Stage 1 – Take Off

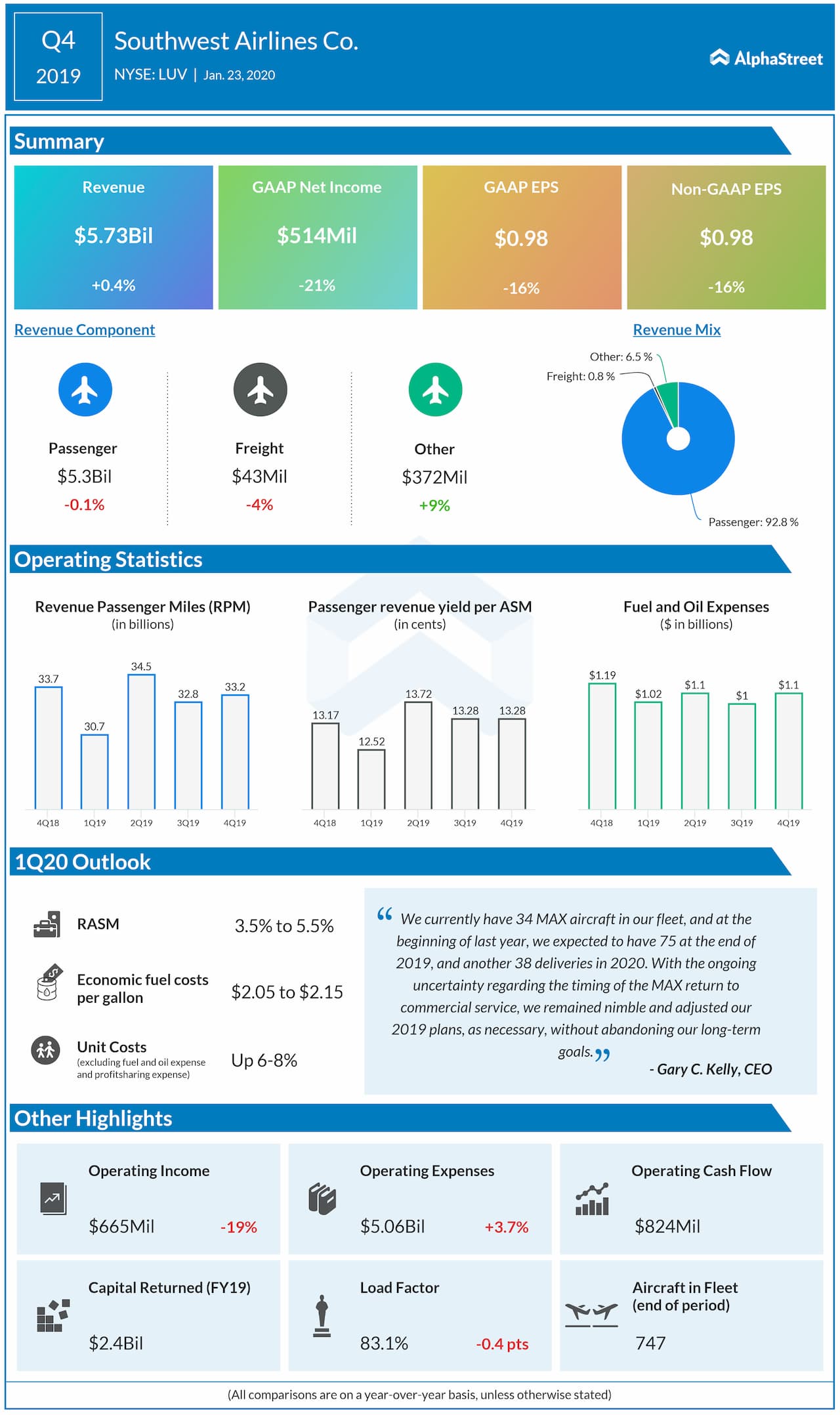

Southwest Airlines’ Chairman & CEO, Gary C. Kelly, on his Q4 Earnings Call was more cautious on his outlook (as they were battered & bruised by MAX groundings) — “Having said all those things, one assumes that demand in the economy remains strong and that oil prices remain stable and low.”

