Mixed Results

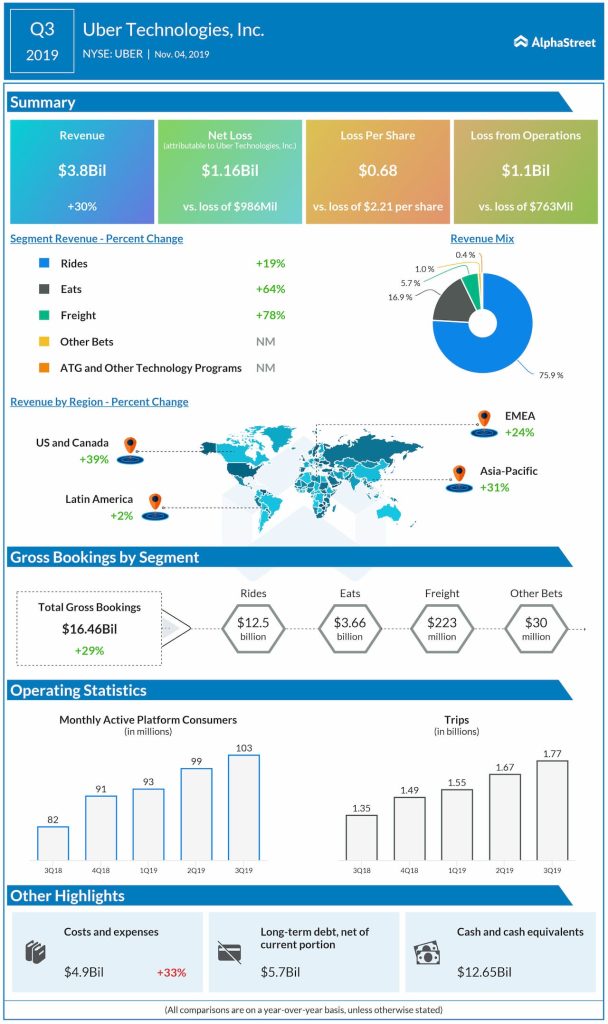

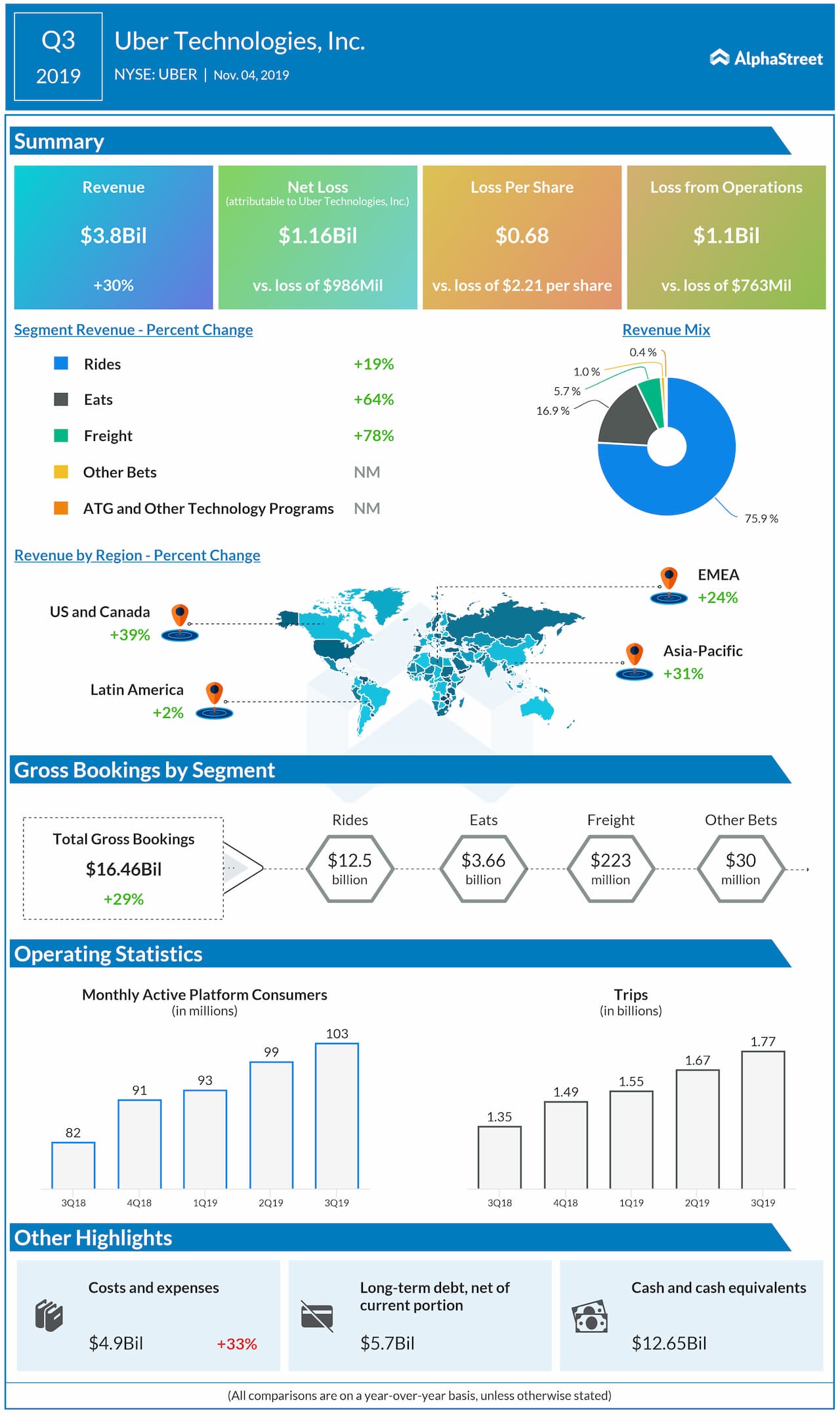

In the third quarter, revenues surged 30% to $3.8 billion, while net loss widened to $1.16 billion. The bottom-line has been hurt by heavy investments in product development and building of corporate infrastructure. The ambitious growth target set by the management also demands significant marketing spending.

While it is generally acceptable in the case of growth companies, the current trend remains a concern as cost-escalation could be an impediment when it comes to shareholder return. Also, Uber faces the uphill task of fighting with rival taxi firm Lyft (LYFT) for market share.

A Long-term Bet

In short, the situation urges the market to stay patient, which also makes the stock an ideal option for long-term investors. If Uber manages to maintain revenue growth at the current levels for long enough, shareholders will be handsomely rewarded in the next two years.

Also see: Uber Q3 2019 Earnings Conference Call – Final Transcript

In what could be yet another setback for the company, a German court this week imposed restrictions on its operations in that country, alleging anti-competitive practices. The ruling bans Uber from providing third-party car-hiring services to customers through its app.

IPO

Uber had a not-so-impressive Wall Street debut. Though the stock remained steady initially, it lost momentum a couple of months after the IPO, as in the case of several tech startups that went public this year. The stock, which is down about 28% since then, traded below the $30-mark this week. However, there has been an improvement since mid-November, after the stock slipped to an all-time low.

A similar pattern is visible in the performance of Lyft, which traded at $75 post-IPO before falling sharply in the following weeks. Both stocks continue to underperform the S&P 500 index, which has been in the positive territory throughout the year.