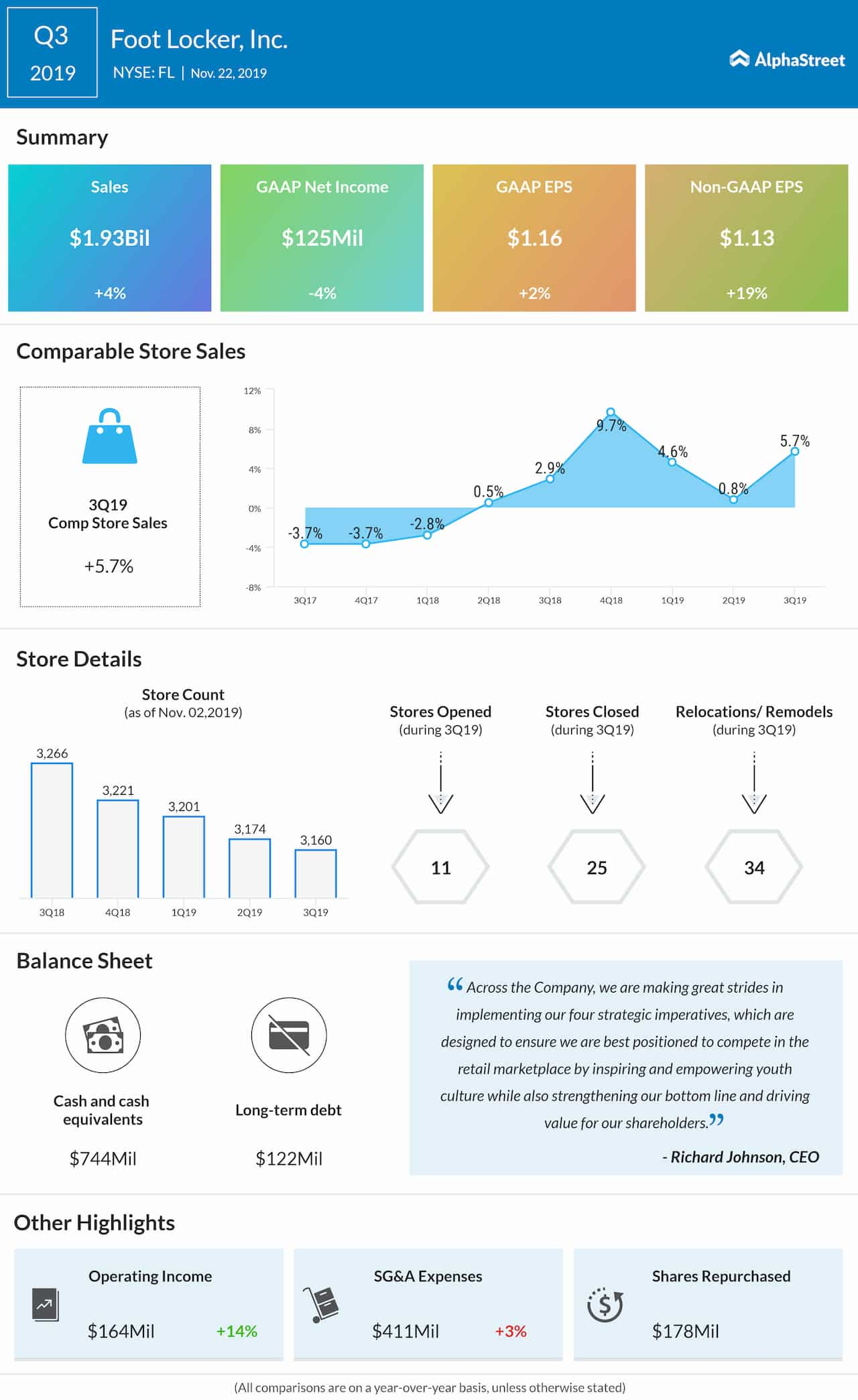

Foot Locker saw an increase of 3.9% in its total sales in

the third quarter of 2019 while comparable store sales increased 5.7%.

The company has been undertaking initiatives to improve its

supply chain in the US. It has also been investing in expanding its digital

capabilities and remodeling its stores. A significant part of this investment

has been focused on its community-based power stores worldwide.

These investments, however, have led to higher costs that have been putting pressure on margins. Foot Locker is also facing tough competition from stronger players in the retail sector.

Also read: A look at how Altria (MO) could pick up pace in the near future

Despite the challenges, the investments being made by the

company to improve its operations is likely to drive growth going forward. Foot

Locker also has the opportunity to further expand its footprint in

international markets which will prove beneficial to its growth.

Last week, Foot Locker declared a quarterly dividend of $0.40 per common share, payable on May 1, 2020 to shareholders of record as of April 17, 2020, reflecting a 5% increase and an annualized rate of $1.60 per share.

Foot Locker is set to report its fourth quarter 2019 earnings results on Friday. Analysts have projected earnings of $1.58 per share on revenue of $2.25 billion. If the company manages to beat these estimates, the stock is likely to see a recovery.