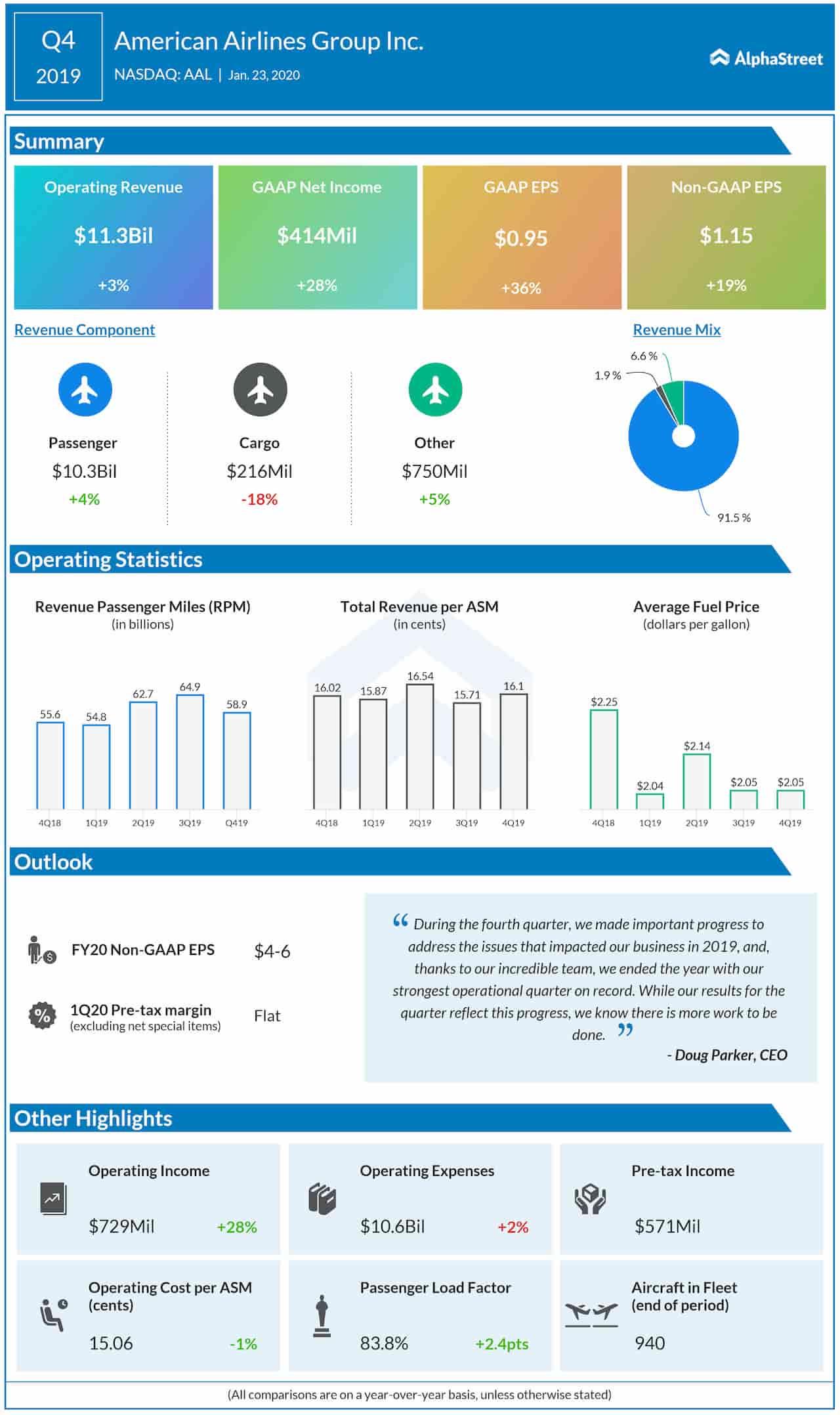

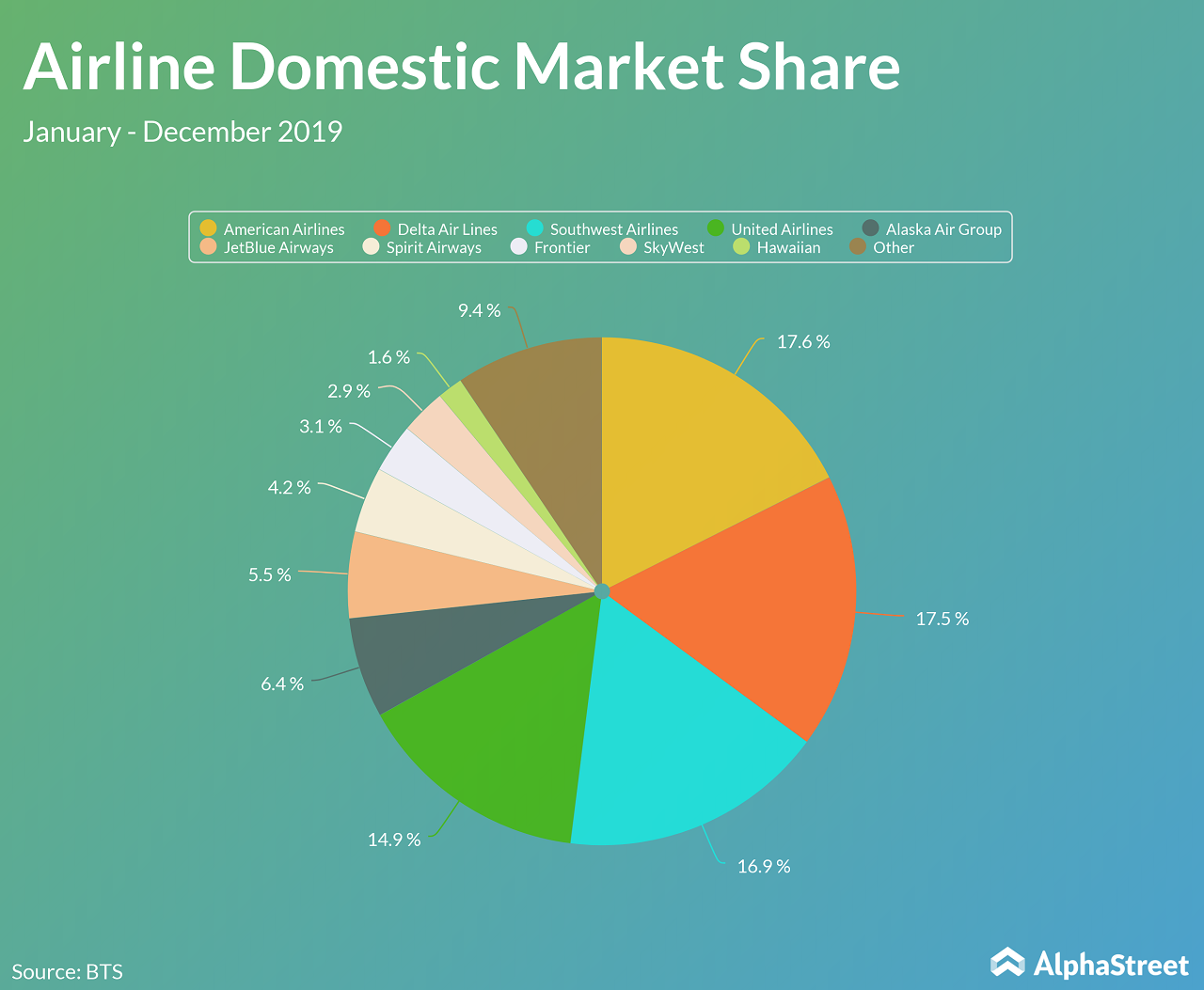

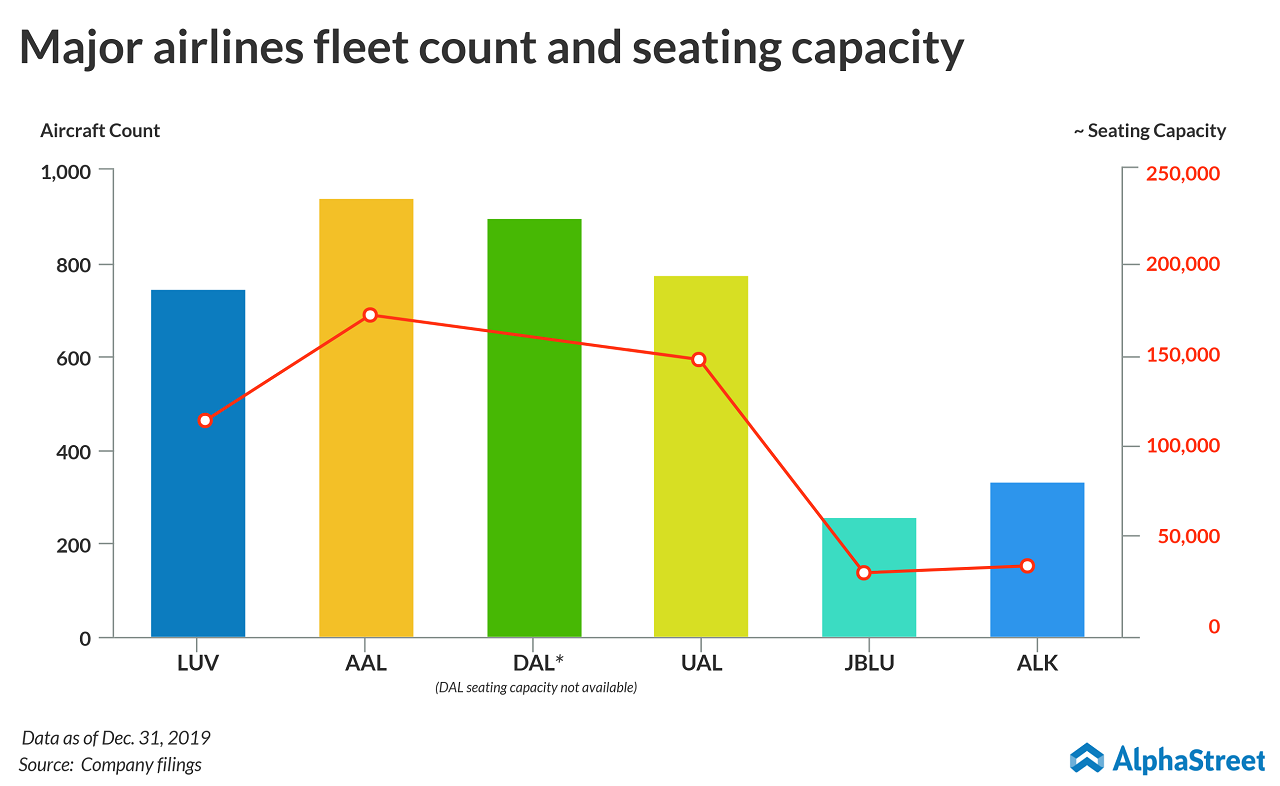

American Airlines, the largest airline in the world, apparently on a mile high after successful integration of US Airways was trying to put its troubles with the Boeing MAX behind and looking forward to a new decade of growth. Doug Parker, Chairman and Chief Executive Officer of American Airlines in his opening remarks of its Q4 Earnings Call on Jan. 24. said, “Our 2019 earnings were negatively impacted by the Boeing 737 MAX being grounded for more than seven months, bringing a lot of uncertainty and frustration to our customers, our team and our shareholders.”

