned with design wins across the mobile handset ecosystem, a strong pipeline for further growth in smartphones, and a roadmap to bring our RF expertise to adjacent industries.“

Looking Ahead

Underscoring the sustainability of its business model, the company has survived multiple legal challenges related to its alleged monopoly in the mobile phone market. At the same time, the steady growth of cash flow has eased the burden of the relatively high debt. Meanwhile, with the market still reeling under the grip of COVID, the issues related to chip supply might persist in the near future, hampering Qualcomm’s sales.

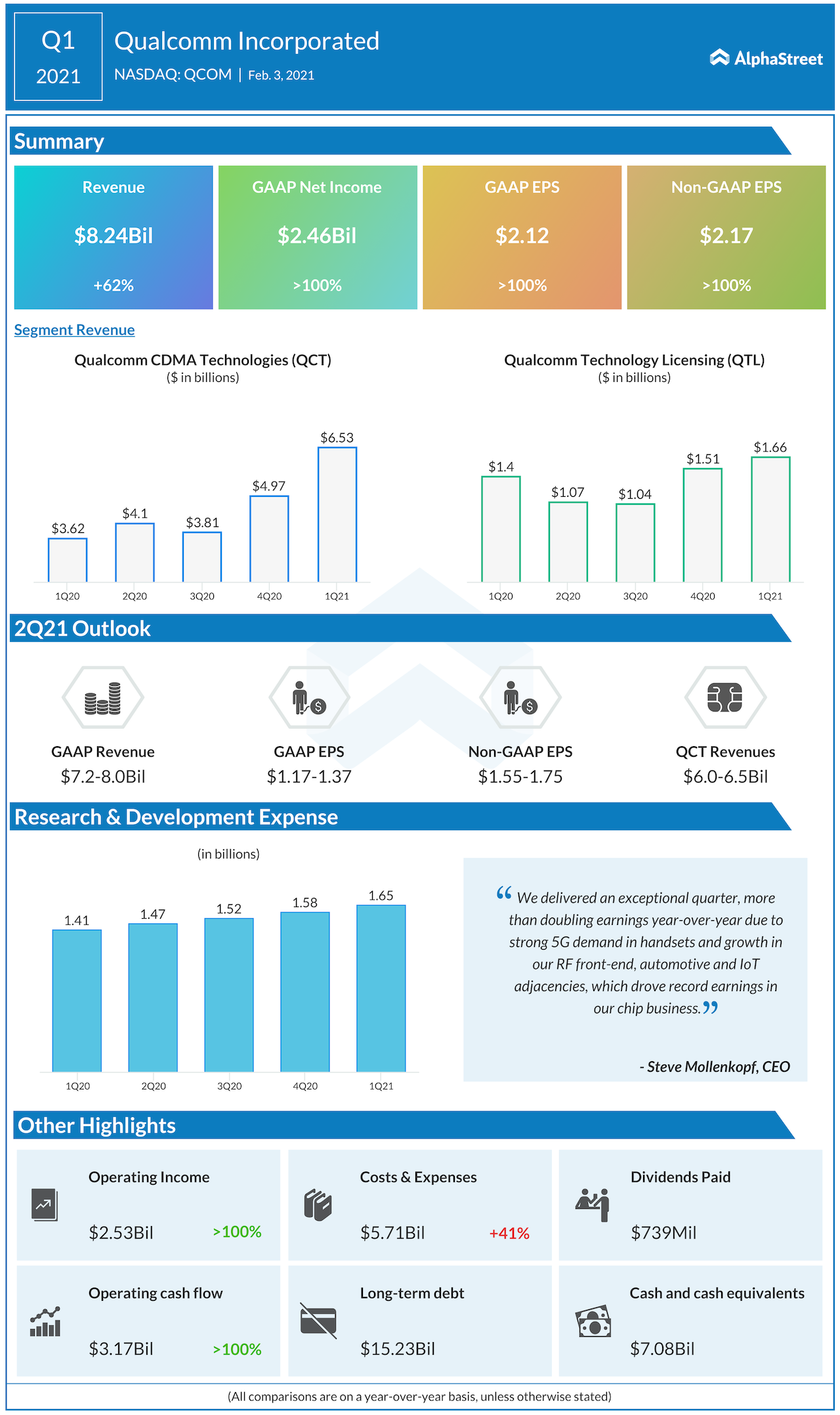

Sales got a major boost from elevated chip demand and revenues surged 62% to $8.3 billion in the first quarter. However, the top-line fell short of the market’s projection. Earnings more than doubled to $2.17 per share and topped expectations, as they did in the past several quarters.

AMD sees a promising year ahead amid unprecedented chip demand

Shares of Qualcomm lost about 9% in the past four months, with most of the contraction coming after the mixed first-quarter results. Staying comfortably above its 52-week average, the stock traded slightly lower early Monday, after closing the last session up 2%.