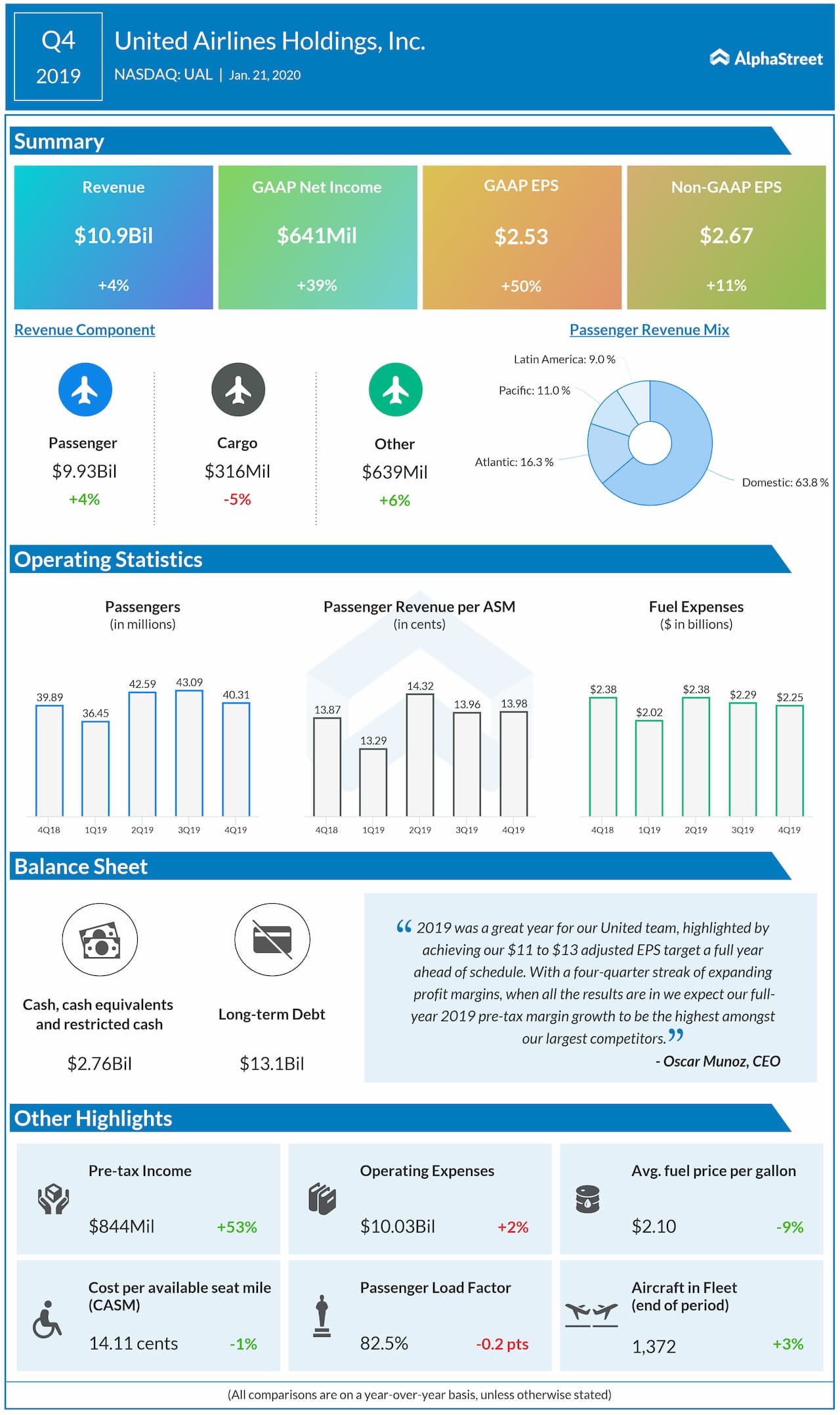

United was the only airline that though was brandishing about it’s past year performance put forth a bit of a caution —“2019 was a banner year for us at United, highlighted by a four quarter streak of growing profit margins. This winning streak allowed us to reach our 2020 adjusted EPS target of $11 to $13 per share one full year ahead of schedule” said Oscar Munoz — Chief Executive Officer.

But United’s CFO Gerry Laderman added this before starting the Q&A, “We currently expect full-year 2020 adjusted earnings per share to be between $11 and $13. While some may view this guidance to be a little conservative, we are only three weeks into the new year and are still facing uncertainty in both the timing of the reintroduction of the MAX and speed at which our associated capacity will ramp up. As always, we plan to update this target throughout the year as we continue to execute on all of our initiatives and we absolutely aspire to end the year in a higher range, regardless of known and unknown headwinds that we as an industry routinely face. The most recent examples of Boeing’s announcement yesterday on the MAX and the uncertainty around the Coronavirus in Asia

Even the Wall St. analysts were gung-ho about the industry prospects back in January based on the type of Questions they asked in the Q&A Section. In fact, we couldn’t find much mention of Coronavirus (Covid-19) in any of the calls that happened in the last weeks of January when things were out of control in China. It was still regarded largely as a “China problem”.

Stage 2 — Turbulence! Hold in a Sneeze

Edward Christie, Chief Executive Officer of the young & brash Spirit Airlines who held its Q4 Earnings Conference a full two-weeks past the big boys club, brought up the Corona Virus issue for the first time and we noticed a spike in Corona Virus related chatter in the conference call.

He began his prepared remarks by saying, “Throughout the earnings season, we heard about a litany of issues the airline industry is facing. Manufacturing delays at both Boeing and Airbus, changes in competitive behavior, tariffs on aircraft, and most recently, concerns about the coronavirus and its potential impacts, all this and the ever-present concern of near-term oil spikes. As a manager of an airline, we expect to have curve balls thrown at us, sometimes from all sides. You can’t always predict the curve balls, but you can set yourself up to react and pivot quickly when unforeseen things happen.“

ADVERTISEMENT

To a Question from Dan McKenzie of Buckingham Research Group on what kinds of tough decisions would the airline be willing to make if demand collapses almost immediately due to Coronavirus becoming a pandemic, Edward Christie, quipped:

“If something were to happen, coronavirus or something else, that would induce a demand shock in the United States, we would react. Obviously, it starts with utilization and deployment. We don’t have scheduled service that we have to maintain. So today, to your point, we haven’t seen an impact as it relates to the coronavirus. There is some administrative burden that we’re dealing with from an inbound passenger perspective at international originations points, that is not material. But beyond that, we’re seeing no impact to demand. And if that were to change, we would adjust accordingly.

And the Questions got louder as analysts’ started worrying. Catherine O’Brien of Goldman Sachs asked Hawaiian Airlines’ Peter Ingram if they’ve seen any discernible fall from bookings in international markets, given what’s going on with the coronavirus in its Earnings Call on Jan 30.

“I know all of you in the investment community are trying to calibrate the impact and it really is a difficult challenge at this point because we all have so much uncertainty about what is going on here and how it’s going to develop in the coming days. As we sit here today, there is obviously an enormous medical challenge in China and a rapidly growing epidemic in China. And from the perspective of the airline industry, that is manifesting itself in significant reductions in near-term demand, and I think you have seen in the last 48 hours the response of global airlines serving China to rapidly reduce, and in a number of cases, eliminate capacity to China. So, clearly that’s an acute impact in the here and now.” said Peter Ingram in response.

But the airline executives were still hopeful that this is limited to China as Brent Overbeek, SVP of Revenue Management & Network Planning at Hawaiian added on, “As we’ve looked at it close, no real discernible impact particularly out of our major geographies. Japan, demand is holding up well. Australia, New Zealand, things are strong. In North America, bookings continue to be strong. We have probably more Lunar New Year impact in Korea, so we’ll keep a close eye on that and how things transpire there. But as Peter mentioned, from a macro impact, we haven’t seen any real impact“

And as we now know, as the coronavirus spread across China in early January, international travel continued as normal. Thousands flew from Wuhan to cities around the world. By the time travel stopped in late January, it was too late and an outbreak became a pandemic.

Stage 3 — Losing Altitude

A sharp fall in travel demand post COVID-19 being declared as a worldwide pandemic and severe travel restriction across the globe forced the entire airline industry into an stress-induced coma. They were forced to reduce capacity and implement severe cost cutting measures.

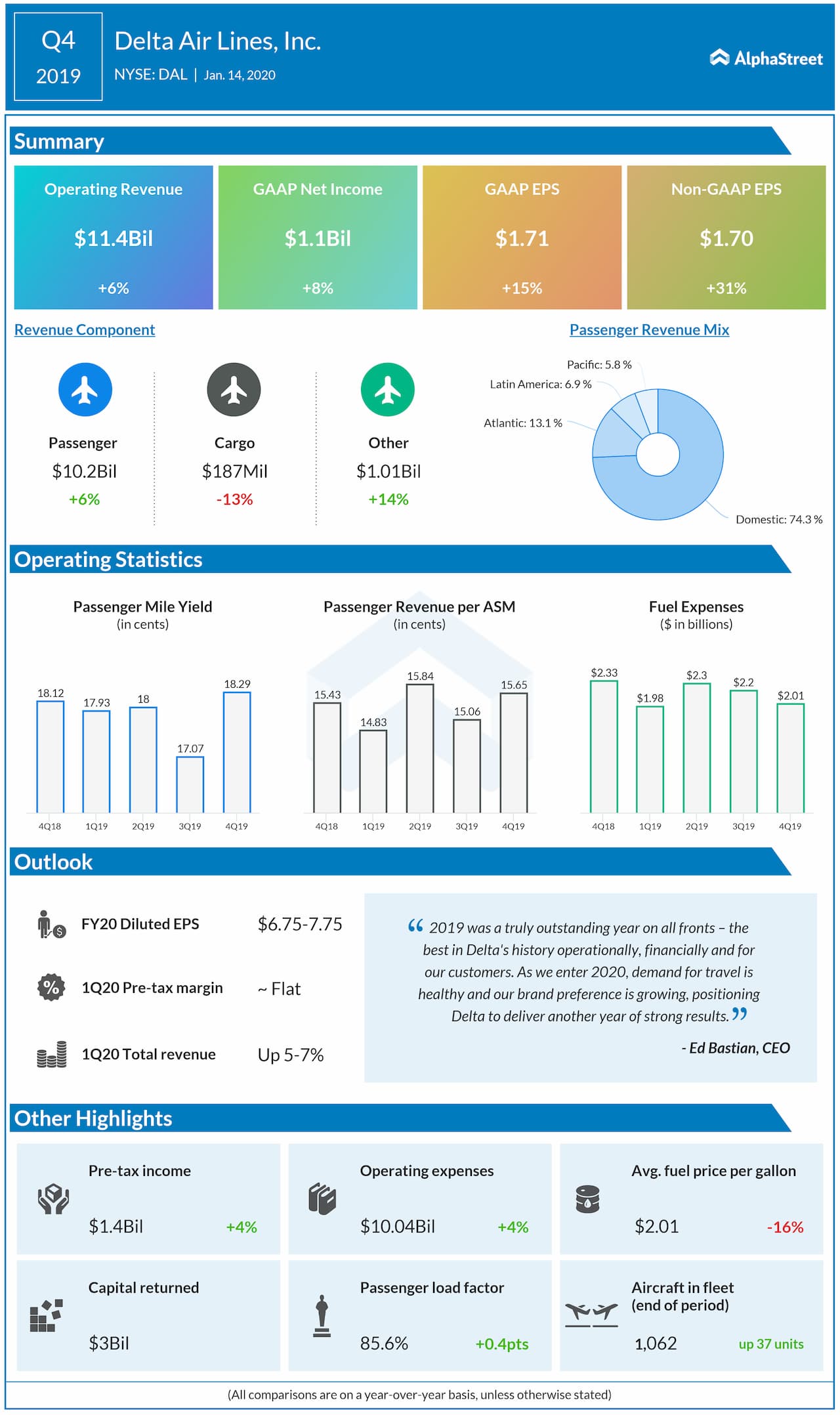

United Airlines (UAL) secured a $2-billion loan to deal with the cash crunch. Delta Airlines (DAL) has pumped in $2 million through a credit facility, while American Airlines (AAL) and Southwest Airlines (LUV) have arranged $1 billion each. However, this additional cash would not be sufficient for the companies to stay in business if the slowdown extends into the second half of the year. There was a flurry of press releases that followed with dire warnings.

Oscar Munoz — Chief Executive Officer of United, in a letter to employees on March 20, 2020 stated, “As travel demand continues to plummet, even more cost-cutting measures will be required soon to keep our company afloat. If Congress doesn’t act on sufficient government support by the end of March, our company will begin to take the necessary steps to reduce our payroll in line with the 60% schedule reduction we announced for April. May’s schedule is likely to be cut even further”

United Airlines seems to be the worst hit, with nearly 90% of international flights going out of service by next month. The rest 10% of flights are still on air to help displaced travelers who still need to get home.

In a similar move, American Airlines slashed international capacity by 75% until the first week of May, with extra focus on Trans-Pacific routes. In the fourth-quarter earnings call, senior executive Robert Isom had expressed hope that impact would be minimal due to the company’s limited exposure to the Asian market. The management’s estimate for $2 billion revenue fall for march gives a sense of what awaits the industry going forward.

For Southwest, the present crisis came as an additional burden as the company is already grappling with the grounding of its 737 Max fleet. Like Southwest, JetBlue (JBLU) is also cutting capacity to a lesser extent compared to others. Both the airlines have decided to halt all hiring activities and impose pay cuts.

“Last year on a typical day in March we took in about $22 million from bookings and ancillary fees. Throughout this March, our sales have fallen sharply and in the last several days we have taken in an average of less than $4 million per day while also issuing over $20 million per day of credits to Customers for canceled bookings. This is a stunning shift, which is being driven by fewer new bookings, much lower fares, and a Customer cancel rate more than 10 times the norm.” said JetBlue’s CEO Robin Hayes in a press release on March 18, 2020

Stage 4 — *Mayday, Mayday*

To state that these are unprecedented times would be an understatement. This is not the first time that Airlines industry has seen demand shocks. The industry has weathered many a storms in the past, be it 9/11 or SARS outbreak from the past decade.

But the COVID-19 induced worldwide disruption is a first for all airlines around the world, including the mighty ME3 cartel (Emirates, Etihad & Qatar Airways) that gets money on tap from its sovereign governments.

One-third of the world’s population is still under lockdown as we write this and almost all non-essential airline traffic is banned. All major airlines have grounded a majority of their fleet and/or have announced stringent cost reduction measures and complete shutdown.

From the chatter we gather from Wall St. folks, there are broadly three options out there for the Governments of the World to make.

- Bailout — Offer them the much needed cash to tide through the liquidity crunch

- Consolidate & Nationalize the Airlines — while the capitalists’ out there will scorn at this, there are precedence to this

- Evolve or Die — The Charles Darwin theory of “Survival of the fittest” will playout and the weaker ones will file for bankruptcy or get taken over.

The industry is looking forward to the much needed “helicopter money” and wants this Hollywood-ish doomsday nightmare to end at the earliest, but with the world at large still fighting the untraceable microbe, it’s a matter of either Evolve or Die!

According to retired airline professional K Mohandas, Aviation represents 3.6% of the world’s GDP as per Air Transport Action Group (ATAG) and contributes to millions of jobs directly and indirectly. When COVID-19 disappears – it should – and economies limp forward, it’s only natural that aviation will come out of the turbulent times on its own, fueled by surging demand or perhaps on financial crutches provided by the respective Governments and keep the blue skies abuzz

We at AlphaStreet will be closely monitoring this industry and will cover all the major airlines as they report their Q1 earnings in the first half of April 2020. If you want to be the first in the know, do subscribe to us.

Evolve or Die — This evolutionary cycle is not just for people but for countries, companies, economies — for everything. And it is naturally self-correcting as a whole, though not necessarily for its parts. If there’s too much supply and waste in a market, prices will go down, companies will go out of business, and capacity will be reduced until the supply falls in line with the demand, at which time the cycle will start to move in the opposite direction

Principles from Ray Dalio

Author’s Note: Radhakrishnan Chonat is an airline enthusiast at heart and Product Manager at AlphaStreet. He’s worried about losing all his airline miles collected and is looking forward to flying again.